Foreign exchange (or “forex”) trading involves the buying and selling of currency pairs in lots. Your position lot size describes the volume of your trade; it technically represents how many units of currency pairs you have in a single forex trade.

This article explains the definition, types, and importance of position lot size for safe and profitable forex trading. Remember, all professional forex traders carefully choose their lot size before entering the market. Read on and be like them!

What Is a Lot Size in Forex?

In its most basic form, lot size refers to the standardized forex position sizes traders can open in the forex market. Position size refers to the trade volume; it shows how many base currency units you buy on a single trade transaction.

Since lot size is literally your trade volume, it’s extremely crucial to your trading account because it directly impacts your position’s risk exposure and potential profitability.

Essentially, when you open a standard lot (100,000 units of currency pair), you subject your capital to higher risks. But on the brighter side, a high-volume position is profitable because of increased pip value with just the smallest currency value movement.

The same logic applies to low-volume positions with micro and nano lots. It has fewer risk exposures and low profitable opportunities because of decreased pip value.

Remember: it’s physically impossible to trade a single unit of any currency pair, and (hypothetically!) even if you can, it’s just a waste of time, effort, and money.

Pip Value and How It’s Affected by Lot Size

In forex trading, the pip (also known as “Percentage in point” or “Price interest point”) refers to the smallest incremental change in exchange rates or prices of any currency pair. In most currency pairs, the smallest pip movement happens at the asset price’s fourth decimal value.

But some pairs, including Japanese yen (JPY), are expressed with two decimals only. Thus, the smallest pip movement for JPY-denominated pairs happens in the second decimal place.

The lot size of your forex trade has a significant relationship with your position’s pip value. So, it impacts your trade’s potential loss and profit.

Assume you open a long EUR/USD with a standard lot at 1.2000. The moment EUR/USD rallies to 1.2001 or depreciates to 1.1999, the market experiences a one-pip movement.

This either gives you 10 USD or causes you to lose 10 USD, depending on whether it appreciates or depreciates.

Why? Every one pip movement in a standard position equates to a $10 pip value.

It’s Derived from the Traditional Stock Exchange’s Lot

The term lot size is also heavily used in the traditional stock exchange. Like in forex, the stock market requires traders to trade in lots to standardize the volume for each trade transaction.

However, instead of currency pair units, lot size in stock trading refers to the quantity of shares traders want to purchase or sell.

Traditionally, the typical lot size is a round lot, which has 100 shares of stock in it. It encompasses lot sizes multiple by 100, such as;

- 200 shares

- 600 shares

- 1,000 shares

- 5,000 shares

- 20,200 shares

- And so on

The stock market has become more flexible with the advent of odd lots, the stock trade size that doesn’t fall under the multiple of 100. It can be below 100 shares, or any number not evenly divided to 100.

It’s called odd lots because—well, it’s not commin! It’s not the typical lot size ancient stock traders used to trade. However, this stock lot size aided the accessibility issue of high-valued stocks.

With odd stocks, individual traders can afford to trade expensive stocks because they are not required to invest in a minimum of 100 shares.

What Are the 4 Types of Lots

A lot is the unit measurement of your forex trade position.

It represents how many units of the base currency you buy or sell. It can be in a standard lot (100,000 units), mini lot (10,000 units), micro lot (1,000 units), or the smallest nano lot (100 units)

Still confused? Here’s how I usually see it, using the egg analogy!

In most grocery stores, the seller sells their eggs in cartons, either in dozen (12 eggs) or half dozen (6 eggs). This is what egg buyers have come to expect. They know they can’t buy just one egg from the carton.

That’s the core concept of how a lot is traded in forex.

What is a Standard Lot in Forex?

The standard lot in forex equals 100,000 units of the base currency. As the name suggests, this is the most common forex lot size for retail and institutional investors.

Trading a standard lot requires a higher risk tolerance, exposing your capital to significant market risk. A single pip movement can result in a cash swing of $10, either incurring a loss or gaining profit. The more the market moves against your position, the more substantial the floating losses it incurs.

