Making money from home, passive income, and the boom of online trading.

All these had boosted the public’s optimism with online investment.

Coupled with investors’ excitement to build a better financial future, the saturation and demand for trading platforms had made investors vulnerable to various investment scams.

One investment scam that has been harming the South African financial market is the Ponzi scheme. Following the controversial Berry Trading Platform, another Ponzi scheme disguised as online asset investment is Throne Legacy Capital.

Through forex trading, Throne Legacy Capital (TLC) promised a 24-month guaranteed return to its clients. This 2-year-long guaranteed ROI surely attracted many investors to join the scheme.

However, it failed to consider the main characteristics of forex trading: Its volatility and dynamic nature.

Even the most profitable trader knows the fact that there’s no such thing as guaranteed returns when you trade forex.

This article reviews Throne Legacy Capital’s company information, investment services, and affiliation with other busted investment companies. Read on and discover the ultimate red flags you must look at to avoid falling into Ponzi schemes.

What Happened to Throne Legacy Capital?

Throne Legacy Capital (TLC) claimed to be a tech-driven forex investment company. However, it offers no definitive products – its source of income only comes from the investment made by new members.

All internal communications are made through TLC’s telegram channel, from announcements, notices, and reward distribution, typically done through emails and other documented communication mediums.

Remember, the Financial Sector Conduct Authority has warned unsuspecting investors about financial services providers mainly operating within social media or messaging platforms, including Telegram, WhatsApp, Skype, etc.

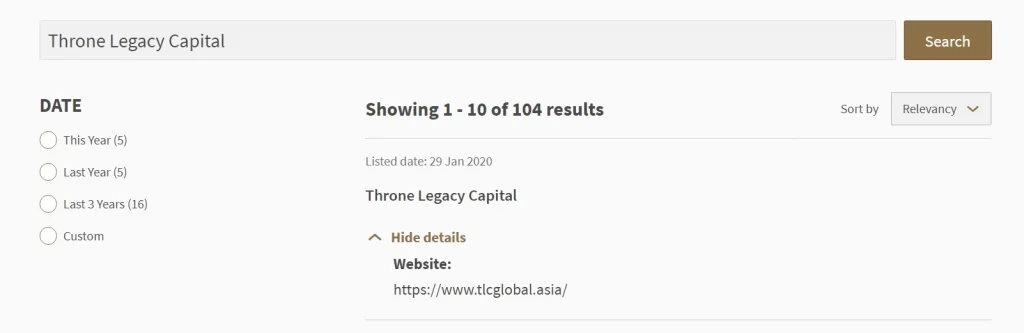

Additionally, several regulatory bodies warned their constituents about TLC’s fraudulent financial services. The Monetary Authority of Singapore (MAS) listed the company in its investor alert list.

Investor alert list is an initiative of the MAS to warn the public about financial service providers that may be wrongly perceived as MAS-regulated entities. Most of the time, such entities claimed to be authorized by the MAS to provide financial services to Singaporean investors.

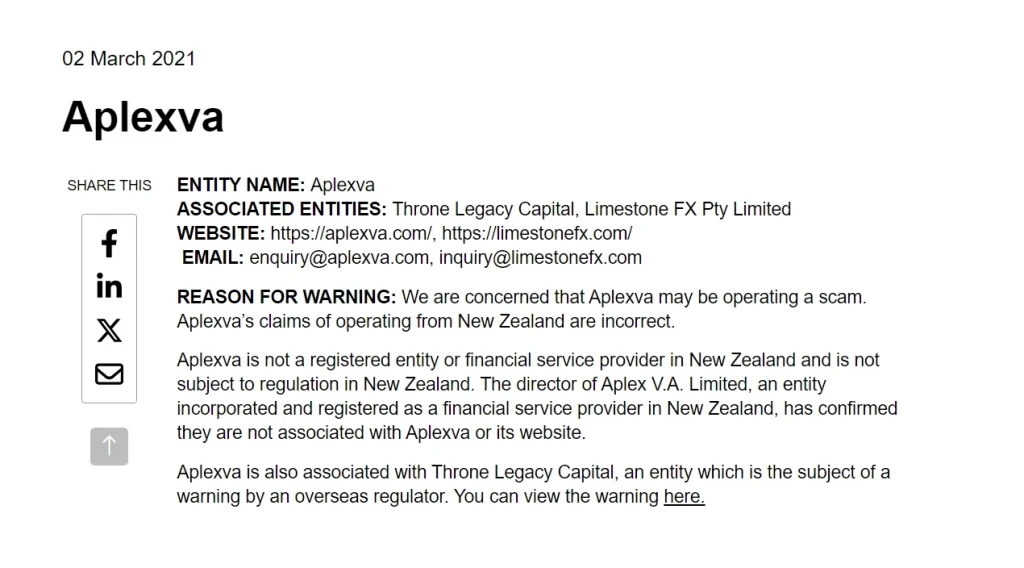

Additionally, the Swiss Financial Monetary Authority (FMA) issued a scam warning against Aplex VA – an entity associated with TLC. Aplex VA/Aplexva claimed to be incorporated in New Zealand.

