Choosing the right assets to add to your portfolio is crucial to achieving long-term success in the stocks trading industry. While risks are always part of the market, some investors seek greater financial stability by investing in stocks from blue chip companies in South Africa.

Blue chip stocks are recognized for their reliability, stability, and strong track record. Coming from household names in the industry, these stocks serve as the cornerstone of investment portfolios.

But why do these stocks stand out as perennial favorites and do not cease to command respect in the financial market?

This TRU Insight explores a whole new area of stability brought about by blue chip stocks. We’ll also uncover our experts’ top picks for the best blue chip stocks in South Africa. Read more to learn whether our top blue chips are the right investment choice for you.

Blue Chip at a Glance:

- Blue chip companies are large, financially stable companies that hold excellent reputations. They often include large household names.

- Blue chip stocks are a great addition to your portfolio, as they offer reliable financial returns.

- Several investors invest in blue chips due to their long-standing history of increasing dividends.

- The top five picks for blue chip stocks in South Africa are FirstRand Ltd, Discovery Holdings Ltd, IMPLATS, Anglo American Platinum Ltd, and African Rainbow Minerals Ltd.

What are Blue Chip Stocks?

Blue chip stocks come from well-known, financially sound companies that often include prominent household names in the financial industry.

Blue-chip companies have established and maintained reputable branding over the years. They have also weathered several economic downturns, attesting to their strength and long records of steady growth.

These companies are considered solid long-term investments, as they possess a large market share, strong brand recognition, seasoned management, and reliable financial performance. Thanks to these qualities, blue chip stocks have established a strong presence in the major market index.

Investors opt for blue chip stocks due to their strong history of performance and growth. Coming from companies that often pay dividends to their investors, these stocks have strong market numbers and dependable earnings.

In terms of market capitalization, blue chip companies often have billions at their disposal. They’re considered market leaders, which makes them among the most popular stock purchases.

Characteristics of Blue Chip Stocks

The term “blue chip” was initially used in 1923 by Oliver Gingold, an employee of the Dow Jones stock market index. Gingold coined the term to describe stocks traded at USD 200 and above per share.

As with poker chips, blue chips have the highest value in the stock market. However, it should not be mistaken for stocks with a high price tag.

In general, blue chip stocks are shares from companies in healthy financial condition that have withstood the tests of time.

Compared to shares from non-blue-chip companies, blue chip stocks are seen as less volatile investments due to their institutional profile and long-standing financial health.

To help you understand these stocks better, our experts laid out four characteristics that commonly describe blue chip stocks:

- High Liquidity: Blue chips are frequently traded in the market by both individual and institutional investors. If you need cash, our experts can confidently say that you can feel secure trading these stocks, as buyers will readily purchase your shares.

- High Returns: Blue chip companies are also characterized by having large market capitalization, minimal to no debt, a high return on equity (ROE), and a high return on assets (ROA).

- High Credit Rating: Our experts found that, thanks to blue chips’ solid balance sheet basics and high liquidity, they earn investment-grade ratings.

- Rising Dividends: Although dividends are not a prerequisite for stocks to be considered blue chips, most blue chip companies have a long history of providing stable or increasing dividends.

Taking all this information into consideration, our experts carefully examined the performance of blue chip companies in South Africa and selected a few of the best stocks to invest in.

With over a decade of experience analyzing the market, rating brokers, and determining the best assets to trade, our experts have developed a keen eye for identifying the best stocks to trade.

Being professional traders in the industry, they are equipped with unmatched expertise and a trading arsenal of advanced assessment tools to identify the best players in the financial market.

Let’s look at their top picks for the best blue chip stocks in South Africa in the next section.

Top 5 Blue Chip Stocks to Trade in South Africa

After carefully considering the market performance of current blue chip companies in South Africa, our experts put forward the following top blue chips stocks list for traders to consider investing in:

