Although Intel Corporation has been an important figure in the semiconductor industry for years, its stock has dropped to approximately $20.05 in April 2025, showing a considerable drop in the past year.

Such a trend has prompted traders and investors to determine the underlying reasons for Intel’s current valuation. Here, let’s talk about why is Intel stock so cheap, the key reasons for this price, how it compares with its competitors, and Intel stock price predictions.

Intel’s Current Market Position

Intel’s recent poor financial performance has led to bearish investor sentiment toward the stock. However, it is seeing an upward trend after key investments with NVIDIA were reported. Over the past few years, Intel has been facing significant challenges, resulting in underperforming growth in the stock market.

Intel’s 5-year price change was -29.54%, indicating that Intel stock is 29.54% lower than it was 5 years ago. However, the 1-year price change is +60.62%, which shows that the Intel stock today is traded at 60.52% higher than one year ago.

The Intel stock today, October 2, 2025, is traded at USD35.94 per share. The current Intel stock price is slightly higher than the previous close price on September 30, 2025, at USD33.55 per share.

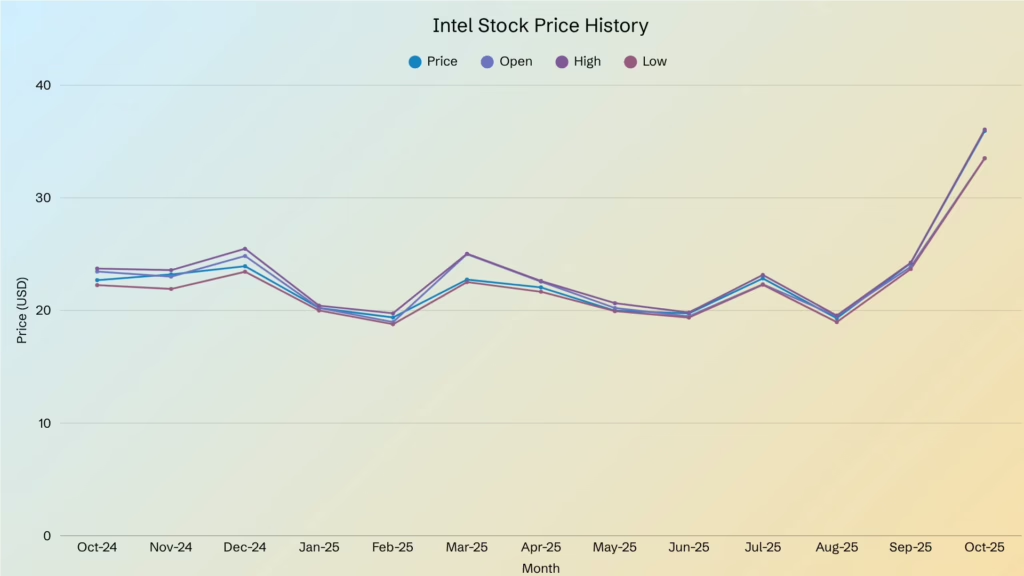

Here is the Intel stock price chart showing historical data from October 2024 to October 2025 (source: Investing.com):

As shown in the graph, Intel experienced cycles of optimism and setbacks in the period covered. For most of the months, the stock price ranged from USD19 to USD25 before the breakout.

The surge in September and October 2025 marks a structural change in investor sentiment, which shows a possible turnaround.

Intel’s financial report for Q2 2025 showed that it exceeded market expectations, showing considerable revenue growth and improved profitability. Such improvements have reassured investors about the company’s potential for future gains and recovery.

However, even with the recent surge, Intel stock price is still relatively cheap, especially compared to its competitors, including AMD (USD164.01), TSMC (USD288.47), and NVIDIA (USD187.24).

Key Reasons Why Is Intel Stock So Cheap

Here are four possible reasons why is Intel stock so cheap for the past year:

Competitive Pressures and Market Share Erosion

Intel used to be the indisputable leader in CPU and semiconductor technology. However, companies like AMD, NVIDIA, and TSMC have captured the market in recent years.

AMD’s Ryzen and EPYC processors offer superior performance and more energy-efficient chips compared to Intel’s, built on advanced 5nm and 4nm nodes from TSMC. NVIDIA has also dominated the AI and GPU markets, leaving Intel struggling to catch up with newer innovations like AI accelerator chips.

Furthermore, the change in Intel’s technical leadership has negatively impacted investor confidence, making the stock less attractive to traders and investors.

Financial Performance and Investor Sentiment

Intel’s financial results show the company’s deep structural issues. For F2024, Intel reported a loss of $18.76 billion due to massive impairment charges, declining margins, and weaker revenues than expected.

In Q1 2025, Intel posted a significant net loss despite its revenues being higher than the analyst predictions at $12.7 billion. This data suggests that turnaround may take time.

