Despite being in its early stages, the artificial intelligence (AI) industry has seen tremendous growth over recent years.

Due to its undeniable potential for further evolution, the AI stock market is gaining popularity among investors who are willing to purchase stocks despite uncertainties in AI stock market predictions.

Several large companies with AI-related stocks have seen substantial returns over the past years. They also experienced massive spikes in value and performance amidst tariffs and broad market volatility.

As the industry is driven by strong investor enthusiasm and rapid technological advancements, AI stocks offer significant potential for investors to grow their income.

For this TRU insight, we’ll discuss five of the best-performing AI stocks in the market and learn what the AI stock industry has in store for investors worldwide.

An Overview of AI Stocks

AI stocks are shares in companies that heavily utilize artificial intelligence in their business operations or work in the AI space in general.

Since AI has several applications, AI stocks come in various forms. For instance, some AI companies create pilotless aircraft, while others utilize voice recognition. Several publicly traded companies have substantial interests in AI and can greatly benefit from the industry’s growth.

AI technology stocks typically fall into two categories: blue-chip technology companies that have partnered with or invested in AI developers and small companies that focus solely on AI development.

Shares from small AI developers may seem like the most direct AI investment, but some research analysts believe they are not necessarily the best investments in AI.

According to Michael Brenner, a research analyst covering AI for FBB Capital Partners, small companies could develop innovative new models by themselves. Still, they will need to partner with bigger companies that have more infrastructure so they can run their models at a commercial scale.

Read More: TradersUnited – Why Forex: Forex vs. Stocks

Our Top Picks for the Best AI Stocks

After reviewing the AI technology stocks based on factors like EPS (TTM), dividend, and market capitalization, we’ve found five of the biggest AI companies that are well-positioned to take the market by storm.

Watch out for these AI stocks, as they will surely give you the best profit for your share price:

Nvidia

Touted as the “King of AI,” Nvidia (NVDA) graphic processing units (GPUs) have become an integral part of AI due to their unmatched processing speeds. However, its Compute Unified Device Architecture (CUDA) software platform provided a wide moat for the company.

With its CUDA, developers easily program their chips and build a collection of tools and libraries to optimize GPUs for running AI tasks. Among the major AI and cloud companies that use its advanced chips and software platforms are OpenAI, Microsoft, Amazon, Tesla, and Google.

While it gained popularity among the gaming community with its GPUs, NVDA now positions itself as a niche company with a total value of trillions of dollars.

As AI infrastructure continues to ramp up, Nvidia continues to benefit and remain on top of the AI stock market prediction.

Price

As of writing, Nvidia’s market capitalization is 3.1 trillion dollars. For its specific price information, please refer to the table below:

| High | Low | Open | Close |

| 146.20 USD | 142.65 USD | 145.45 USD | 145.48 USD |

Read More: Reading Different Types of Trading Charts: 3 Types of Price Charts Explained in 2025