Impala Platinum Holdings Limited

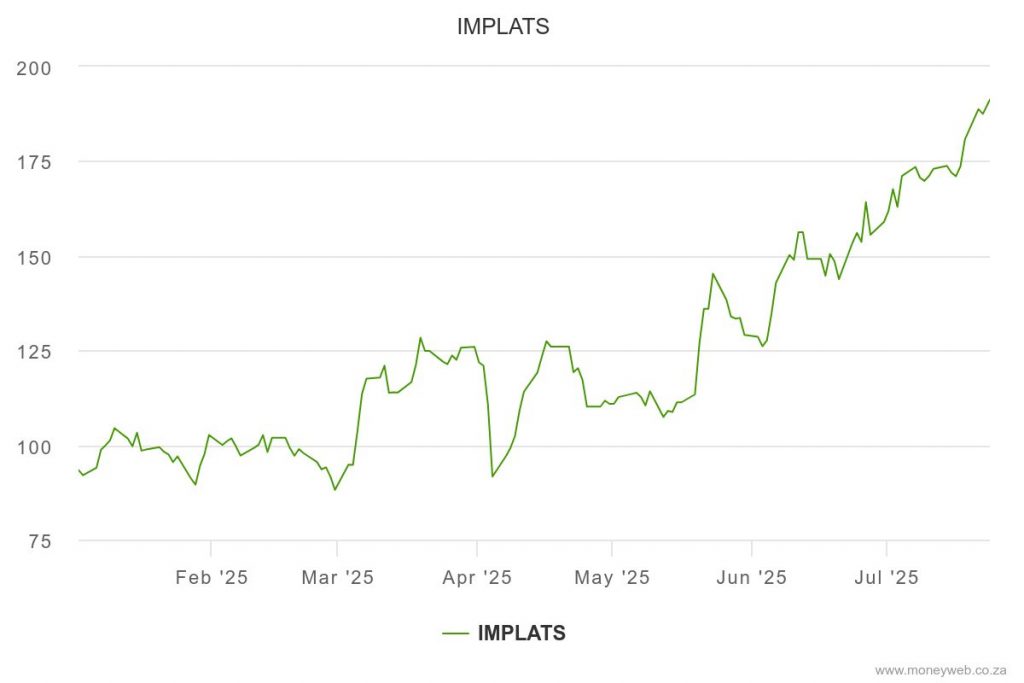

Impala Platinum Holdings Limited, or IMPLATS, is one of the leading global producers of platinum group metals (PGMs).

They are mainly responsible for mining, refining, and marketing PGMs such as platinum, rhodium, and palladium, as well as base metals like copper, cobalt, and nickel.

Currently, IMPLATS operates mines in Zimbabwe and South Africa, as well as a refining business known as Impala Refining Services (IRS).

Below is a summary of JSE: IMP current market values:

| Market Capitalization | 171,106,517,362 |

| 52-Week Price Range | R70.35 – R190.42 |

| EPS-TTM | 110 |

| Dividend Yield | 0 % |

| Authorized Shares | 1,044,008,000 |

| Issued Shares | 904,368,485 |

Based on our experts’ research, JSE: IMP experienced an astonishing increase in its year-to-date (YTD) return, valued at 113.68%. They attributed this increase to rising platinum prices and a supply deficit of PGMs worldwide.

Furthermore, strong cost control measures and a weakened South African rand have also impacted IMPLATS’ YTD performance. According to our experts, this could benefit the company’s earnings in US dollars from its Canadian and Zimbabwean operations.

Be sure to check the next earnings report from IMPLATS on August 27, 2025. As per our review partner’s generated data, JSE: IMP estimated Earnings Per Share (EPS) is valued at $3.84 per share.

