The non-farm payroll (NFP) report is a highly anticipated market event that is released monthly. Although its significance has waned in recent years, the NFP report remains one of the most important economic indicators.

Expert analysts across financial markets attempt to predict the NFP figure monthly, as well as its potential market impact.

For this TRU Insight, we’ll examine what NFP in forex is and how it can affect your trading strategies.

Overview

- The Non-Farm Payroll (NFP) report reflects the previous month’s data on the estimated jobs lost and gained in the U.S. labor market.

- The Bureau of Labor Statistics releases the NFP report on the first Friday of each month at 8:30 AM ET.

- The NFP report helps forex traders determine when to execute their trades to avoid the consequences of a potential fall in the USD.

What is the Non-Farm Payrolls?

Non-farm payrolls (NFP) is a segment of the monthly Employment Situation report that estimates how many people are employed in the U.S. construction, manufacturing, and goods companies in the previous month.

NFP in forex is a crucial economic indicator closely tied to U.S. employment. It represents the number of jobs gained in the previous month.

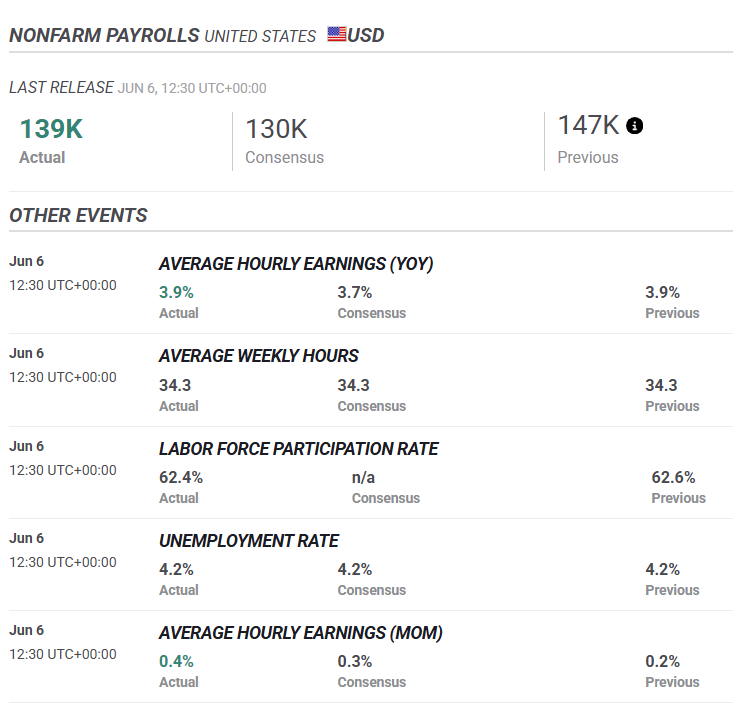

The Bureau of Labor Statistics, which is an agency for the U.S. Department of Labor (DOL), releases the Employment Situation Report. Besides NFP, the report also includes other statistics like the:

- Labor Force Participation Rate

- Average Hourly Earnings

- Average Weekly Hours

- Unemployment Rate

Among all these components, the NFP typically receives the most attention, as it provides an estimate of the actual number of paid employees in business and government establishments.

Given the name “Non-Farm Payrolls,” NFP in forex gets its name from one of the jobs excluded: farmworkers. It also does not include individuals employed in non-profit organizations or private households.

Since the NFP figure represents the number of jobs added or lost in sectors covered by the report, the figures shown are sometimes referred to as non-farm employment change rather than NFP.

When is NFP in Forex?

The Bureau of Labor Statistics issues NFP data on the first Friday of each month (8:30 AM ET).

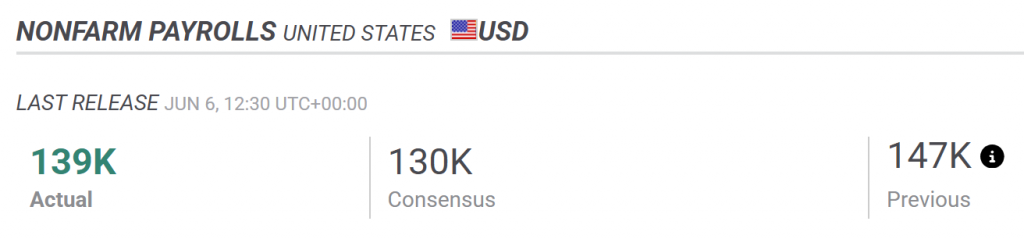

As of May 2025, the U.S. Bureau of Labor Statistics posted an increase in the U.S. labor market NFP by 139,000, compared to the market expectation of 130,000. This reading follows the 147,000-increase recorded in April.

Since NFP in forex can create high volatility in the financial markets, several analysts are quick to release their predictions on where the NFP might land before the actual release date. As a result, several speculations arose before the actual NFP forex news forecast.

A particularly positive NFP forex news forecast ahead of the actual NFP release can have a similar impact to the NFP data itself, as it significantly outperforms estimates.

Why is NFP Important?

The NFP report offers a fresh insight into the overall state of the U.S. economy and the labor market.

So, if the labor market is growing, it translates into more people making money and an increase in expenditures. This increase in spending, in turn, results in a higher Gross Domestic Product (GDP)—the broadest economic measure.