Its deteriorating bottom line due to lower sales and high capital expenditure has caused multiple analyst downgrades, leading to weaker market sentiment and lowering the stock price.

Organizational Restructuring and Cost-Cutting Measures

Intel’s leadership under CEO Lip-Bu Tan initiated aggressive restructuring in response to challenges. This included cutting 22,000 jobs, selling non-core businesses, and decreasing capital spending.

Although these actions may be necessary to refocus on the company’s core competencies, it has a negative impact in the short term because restructuring often sends a signal of internal turmoil to investors.

Trade Tensions and Geopolitical Factors

Intel, like many tech companies, is entangled in geopolitical risks, especially the US-China trade relations. Restrictions on semiconductor exports to China, which is Intel’s major end-market, have a negative impact on revenues.

Because of such restrictions, Chinese companies that used to buy Intel servers and PC chips are turning to domestic alternatives like Huawei.

Comparing Intel’s Valuation with Competitors

Intel’s price-to-sales ratio is 1.7x, which is lower than that of AMD (9.0x) and NVIDIA (27.5x). Intel seems undervalued based on sales, possibly due to investor skepticism about the company’s ability to grow its revenue and catch up to its competitors.

On the other hand, Intel’s price-to-book ratio is 1.7x, which is lower than that of AMD (4.5x) and NVIDIA (45.4x). This data shows that Intel is valued just slightly above its net assets.

In contrast, AMD and NVIDIA trade at a premium, indicating that investors are pricing them far beyond their book value. Overall, Intel’s low multiples show that the market doubts its growth strategy, execution, and ability to compete with its competitors.

Intel Stock Predictions & Outlook

After months of the Intel stock price ranging from USD19 to USD25, it had a breakthrough in September and October 2025.

This recent surge in the Intel stock price has sparked renewed interest among investors who continue to ask, “Why is Intel stock so cheap?” because stronger-than-expected financial results, bold strategic initiatives, and improving market conditions reshape sentiment.

Analysts mentioned that this growth may be attributed to the company’s focus on AI and data centers. This recent upward trend may also be attributed to the monumental $5 billion investment from NVIDIA, according to recent Intel stock news.

With shares of Intel increasing by more than 70% year-to-date, Wall Street is reconsidering Intel’s competitive advantage following the increasing optimism about its growth strategy and AI chip-manufacturing potential.

Although NVIDIA would manufacture its parts with TSCM, this $5 billion equity wager is a show of trust in Intel’s productized manufacturing plan. It is also a geopolitically driven investment in the US, where domestic chipmaking is becoming increasingly a national need.

In addition to the partnership with NVIDIA, Intel is in early-stage talks with AMD as one of its customers at its factories. This report has increased the midday Intel shares on October 1, 2025, by nearly 6%.

Moreover, Intel also secured investment and support from the White House and SoftBank. The company is also rumored to be in discussions with Apple.

You may also be asking…

Is it worth it to buy Intel stock?

Yes, especially for value-oriented investors who believe that its growth initiatives will succeed. Understanding why is Intel stock so cheap is key here. Intel trades much lower than AMD and NVIDIA because of past missteps, but that discount could be an opportunity.

Can Intel bounce back?

Yes, Intel can bounce back, especially with the recent increase in the Intel stock price. However, it would depend on the successful execution of its restructuring and growth strategies.

Is Elon looking to buy Intel?

Although some analysts have mentioned Elon Musk as a possible wild card in takeover talks, there is no credible report saying that he is planning to buy Intel.

Conclusion: Is Intel a Buy at This Price?

Intel’s stock looks cheap compared to its competitors, and that’s both its biggest weakness and potential opportunity. The reasons why is Intel stock so cheap include market share erosion, financial performance, organizational restructuring, and trade tensions.

While AMD and NVIDIA command premium valuations because of their innovation and dominance in GPUs, AI, and advanced chips, Intel trades at 1.7x sales and 1.7x book value, suggesting that the market still doubts its growth prospects.

The recent surge, however, tells a different story. After spending most of the year in the $19–$25 range, Intel shares broke out past $35 in September and October 2025, fueled by stronger-than-expected earnings and a $5 billion investment from NVIDIA.

This move signals that investor sentiment is beginning to shift, with Wall Street starting to take Intel’s turnaround more seriously.

So, is Intel a buy at this price? For value-oriented investors, the discount compared to peers could be attractive if you believe Intel can deliver on its AI and foundry ambitions.

However, for growth-focused investors, AMD and NVIDIA remain the market favorites, backed by faster innovation and stronger competitive positioning. For investors asking why is Intel stock so cheap, the answer lies in its recent struggles, but those same struggles could set the stage for a rebound if Intel executes well.

If you want to keep informed about the fluctuating Intel stock price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.