Key Statistics

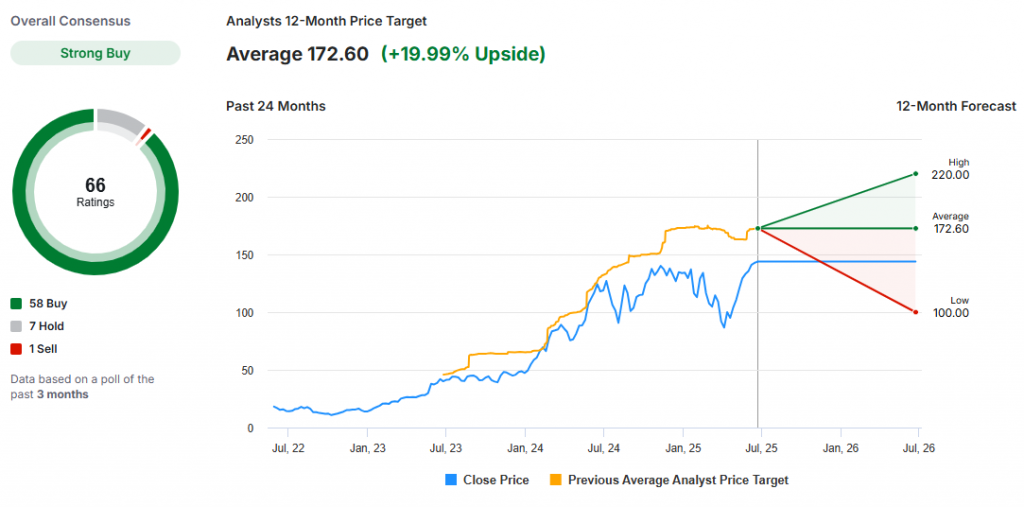

Based on the overall analysis of Nvidia, the computing infrastructure company’s AI stocks are a strong buy. Its current monthly statistics are as follows:

| 52-Week Range | 86.62 USD–153.13 USD |

| EPS (TTM) | 3.13 |

| Dividend | 0.03% |

Moreover, analysts’ consensus on the AI stock market prediction for NVDA’s price is a target of an average monthly price of $172.60, representing a 19.99% upside.

News on Nvidia

Recent news on NVDA claims the chip giant’s indispensability in the current AI era. According to tech analyst Dan Ives, Nvidia is not only becoming crucial to the U.S.’s global chip prowess but is also increasingly becoming significant in diplomatic negotiations.

Its CEO, Jensen Huang, noted that Nvidia’s Blackwell chip architecture significantly improves AI model training and inference, allowing for more efficient AI applications.

With that in mind, NVDA’s AI stocks will undoubtedly reflect its bolstered dominance in the GPU industry.

Broadcom Inc (NASDAQ:AVGO)

Broadcom Inc (NASDAQ:AVGO) is a global technology company specializing in infrastructure software and semiconductor solutions. It helps optimize operations and manage data in areas such as networking, broadband, and wireless software.

The company’s networking portfolio has given Broadcom Inc. strong momentum and has become more valuable, with more AI clusters requiring more high-throughout, low-latency interconnects.

However, Broadcom’s AI stocks are seeing bigger opportunities in its custom AI chips. With these chips, the company is enabling customers to develop their own customized chips to handle specific AI workloads.

For instance, Broadcom successfully helped Alphabet in developing its Tensor Processing Unit (TPU), which also added more custom chip customers.

Price

Broadcom Inc.’s market capitalization is 1.18 trillion dollars. For its specific price statistics, please refer to the table below:

| High | Low | Open | Close |

| 253.52 USD | 244.17 USD | 253.21 USD | 249.99 USD |

Key Statistics

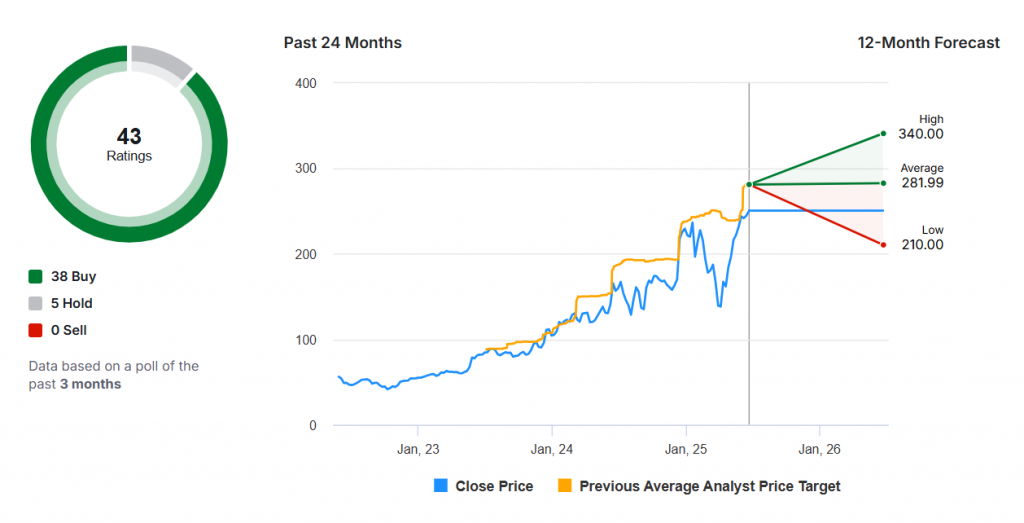

Technical analysis of the semiconductor solutions company indicates that its AI stocks are a strong buy. Its current monthly statistics are as follows:

