Attacq Limited is a real estate investment trust (REIT) based in South Africa. The group invests in real estate across various sectors, such as retail, residential, and office.

Here, let’s talk about Attacq share price and other key metrics, its historical data, and how it compares with its competitors.

- Company Overview: Attacq Limited

- Attacq Share Price Performance

- Attacq Share Price Historical Trends

- Attacq Share Price Performance vs Competitors

- You may also be asking…

- What is Attacq’s strategy for growth?

- Who are Attacq’s main competitors?

- What is Attacq’s dividend yield currently?

- Conclusion: Is Attacq a Good Investment in 2025?

Company Overview: Attacq Limited

Attacq Limited, incorporated in 1997, focuses on owning and managing retail-dominant mixed-use precincts, which include the development rollout of Waterfall.

Attacq’s properties include the following: Glenfair Boulevard and Waterfall City Corporate Campus.

Its subsidiaries include AIH International, Brooklyn Bridge, and Lynnwood Bridge.

Attacq Share Price Performance

Here are the key metrics relative to Attacq stock performance, according to Investing.com:

| Metric | Value |

| Share price | 1,417c |

| 52-week high/low | High: 1,413c Low: 1,440c |

| Market capitalization | ZAR 9.92 billion |

| P/E ratio | 6.8× |

| Earnings per share | 215c |

| Dividend yield (%) | 6.1 |

The data showed that the Attacq share price has increased by 6.9% in the last 52 weeks.

The 52-week range shows that Attacq is quite volatile. The current Attacq stock price is closer to the high range, which means some investors may expect pullbacks.

Its dividend yield is pretty good at 6.1%, which means a good incentive for investors.

Lastly, Attacq has a very low P/E ratio, which means Attacq share price appears cheap relative to profits.

Attacq Share Price Historical Trends

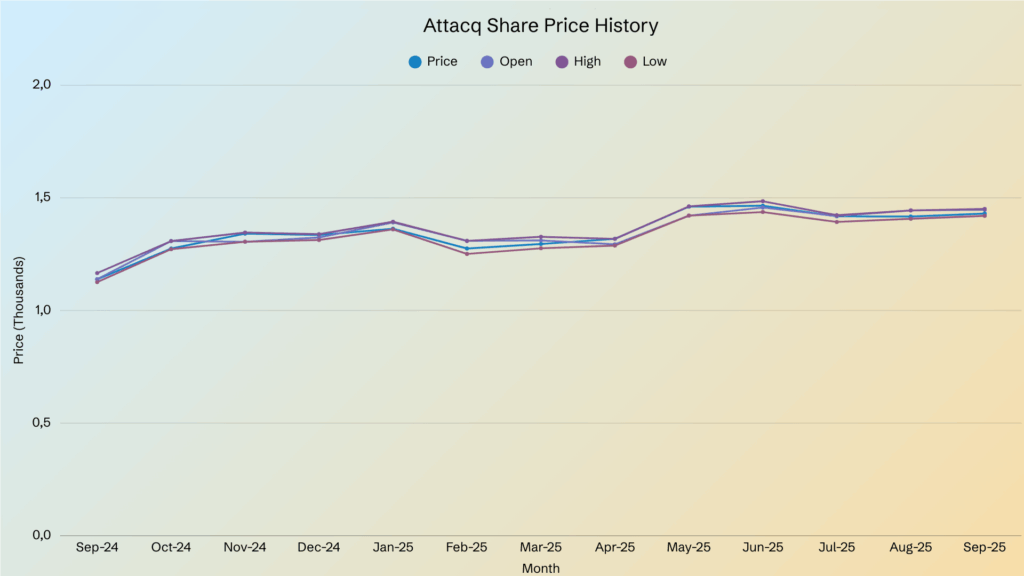

Here is a graph showing the historical data of Attacq share price, according to Investing.com:

The highest share price was observed in June 2025, with 1,465c per share. Meanwhile, the lowest share price was observed in September 2024, with 1,138c per share.

The average share price is 1,3858.54c, and the total change from September 2024 to September 2025 is 25.66%.

The share price showed an upward momentum, with the share price rising steadily over the year. However, there was a short-term dip in February 2025 (1,275c).

Nonetheless, it recovered in March 2025 (1,295c) and continued a relatively upward trend until September 2025.

Overall, the Attacq share price between September 2024 and September 2025 showed bullish growth with cyclical pullbacks.