On the flip side, your capital can reap substantial benefits if the market moves in your favor. A single pip movement in a favorable direction can lead to a gain of $10. It’s important to remember that forex trading is renowned for its volatility, making it possible for it to experience more than hundreds of pip-movements.

But how much is needed to open one standard lot in forex?

It depends on the current market price of the currency pair you’re trading.

Suppose you want to buy a standard lot of EUR/USD at 1.2000. This means you’re buying 100,000 units of the base currency (EUR) using 120,000 units of the quote currency (USD). Thus, you need to have $120,000 in your trading account to open and control a standard size of this currency pair.

| Advantages | Disadvantages |

|---|---|

| High returns Beneficial for long-term trading Effective for risk management | High risk exposure Unsustainable for short-term trading Extremely expensive |

What is a Mini Lot in Forex?

A mini lot in forex is one-tenth the size of the standard lot. When you trade a currency pair with a mini lot, you essentially trade 10,000 units.

Considering its relatively smaller volume, trading mini lots is advisable for individual traders with smaller trading accounts and lower risk tolerance.

However, it’s not limited to cautious and beginner traders. Trading mini lots of those currency pairs is sustainable if you want to diversify your portfolio and limit expenses by trading smaller positions.

When the market moves a single pip, your position will either make or lose $1. So, while trading this position limits potential loss, it also limits you from quickly profiting from the market.

But hey, that’s absolutely okay! In forex trading, it’s always smart to put more emphasis on your risk tolerance than your prospect profit.

To determine how much you need for one mini lot, you need to know the asset’s current market price. For example, say you’re going long GBP/USD at 1.1000 in a mini lot.

Simply multiply the GBP/USD market price by 10,000, the number of currency pair units in a mini lot. In this case, you need 11,000 of the quote currency (USD) to buy 10,000 units of the base currency (GBP).

| Advantages | Disadvantages |

|---|---|

| Lower risk Better flexibility Beneficial for short-term trading | Low returns High spread percentage |

What is a Micro Lot in Forex?

A micro lot is one-hundredth the size of the standard lot and represents a forex trade with a volume of 1,000 currency pair units.

Trading micro lots will have less financial impact than trading large-volume positions like mini or standard lots. In micro lots trading, a single pip movement only results in 1 currency unit.

However, this doesn’t mean it’s unsustainable to trade micro lots. Opening multiple trade positions in micro lots is ideal for those who scalp their trade because they’re known to take advantage of the small profits from multiple forex trades.

Want to know how much is needed to open a micro lot position for USD/JPY at 155.20? Simply multiply the asset price, 155.20, by the volume of micro lots, 1,000. So, you should get an answer of 155200. Basically, you need 1,552(.00) units of JPY (quote currency) to buy 1,000 units of USD (base currency).

| Advantages | Disadvantages |

|---|---|

| Lower risk More flexibility Lower capital requirement Sustainable for scalping | Limited returns Limited market exposure High transaction costs Unapplicable to majority of strategies |

What is Nano Lot in Forex?

Nano lot is not nearly common among the other three lot sizes in forex trading. In fact, you might find it difficult to find a broker and trading platform that supports and executes nano lot trade positions.

While nano lot trading is the least risky among all forex lot sizes, it is also the least profitable, even for scalpers and beginners. Just imagine: a single pip movement would only cost or give you 0.01 currency unit. This means your position needs to have a 100-pip movement just to generate a single currency.

Many traders also avoid trading nano lot positions because they are not cost-effective. When you trade nano lot, you pay your broker high fees. Also, because of its small size, your position has a high spread percentage.

Wondering how much it would cost you to open nano lot of EUR/USD at 1.2000? You only need 120 units of USD to buy 100 units of EUR.

| Advantage | Disadvantages |

|---|---|

| Lowest risk exposure | Unstainable for both long- and shot-term trading Not profitable High broker fees and spread percentage |

How Do You Calculate Pip Value Using Lot Sizes?

Risk management is an important aspect of every forex trade. Given the risk involved in your position, you must always have a sound plan to secure your investment.