| 52-Week Range | 128.5 USD–265.43 USD |

| EPS (TTM) | 2.83 |

| Dividend | 0.94% |

Analysts’ consensus on the price of Broadcom Inc.’s AI stocks is targeted at an average monthly price of $281.99, representing a +12.80% upside.

News on Broadcom Inc.

Recent news on the company’s AI stock market prediction shows a positive trend as its future earnings growth is expected to gain momentum.

While Broadcom mostly pays its earnings as dividends, it has seen improved growth. Furthermore, its earnings are said to be backed by its high return on equity (ROE)— a test of a company’s effectiveness in increasing its value and managing investors’ money.

Its success in transforming shareholders’ investments into profits shows a positive light on the future of its AI stocks.

Palantir Technologies Inc.

Founded in 2003 as a means for U.S. intelligence agencies, Palantir’s core product was initially used by the U.S. government as a counter-terrorism tool. To date, the company caters to more than 700 global clients, including local governments and private corporations.

The software company specializes in data analytics and AI. Instead of building its own models, Palantir took a different approach to artificial intelligence.

They sought to become an operating system for the technology by collecting data from various sources and transforming it into a system that enables businesses and individuals to make sense of complex information. As a result, its customers can use the platform to solve complex, real-world problems with the aid of AI.

Palantir Technologies Inc.’s platform can be widely used across several industries, presenting its AI stocks with a significant opportunity ahead.

For instance, Archer Aviation recently utilized the company’s Foundry and Artificial Intelligence Platform (AIP) products to enhance aircraft manufacturing capabilities. This ultimately led to a future collaboration to develop critical aviation systems for future use.

Price

Broadcom Inc.’s market capitalization is 324.02 billion dollars. For its specific price statistics, please refer to the table below:

| High | Low | Open | Close |

| 142.24 USD | 136.74 USD | 140.69 USD | 139.96 USD |

Key Statistics

Palantir’s current monthly statistics are as follows:

| 52-Week Range | 21.23 USD–144.86 USD |

| EPS (TTM) | 0.25 |

| Dividend | N/A |

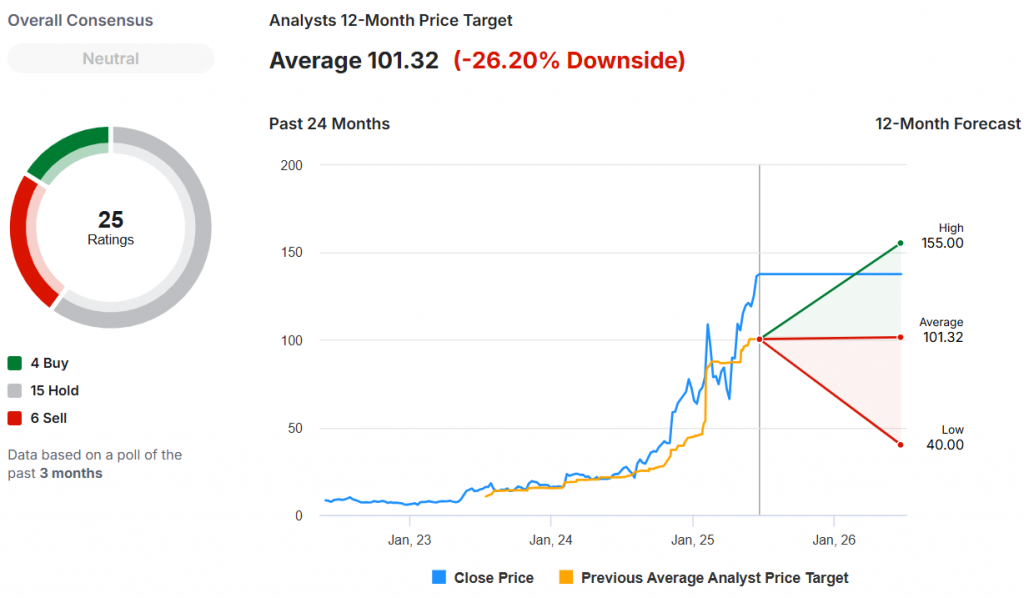

Based on the table above, investors can infer that Palantir Technologies Inc. does not provide dividends to its investors. Nonetheless, technical analysis of the software company indicates that its AI stocks are a strong buy.

The analysts’ consensus on the price of its AI stocks is expected to be an average monthly price of $101.32, representing a 26.20% downside.

News on Palantir Technologies

One of the most recent news reports on Palantir features Dan Ives, a well-known tech analyst from Wall Street, unveiling the company as part of his top AI ETFs. Palantir and Salesforce (NYSE) were the two software companies that the Ives portfolio primarily centered around, in addition to chip manufacturing giants such as Advanced Semiconductor Materials Lithography (ASML).

Forrester Research also reported that Palantir is a leader in AI and machine learning platforms last August, giving Palantir’s AIP products higher scores than tools like Alphabet’s Google and Microsoft. The document highlights Palantir’s differentiated software architecture as its key strength.

On that note, another analyst, Mike Gualtieri, recognized Palantir as becoming one of the largest players in the market.

Advanced Micro Devices

Advanced Micro Devices (AMD) is a semiconductor company focusing on graphics visualization and high-performance computing—both crucial in AI technology advancement.

Although it does not come close to Nvidia in the GPU space, AMD is now taking the lead in central processing units (CPUs), which serve as the brains of operations in the data center.

With AI interference, the company achieves a niche for its GPUs without the technically demanding nature of training AI models,

Since AI interference is expected to become a larger market than training, AMD holds a significant opportunity in the AI stock market prediction despite its AI stocks’ distance from Nvidia.

Price

At present, Advanced Micro Devices’ market capitalization is 207.93 billion dollars. Below are its specific price statistics:

| High | Low | Open | Close |

| 132.80 USD | 127.55 USD | 129 USD | 128.24 USD |

Key Statistics

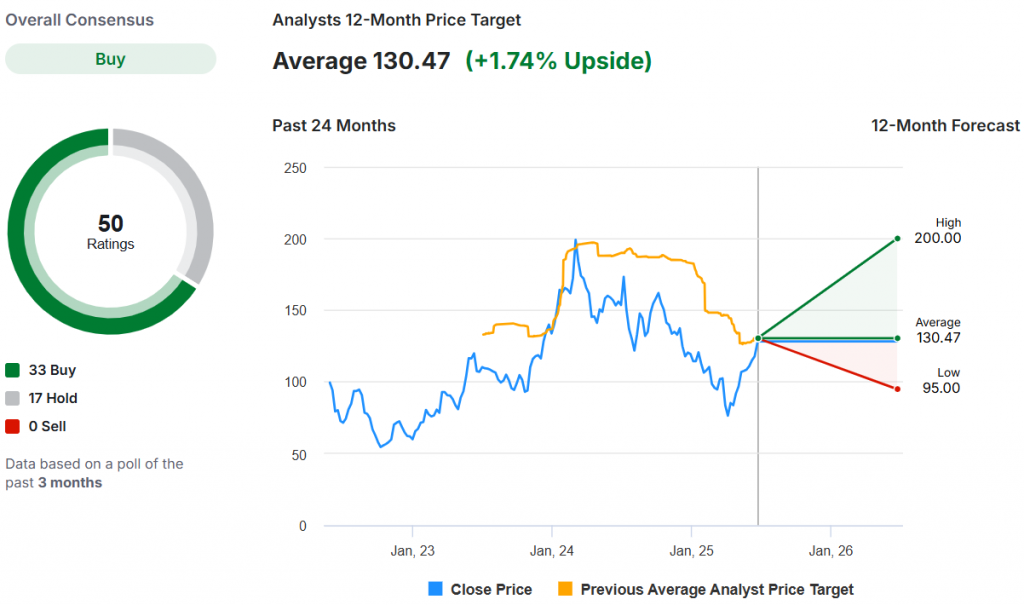

The overall analysis of AMD’s AI stock market prediction suggests that the semiconductor company’s AI stocks are a moderate buy. On that note, its current monthly statistics are as follows:

| 52-Week Range | 76.48 USD–187.28 USD |

| EPS (TTM) | 1.37 |

| Dividend | N/A |

The table above shows that AMD, like Palantir, does not provide dividends to its investors.

Nonetheless, the analysts’ consensus on AMD’s AI stock price is predicted to be at an average price of $130.47 per month, representing a +1.74% upside.

News on Advanced Micro Devices

News concerning AMD confirms the company’s steadfastness in securing a “moderate-buy” consensus. According to the MSN article, 28 out of 42 analysts closely following the stock gave it a “strong buy” rating, one chose “moderate buy,” and 13 adopted a “hold” stance.

On May 6, AMD made headlines as it surpassed 2025 Q1 earnings, beating analyst expectations. Its reported revenue continues to rise 35.9% yearly, which exceeds Wall Street’s AI stock market prediction of $7.12 billion.

In early June 2025, AMD announced its strategic agreement with the developers of Unether AI, known for creating AI interference chips that outperform competitors in terms of speed and energy efficiency. These developers will further enhance AMD’s capabilities in enterprise data centers and edge computing.

Quantum Computing Inc. (QUBT)

As the name implies, Quantum Computing Inc. (QUBT) develops quantum computers that use exotic physics phenomena to run computers faster than traditional binary computers.

The company builds its AI hardware by combining light and electricity to process information more quickly and efficiently. Its AI technology, known as reservoir computing, is usually used to predict trends, analyze time-based data, or recognize patterns.

QUBT operates as a semiconductor workshop that produces chips used in quantum computing. Being well-known for developing next-generation hardware, QUBT could play an important role in future AI hardware innovation.

Price

Quantum Computing Inc.’s current market capitalization is 2.66 billion dollars. Below are its specific price statistics:

| High | Low | Open | Close |

| 20.34 USD | 18.83 USD | 20.10 USD | 19.09 USD |

Key Statistics

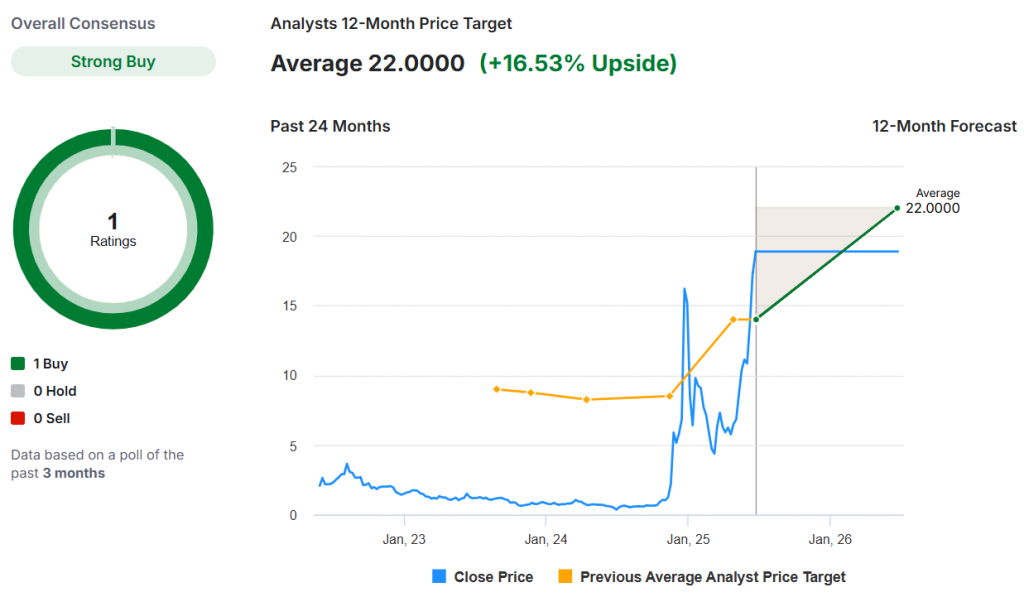

The consensus analysis of Quantum Computing Inc.’s AI stock market prediction suggests that the integrated photonics company’s AI stocks are a “moderate-buy” consensus like AMD.

Its current monthly statistics are as follows:

| 52-Week Range | 0.3549 USD–27.15 USD |

| EPS (TTM) | -0.42 |

| Dividend | N/A |

The table above indicates that similar to AMD and Palantir, Quantum Computing Inc. does not provide dividends to its investors.

Nonetheless, the consensus on Quantum Computing Inc.’s AI stock price is predicted to be at an average price of $22 per month, representing a +16.53% upside.

News on Quantum Computing Inc.

When it comes to its AI stock market prediction, news about Quantum Computing Inc. points out that the odds are not too great if you invest $10,000 in the company’s AI stocks and expect to be a millionaire.

According to the article, the company’s photonics technology may not be superior to some approaches adopted by its competitors. Many of these companies, including Nvidia, Amazon, and Microsoft, have substantial financial resources.

Other rising competitors, such as IonQ and D-Wave Quantum, are thought to be potentially better than Quantum Computing itself.

On the bright side, Quantum Computing Inc. does not necessarily need to turn your initial investment into a million dollars to provide you with exceptional returns.

Should You Invest in AI Stocks?

Given the rapid technological innovation and high investor enthusiasm surrounding artificial intelligence, AI stocks offer significant potential to grow your profits.

However, as an investor, you must know how to navigate the regulatory uncertainties, high valuations, and intense competition accommodating these stocks.

Furthermore, you must thoroughly examine the company’s financial situation and risk management strategies to avoid being swayed by hype and speculation.

With their relevance in today’s functionalities only getting stronger, investing in AI stocks will enable you to experience the benefits of its market dominance.

Read More: The Future of Online Trading Scene – 2025 Update

Invest Your Money Smartly

Artificial intelligence is rapidly transforming how businesses operate in the financial market. With the integration of AI in the stock industry, there’s no doubt its complexities only make it even more challenging to decide which AI company to invest in.

Not to worry! CommuniTrade experts are here to help you make the best decisions that align with your trading and profit goals. We offer an expert online community that can help guide you on the right steps to take to invest your money smartly.

With our help, you’ll get the best out of AI stock investment!

FAQs

How do AI stocks work?

AI in stock trading utilizes machine learning to analyze market trends and determine price movements, resulting in automated trades based on data-driven insights. AI helps pinpoint patterns in real time, enhances decision-making speed, and optimizes investment strategies.

How risky are AI stocks?

While AI stocks may offer stronger growth potential compared to other industries, high valuations can mean that those prospects are already factored into the price. If the performance of actual earnings does not meet the expectation, then AI stocks may begin to underperform. High valuations usually measure long-term performance.

What is the best way to invest in AI stocks?

Most investors invest in stocks and exchange-traded funds (ETFs), which are considered the most effective way to invest in artificial intelligence. If you’re still unsure which AI investment approach is the best for you, consider doing your own research or consulting financial experts.

Still Not Sure Whether to Invest in AI Stocks?

CommuniTrade is more than just a healthy online community. Besides our helpful educational content and tools from TradeGeek and TruCast Webinars, we house a team of trading and financial experts who can provide you with a wealth of knowledge and well-established insights into your trading problems.

With our experts’ help, you can make informed decisions in your AI stock investments and bag the best profits.

Maximize your trading knowledge in the competitive world of AI stocks trading with CommuniTrade!