Employment figures found in the NFD also affect interest rates. The Federal Reserve is mandated to maintain optimal employment in the U.S. and keep prices stable. So, they keep an eye on the NFP report when creating the interest rate policy.

Since the central banks’ monetary policies are aimed at balancing inflation with growth, higher employment usually results in higher interest rates.

Interest rates are also an important factor considered by forex traders. Since the U.S. is the largest economy worldwide, any actions taken by the Federal Reserve tend to significantly impact global financial markets.

Their actions will also have a significant impact on the USD, so forex traders will closely monitor NFP in the forex market and adjust their trading strategies quickly based on the data received. Some traders will also attempt to capitalize on the volatility of the NFP in the forex market.

What Does NFP Mean in Forex?

NFP reports generally tend to cause large movements in the forex market.

Suppose the Federal Reserve decides to lower interest rates to combat an increase in unemployment. This decrease will reduce the dollar’s demand, leading the dollar’s price to fall.

Conversely, an increase in the number of jobs added (200,000 and above) is likely to impact the potential for USD gains positively.

As with other economic releases, a group of professional analysts conducts a prediction before the release itself. If the NFP data significantly “misses” or “beats” this consensus, a major market move usually follows. If the data aligns roughly with expectations, low volatility may persist.

Note that the NFP data does not necessarily follow gradual monthly inclines or declines. This radical nature of NFP was evident even in the pre-pandemic era, where the NFP data tended to fluctuate wildly.

What Do Forex Traders Do With NFP Data?

NFP in forex requires traders with open positions to actively react to NFP data releases. A sudden increase in volatility becomes risky when you do nothing with your position, as it leads to wider spreads and margin calls.

In some cases, forex traders will consider closing all active positions before an NFP release and starting a new trading pattern following the release. Alternatively, they avoid trading altogether during these releases.

If you take this immediate action, it could lead to unpredictable outcomes as scalpers (or traders who seek constant opportunities to lock in several short-term trades) enter the picture and attempt to overtake you in the fastest way possible.

Note that currency pairs may take a while to start moving in a more typical fashion. At this point, a wider pool of traders may begin to get involved.

Is There a Reliable Strategy for Reacting to NFP in Forex?

When it comes to currency trading, it is important to know that no single strategy is perfect when you seek trading opportunities from NFP data.

However, several forex traders seem to adopt one common strategy: the pullback strategy. Here, you wait for a currency pair to retrace before you enter a trade.

For instance, in the March 2019 NFP report, the data show a highly disappointing 20,000 new jobs compared to the expected 180,000 jobs. Usually, this data harms the USD and causes the EUR/USD to rise.

However, while the graph above shows the numbers spiked rapidly, they still fell back quickly—even going below the pre-NPF level.

At this point, the pullback strategy would suggest you buy a trade in the expectation that the graph will move back into a positive position. And that’s exactly what happened. You can see this increase using the large green candle, which represents the next five-minute period.

When to Trade NFP

There are two ways to trade NFP in forex:

Before the NFP Release

If you execute a trade before the figure is released, you are applying your deductive reasoning skills to predict which way the market will go before it does.

Risk management is always essential to any trader, even more so when opting for this type of strategy. An unexpected figure can create market gaps, which could move past any risk-minimizing tactics that you have in place.

To give yourself a better chance, provide a wide range of options for your trading instrument to move and oscillate.

After all, most central banks worldwide prefer inflation to grow at a rate of 2% to 3% annually.

Related: TradersUnited – 5 Pro Tips: How to Be a Good Trader?

After the NFP Release

Executing a trade after the NFP release calls for a bit more caution and comes with its own risks. That’s because the initial reaction to the NFP data isn’t always the reason for the market movement that day.

Previous documentations show that the market can mimic a V-shape after the NFP release. This shape indicates that the spike goes in a certain direction and then reverses in the minutes or hours that follow.

How Can CommuniTrade Help Me Learn When to React to NFP Data?

It may be extremely daunting and risky to trade instruments when NFP in forex is involved. It is not enough to guess, but learning from a community of experts can help you get on the right track.

Our forex trading experts at CommuniTrade can guide you with a reliable strategy for forex trading based on factors like the NFP report. You can learn and grow with an online community that shares accurate insights based on their craft and expertise.

Join millions of traders worldwide and minimize the risks of NFP data releases with CommuniTrade.

FAQs

Is it safe to trade during NFP?

Non-farm payrolls are significant indicators of the U.S. economic health. Trading around an NFP release can be risky and volatile because almost every asset tends to move rapidly in a matter of minutes or even seconds.

How many pips can NFP move?

Within 15 to 30 minutes of the NFP report release, the price should move at least 30 pips. If the price only causes a few pips to move on the release, it is not significant to the market. Hence, your strategy might not be worth using.

Is a higher NFP good?

Generally, a higher NFP indicates a stronger U.S. economy, which can have a positive impact on the U.S. dollar (USD). However, extremely high NFP figures are not good. These high values raise concerns about inflation and possible Federal Reserve rate hikes, which may weaken the USD.

Learn Advanced Trading Strategies With CommuniTrade

CommuniTrade is more than just an online community: we equip you with several features that will help you form the best strategies to boost your earnings.

Trading forex based on the NFP report is only one aspect of the entire strategy. Learn what works in real-world situations of the foreign exchange market from our expert guides and credible members at CommuniTrade.