One effective risk management technique is calculating pip value using your lot size. Remember, your lot size dictates your position’s pip value. By calculating the potential losses and profits per single pip movement, you can see which lot size suits your risk tolerance and overall trade goals.

For USD-Quoted Currency Pairs

Calculating the pip value is simple for currency pairs with USD as the quote currency currency. Just use this reference:

- Standard Lot: $10.00

- Mini Lot: $1.00

- Micro Lot: $0.10

- Nano Lot: $0.01

But what’s the calculation behind it? Well, we calculate it using this formula:

Formula: Pip value = Pip movement x Lot Size

Example for every 1 pip movement for EUR/USD with an exchange rate of 1.1000:

| Standard Lot | Mini Lot | Micro Lot | Nano Lot |

|---|---|---|---|

| 0.0001 x 100,000 Pip value: 10 | 0.0001 x 10,000 Pip value: 1 | 0.0001 x 1,000 Pip value: 0.10 | 0.0001 x 100 Pip value: 0.01 |

For Non-USD Quoted Currency Pairs

The pip value for each lot size differs for other currency pairs that don’t have USD as the quote currency. Essentially, it considers the exchange rate of the currency pair.

Formula: Pip Value: (Pip movement / Exchange rate) x Lot size

How It Works: Chelsey Calculating USD/JPY Pip Value

Chelsey is a beginner trader with a $4,000 trading account. Given her relatively small trading account, she’s strictly following the 1% capital rule. Thus, she plans to risk $40 for each trade.

However, she’s bullish on the USD/JPY because of the upcoming US Employment/Unemployment Data Release. Therefore, she’s planning to go long on USD/JPY at 150.20 with a sustainable lot size.

To determine how much she will take for this trade, she calculates the pip value of USD/JPY on different lot sizes per single pip movement.

| Standard Lot | Mini Lot | Micro Lot | |

|---|---|---|---|

| Given | 0.01 150.20 100,000 | 0.01 150.20 10,000 | 0.01 150.20 10,000 |

| Computation | (0.01 / 150.20) x 100,000 6.6577 x 100,000 | (0.01 / 150.20) x 100,00 6.6577 x 100,000 | (0.01 / 150.20) x 100,00 6.6577 x 100,000 |

| Pip Value | 6.65 /pip | 0.66 /pip | 0.07 /pip |

With this calculation, Chelsey decided to open a mini lot of USD/JPY so her trading account could withstand a 60-pip movement against her position. This lot size provides her investment enough market space to play with and profit in.

Why Are Lots Important?

Considering your position, lot size is among the essential building blocks of your trading strategy. It provides a clearer idea of effective and suitable risk management techniques, precise position sizing, and the fighting chance to yield high returns.

Risk Management

Your chosen lot size tells your trade’s risk exposure; the bigger your position size, the higher the risk to subject your position to. Conversely, a smaller position lot size has lower risk exposure.

When choosing which lot size to open, consider your risk tolerance and trading account balance.

Opening a standard lot for high-conviction trades is only reasonable if you have a high-risk tolerance and account balance. However, if you know your account can’t take high risks due to a small balance, opening a standard lot is just a recipe for disaster. You should only open a small-volume position for lesser risks when you have a small account.

Proper Position Sizing

All traders strategize their trades to avoid losing money rapidly. Among the trading strategies they use is proper position sizing.

With position sizing, you determine how many units of currency pair you’re trading and how big of an investment you’re exposing to market risk. This reference helps you control market risk and maximize potential returns.

To ensure your position size is sustainable for your trading account, you first need to determine your risk-reward ratio. The risk-reward ratio measures your target profit relative to the risked capital. For starters, a 1:2 risk-reward ratio is ideal.

With this risk-to-reward ratio, you basically expect to gain 2 currency units for every unit exposed to risk.

How to Choose Lot Size in Forex?

You don’t choose a lot size on a whim. You need to sit through and analyze your trading plan before you can come up with a suitable lot size for your trade.

Remember, you should put more weight on your position sustainability over profitability when choosing your forex trade size. To ensure trade sustainability, you have to consider your risk tolerance and trading account size.