Read more: What is the Impala Platinum Share Price 2025 – TradersUnited

African Rainbow Minerals Ltd

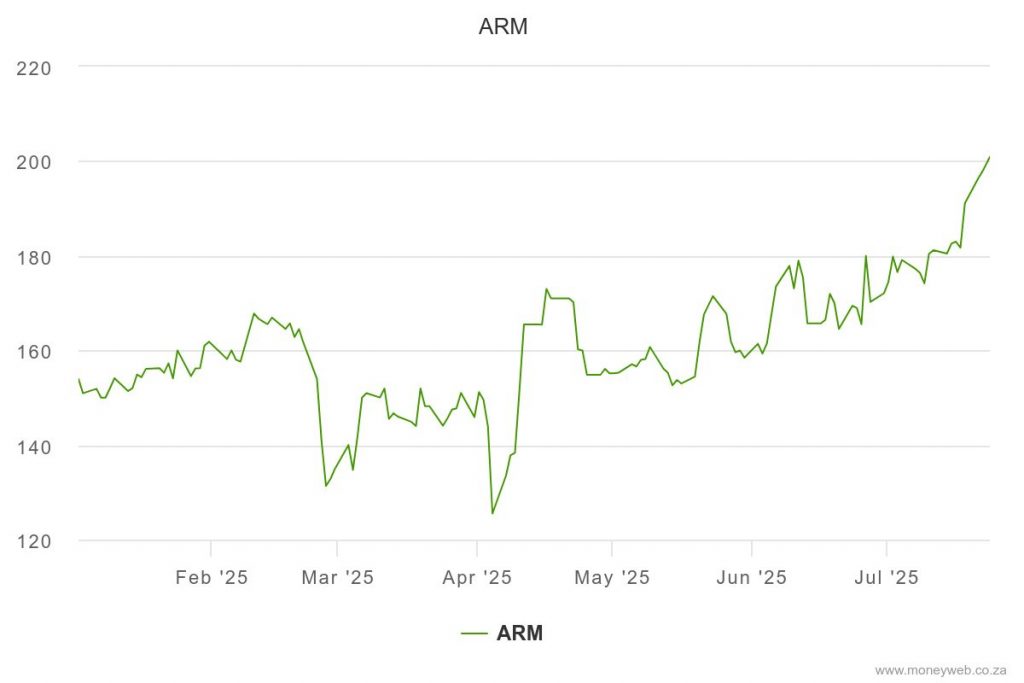

African Rainbow Minerals Ltd (JSE: ARM) is a diversified minerals and mining company based in South Africa. Similar to IMPLATS, it mines and processes platinum group metals (PGMs), as well as iron ore, manganese ore, chrome ore, copper, coal, and nickel.

The blue chip company currently operates in South Africa and Malaysia. Through its strategic investment in Harmony Gold Mining Company (Harmony), it also holds a stake in the gold mining industry.

Based on our experts’ data, below is JSE: ARM’s current market value:

| Market Capitalization | 44,471,619,001 |

| 52-Week Price Range | R115.07 – R223.55 |

| EPS-TTM | 1859.15 |

| Dividend Yield | 6.82 % |

| Authorized Shares | 500,000,000 |

| Issued Shares | 221,428,097 |

JSE: ARM currently has an increased YTD return of 31.66%. According to our experts, this increase in basic earnings could be attributed to lower impairments in the first half of 2025 compared to the previous year.

On one hand, some reports show a decrease in ARM’s headline earnings for the first half of the 2025 financial year. According to our experts, the decrease is likely due to lower iron ore sales volume and price, as well as higher cash costs and a stronger rand.

For those anticipating, the next earnings report for ARM is scheduled for September 5, 2025, and its estimated Earnings Per Share (EPS) is $17.33697 per share.

Read more: 2025 UPDATE: African Rainbow Minerals Share Price Today

Discovery Holdings Ltd

Also known as Discovery Limited, Discovery Holdings Ltd (JSE: DSY), is a South African financial services organization that operates in different sectors, such as:

- Life insurance

- Healthcare

- Short-term insurance

- Long-term savings

- Banking

- Wellness

Known for its Shared-value Insurance model, Discovery Limited aims to improve health and financial insurance through its wide range of financial products and services.

As the model’s name implies, Discovery Ltd offers clients, insurers, and society “shared value” through interconnected positive outcomes.

Based on our review partner’s data, below is JSE: DSY current market value:

| Market Capitalization | 146,246,926,558 |

| 52-Week Price Range | R133.00 – R224.60 |

| EPS-TTM | 1248.47 |

| Dividend Yield | 1.11 % |

| Authorized Shares | 1,000,000,000 |

| Issued Shares | 679,680,841 |

JSE: DSY has seen a significant increase in its YTD performance, showing a 10.7% improvement. According to our experts, this is largely due to positive investor sentiment and strong financial results.

When it came to its interim results, our experts found a 27% increase in operating profit and a 34% increase in headline earnings. Our experts explain that this result is underpinned by DDSYJ’s effective execution of its Vitality program, as well as other South African businesses.

DSY’s focus on innovation and unique Shared-value Insurance model has further strengthened its performance, contributing to investor confidence and a positive YTD stock price movement.

Discovery Holdings Ltd’s next earnings report will be on September 11, 2025, and its estimated Earnings Per Share (EPS) is forecasted to be $13.53 per share.