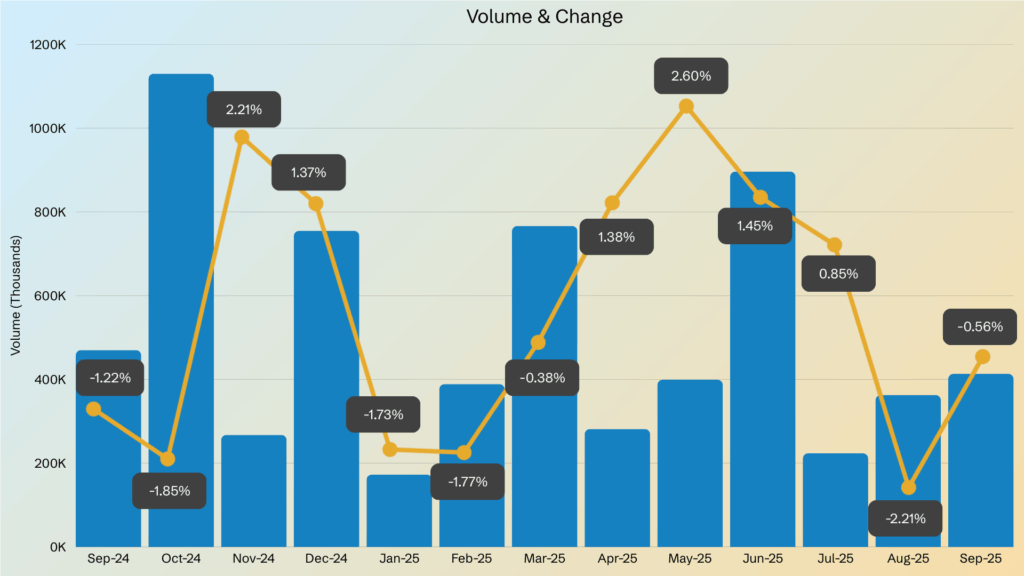

The highest volume of 1.130 million was observed in October 2024, while the lowest volume of 172.7k was observed in January 2025.

This showed that there is high activity during periods with an upward trend in share price (October 2024, June 2025) and low activity during dips (January-February 2025).

The month with the best change was May 2024, with +2.60%, while the worst month was February 2025, with -6.45%.

Overall, high trading volumes aligned with turning points, showing strong shifts in investment sentiment.

Attacq Share Price Performance vs Competitors

Here are Attacq’s main competitors and their key financial data compared to Attacq, as of September 24, 2025 (data from Investing.com):

| Name | Ticker | Price (c) | Market Cap (ZARb) | EPS (c) | P/E Ratio | Dividend Yield (%) | EV/ EBIDTA |

| Attacq Limited | JSE:ATT | 1,417 | 9.916 | 215 | 6.6x | 6.1 | 12.1x |

| Newpark REIT Ltd | JSE:NRL | 480 | 0.265 | 36 | 13.3x | 16.3 | 10.4x |

| Oasis Crescent Property Fund | JSE:OAS | 2,000 | 1.299 | 206 | 9.7x | 5.9 | 5.0x |

| Octodec | JSE:OCT | 1,137 | 3.027 | 130 | 8.8x | 11.2 | 8.8x |

| Spear REIT Ltd | JSE:SEA | 1,033 | 3.31 | 183 | 6.3x | 7.9 | 12.5x |

| Dipula Income Fund Ltd | JSE:DIB | 538 | 4.898 | 89 | 6.0x | 9.3 | 10.4x |

| Heriot Reit Ltd | JSE:HET | 1,600 | 5.108 | 359 | 4.9x | 7.1 | 12.6x |

| Emira Property Fund | JSE:EMI | 1,180 | 5.673 | 493 | 2.4x | 10.1 | 5.2x |

| Burstone Group Ltd | JSE:BTN | 833 | 6.609 | -280 | -3.1x | 11.1 | 11.7x |

| SA Corporate Real Estate Fund Managers Ltd | JSE:SAC | 311 | 8.058 | 25 | 13.0x | 8.1 | 10.1x |

| Fairvest Ltd | JSE:FTA | 1,750 | 10.247 | 67 | 9.9x | 8.0 | 13.0x |

Oasis Crescent Property Fund had the highest share price of 2,000c per share.

Meanwhile, SA Corporate Real Estate Fund Managers Ltd had the lowest share price of 311c per share.

Attacq share price is on the higher side at 1,417c per share.

In terms of market capitalization, Fairvest Ltd had the highest number (ZAR 10.247 billion) and Newpark REIT Ltd had the lowest at ZAR 0.265 billion.

Burstone Group Ltd had a negative EPS of -280, making it the lowest among the competitors. Meanwhile, Emira Property Fund had the highest EPS at 493.

Newpark had the highest P/E ratio at 13.3x, while Burstone had the lowest at -3.1x. Attacq was in the mid-range at 6.6x.

Newpark had the highest dividend yield of 16.3%, while Oasis had the lowest at 5.9%. Attacq had the second-lowest dividend yield at 6.1%.

Lastly, Fairvest, Heriot Reit Ltd., and Attacq had the highest EV/EBIDTA of 13.0x,12.6x, and 12.1x, respectively. In contrast, Oasis had the lowest EV/EBIDTA at 5.0x.

You may also be asking…

What is Attacq’s strategy for growth?

It is threefold: Thrive, Transform, and Transcend.

Thrive means embracing challenges by creating vibrant and sustainable environments where communities can flourish and businesses can thrive.

Transform means redefining traditional development and property management to create remarkable experiences in its hubs.

Finally, transcend means going beyond conventional boundaries, fostering a culture of excellence.

Who are Attacq’s main competitors?

Attacq’s competitors include Newpark REIT Ltd, Oasis Crescent Property Fund, Octodec, and Spear REIT Ltd.

What is Attacq’s dividend yield currently?

Attacq’s dividend yield for H2 2025 is 6.1%.

Conclusion: Is Attacq a Good Investment in 2025?

Attacq stock performance this year has been strong, gaining over 25% year-on-year with steady upward momentum despite short-term pullbacks.

With the share price sitting at around 1,417c, it is close to the 52-week high, reflecting growing investor confidence in Attacq’s long-term growth potential.

In terms of valuation, Attacq seems a good choice. Its low P/E ratio of 6.6x suggests that it is undervalued relative to profits. Meanwhile, its dividend yield of 6.1% shows it offers reliable income for investors seeking stable returns.

Therefore, for investors navigating the JSE, Attacq offers an appealing mix of steady returns, competitive dividends, and growth potential, making it a stock worth watching.

If you want to keep informed about the fluctuating Attacq share price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.