Consider Risk Tolerance and Account Equity

Before you can come up with a suitable and sustainable lot size, you first need to determine your risk tolerance and consider your account equity.

Essentially, this tolerance level represents the risk you’re willing to take for a single trade position. Meanwhile, the account equity is the sum amount of money available on your trading account.

While there’s no universal rule in setting a risk tolerance level, it’s advisable for novice traders to only risk 2% of their trading capital per trade. This means that if you have a trading account of $20,000, you should never expose your trade to a risk of more than $4,000.

For general traders, make sure to consider your trading strategy, risk appetite, and financial goals/situation when determining this tolerance level.

Also, always follow the rule of thumb when you’re trading; to always set up a stop-loss order to battle the volatility of the market.

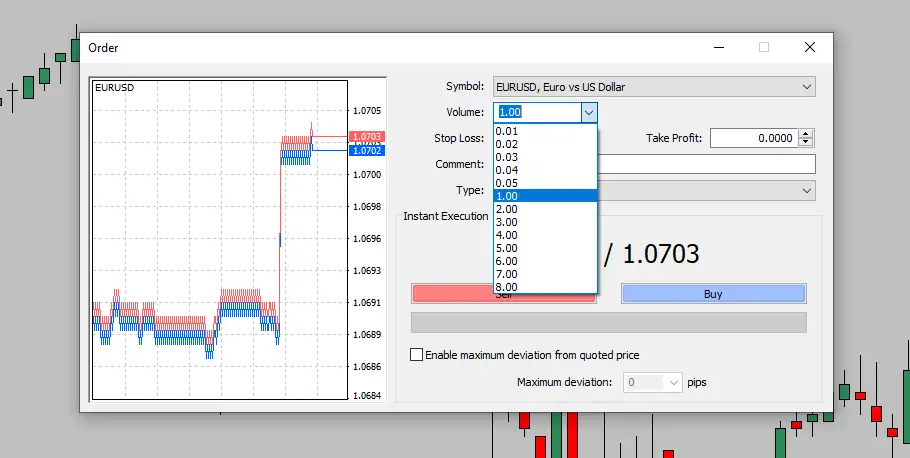

Setting Lot Size on MetaTrader 4

The MT4 trading platform allows you to use position sizes which are multiples of micro-lots, multiples of mini-lots, or multiples of standard lots.

As mentioned earlier, majority of trading platforms don’t support an execution of nano lots. MT4 is one of those trading platforms.

The MT4 platform represents the lot sizes in volume. Specifically, the lot sizes are expressed using these:

- 1 standard lot: 1 Volume

- 1 mini lot: 0.1 Volume

- 1 micro lot: 0.01 Volume

If you want to open a trade with more than 1 lot, simply multiply the number of lots you want to open to the representing volume of the lot you’re opening.

- 5 standard lots: 5 x 1 = 5 Volume

- 3 mini lots: 3 x 0.1 = 0.3 Volume

- 4 micro lots: 4 x 0.01 = 0.04 Volume

Frequently Asked Questions

How can I start trading forex?

To start trading forex online, you have to find a reliable forex broker, open an account, fund your trading, and do tons of research when deciding which currency pair to trade.

If you’re a beginner trader, practicing with a demo account is advisable to be familiar with the forex market dynamics without financial risks.

Can I change the lot size of an open position?

Most of the time, trading platforms don’t support changing lot sizes once the trade is executed to the market. To confirm, check the terms of use of your broker’s trading platform.

Can I trade only hundreds of currency pair units?

Yes, it’s possible to trade only a hundred of currency units by opening a trade in nano lot. However, it’s typically difficult to find a broker and trading platform that support an execution of nano lot position.

Always Trade Forex with a Suitable Lot Size

By being equipped with the concept and importance of lot size, forex trading can be safe and profitable. If you know how to choose the right and sustainable lot size for your position, you can control your trade’s risk exposure and even maximize potential profits.

Want to learn more about the basics of forex trading? TradeGeek offers courses about everything you need to know before you start trading currency pairs. Leverage Traders United free educational courses and start making a more informed and effective trading decisions!