Read more: High Performing SA Stocks: Discovery Share Price JSE 2025 – TradersUnited

Anglo American Platinum Ltd

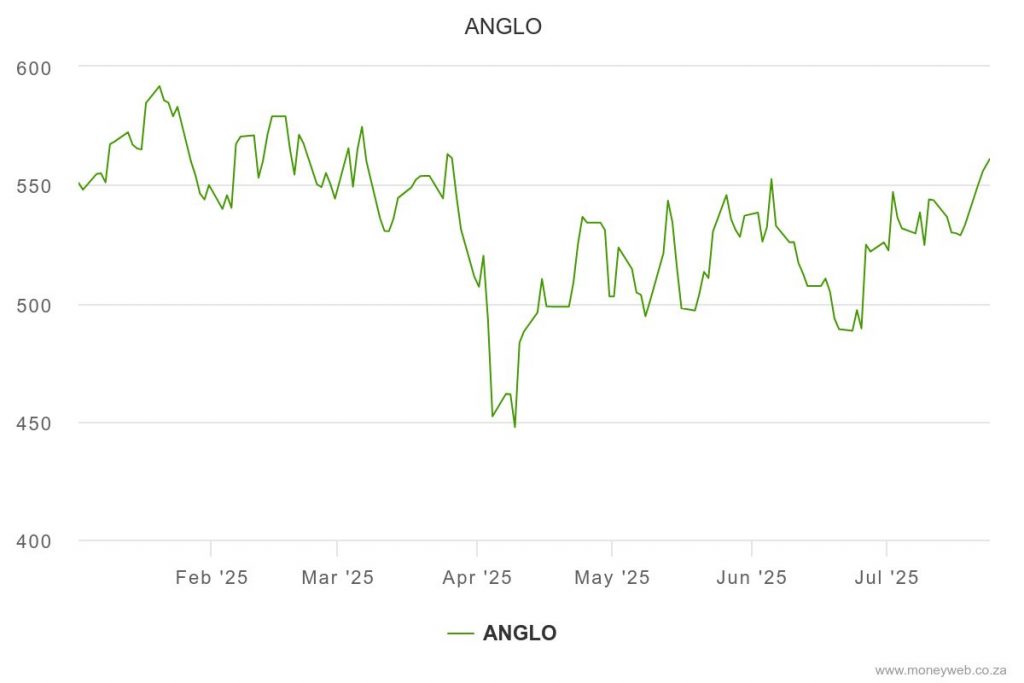

Anglo American Platinum Limited, commonly known as Amplats, is the largest producer of platinum in South Africa and globally.

Amplats is a subsidiary of Anglo-American South Africa Investments Pty Ltd. Effective May 28, 2025, the company rebranded as Valterra Platinum Limited.

Valterra Platinum Limited mines and processes PGMs such as platinum, palladium, iridium, rhodium, ruthenium, and osmium.

Currently, the products of this platinum metals-producing company are used in various industries, including jewelry, technology, and the automotive sector.

Below is a summary of JSE: AGL’s current market values:

| Market Capitalization | 646,879,184,858 |

| 52-Week Price Range | R417.88 – R596.29 |

| EPS-TTM | 1319.08 |

| Dividend Yield | 2.13 % |

| Authorized Shares | 1,820,000,000 |

| Issued Shares | 1,178,050,272 |

Based on our experts’ data, Valterra Platinum Limited saw a positive increase in its YTD performance, showing a YTD return of 0.73%.

According to our experts, this increase in Valterra Platinum Limited YTD is due to a rebound in PGM prices and increased market sentiment, which is caused by a combination of four factors:

- Increased investment demand

- Supply constraints

- Recovery in Chinese jewelry fabrication

- Supply constraints

Each factor contributed to market deficits, which pushed PGM prices above the cost support. For instance, platinum and palladium rose by 58% and 43%, respectively. Our experts further note that most of these price increases occurred at the beginning of May.

For Amplats investors, the next earnings report is scheduled for July 28, 2025. Note that the estimated Earnings Per Share (EPS) for Valterra Platinum Limited is $0.12 per share.

Read more: What is the Amplats Share Price Today? Stock Analysis Updated 2025 – TradersUnited

FirstRand Ltd

FirstRand Ltd (JSE: FSR) is a financial holding company based in South Africa. It offers a wide range of financial services through its several subsidiaries, including:

- Lending

- Investment

- Insurance solutions

- Transactional services

As one of the largest financial services groups in Africa, FirstRand Ltd maintains a strong presence in the South African market. To date, it also has operations in India and the U.K.

The current market value of JSE: FSR is as follows:

| Market Capitalization | 422,731,015,755 |

| 52-Week Price Range | R59.08 – R89.22 |

| EPS-TTM | 712.19 |

| Dividend Yield | 5.76 % |

| Authorized Shares | 6,001,688,450 |

| Issued Shares | 5,609,488,001 |

Based on our experts’ research, JSE: FSR currently has a negative YTD performance, decreasing to –0.8%. They explain that this decreased YTD is likely due to the same factors that affect other financial holding companies in South Africa, such as:

- increased credit impairments

- a decline in net interest income

- challenging business operations

- currency fluctuations

- increased competition

Alt text: an image showing the YTD chart of FirstRand blue chip stocks

On a positive note, our experts found that FirstRand experienced a decrease in credit loss ratios and an increase in net interest income.

For existing and current investors, the next earnings report from FirstRand is scheduled for September 12, 2025. Our experts estimate the Earnings Per Share (EPS) for the company to be $7.55487 per share.

Read more: What is the FirstRand Share Price in South Africa 2025? – TradersUnited

Are Blue Chips Worth the Investment?

If you are seeking stability and long-term growth in your stocks trading, adding blue chips to your portfolio can be a worthwhile investment.

However, they are not without some drawbacks. Blue chip companies, although well-established, may have smaller growth potential compared to more volatile stocks.

This is primarily because these companies already have achieved significant market capitalization and successfully established a dominant presence in their respective industries.

Given this limited growth potential, adding more volatile stocks to your portfolio could help strike a balance and maintain a positive trajectory in terms of profit.

To learn more about the best strategies to include blue chip company stocks in your portfolio, you can ask our professional investors at CommuniTrade.

Be part of our verified online trading community and join millions of investors in the journey towards unlocking maximum profits in your investments.

Frequently Asked Questions (FAQs)

Are Blue Chip Stocks Safe?

Blue chips are generally considered safe investments thanks to their long-standing financial stability.

Since they come from companies that have survived difficult economic challenges and market cycles, these stocks are generally less prone to failure, especially during times of significant stress.

This is evident in the 2008 global recession, where banks like Lehman Brothers went bankrupt.

What Makes Companies a Blue Chip?

Blue chip companies are considered “titans” of their respective sectors. These companies are:

- Long-term stable

- Well-known

- Well-capitalized

- Have solid financial prospects

While there are no definitive characteristics that qualify stocks as blue chips, a generally accepted benchmark is a market capitalization of USD 10 billion. Nonetheless, it’s worth noting that market or sector leaders can come in companies of all sizes.

Where Can I Find Blue Chip Stocks?

You can find blue chips stocks list on the most reputable market indexes, including:

- Standard & Poor’s 500 (S&P 500)

- Dow Jones Industrial Average

- TSX-60 (for Toronto Stock Exchange)

- Financial Times Stock Exchange (FTSE) Index

For South African investors and traders, the Johannesburg Stock Exchange (JSE) facilitate centralized Sa stocks trading.

These lists are also available on a non-benchmark list known as the Nifty Fifty. Additionally, you can find them on major stock exchanges, such as the National Association of Securities Dealers Automated Quotations (NASDAQ) and the New York Stock Exchange (NYSE).

How Do I Invest in Blue Chip Company Stocks?

Investors often purchase blue chip stocks through exchange-traded funds (ETFs) that invest in them. ETFs hold various stocks and asset classes, which include blue chips.

In some cases, these funds and ETFs may focus exclusively on blue chips. An example of this is an ETF that tracks the Dow Jones Industrial Average, which has 30 of the largest blue chip stocks.

Diversify Your Portfolio with Blue Chip Stocks

You can use blue chip stocks as core holdings within a larger portfolio. However, given the tremendous risk that accompanies a potential loss from these stocks, they should not make up your entire portfolio.

Learn how to trade stocks from blue chip companies and integrate them effectively into your portfolio with CommuniTrade.

Whether you’re interested in FirstRand Ltd, Discovery Holdings Ltd, or the like, our experts can help you make the most well-informed decision in choosing the best blue chip stock to add to your portfolio.