The claim was flagged incorrectly, further concluding that Aplexva was impersonating Aplex V.A. Limited, a rightful FMA-regulated financial service provider.

Aplex VA and Throne Legacy Capital

According to the Swiss Financial Monetary Authority (FMA), Aplex VA was part of the Throne Legacy Capital Ponzi scheme.

Its emergence was aimed at continuing to defraud investors amidst the ongoing controversy of TLC.

The Collapse of Throne Legacy Capital

Throne Legacy Capital, headquartered in Tsim Sha Tsui, collapsed in 2024 after the company failed to sustain its multi-level marketing (MLM) business.

In July 2024, TLC investors reported unusual difficulties with investment withdrawal. It’s noted that TLC would allow affiliates to request withdrawals but to no avail of going through.

Cunningly enough, members reported that while withdrawals have been disabled, TLC has no issue processing the investment of new investors.

A few weeks after disabling withdrawals, Throne Legacy Capital finally collapsed.

The Promised 24-Month Forex Investment

Throne Legacy Capital’s primary offering was a “guaranteed” 24-month forex investment plan.

The company claimed that investors would receive fixed monthly investment returns over a specific period, regardless of market conditions.

TLC promised impressive returns without any tangible proof of actual forex trading or investment strategies. Moreover, the company doesn’t have any retailable products.

Remember, guaranteed returns are rare and frankly unfeasible, given the volatility and complexity of the forex market. Coupled with the fact that the company doesn’t have transparent financial reports and a track record of success.

Throne Legacy Capital Deals and Affiliate Ranks

Throne Legacy Capital utilized a multi-level marketing (MLM) model to attract a wide network of affiliates and investors. This structure incentivized affiliates to recruit others, creating a hierarchical system where earnings increased with the number of recruits.

While MLM models are not inherently illegal, they can become predatory and unsustainable when recruitment. Rather than investors having actual investment returns, they become the main source of income.

Throne Legacy Capital’s affiliate program offered various ranks, each promising increased rewards based on the number of recruits and the volume of investments.

TLC’s ranking includes the following:

| Hierarchy | Ranking | Initial Investment | Other Requirement |

|---|---|---|---|

| #7 | IB Rank | $1,500 | N/A |

| #6 | IB1 Rank | $1,500 | Deposit further investment |

| #5 | IB2 Rank | $1,500 | Recruit two IB1 Rank members |

| #4 | MIB1 Rank | $1,500 | Recruit three IB2 Rank members |

| #3 | MIB2 Rank | $1,500 in five different projects | Recruit two MIB1 Rank members |

| #2 | SIB1 Rank | $1,500 in eight different projects | Recruit two MIB2 Rank members |

| #1 | SIB2 Rank | $1,500 in ten different projects | Recruit two SIB1 Rank members |

Generation Bonus

One of the primary incentives Throne Legacy Capital used to fuel recruitment was the Generation Bonus.

This bonus was designed to reward affiliates for building extensive downlines, which meant enrolling new members and encouraging them to recruit others, expanding the affiliate network across multiple “generations” or levels.

Affiliates earned a commission not just from their direct recruits, but also from the recruits of their recruits—essentially earning from a “downline” several levels deep.

Generational Bonus Structure

- Direct Bonuses: Affiliates receive a small bonus for every person they directly recruit, encouraging constant expansion of their first level.

- Indirect Bonuses: As new recruits joined, affiliates received bonuses from multiple “generations,” creating passive income as long as the downline continued to grow.

- Residual Bonuses: Some ranks included residual bonuses, meaning affiliates earned a small percentage of the earnings generated by every new recruit within their network.

While lucrative for top-level affiliates, this model is problematic because it often leaves lower-level affiliates with minimal returns. This income structure is unsustainable and risky, as it requires continuous recruitment to generate payouts. When recruitment inevitably slows or halts, those at the bottom levels are typically left with no returns on their investment.

Key Red Flags and Warning Signs

When considering any investment, particularly in forex or other high-yield opportunities, it’s essential to look for warning signs that may indicate a Ponzi or similar investment scheme.

Throne Legacy Capital presented several red flags that potential investors should be aware of. Here are TLC red flags that resonate with common characteristics of the Ponzi scheme.

Guaranteed Returns

Throne Legacy Capital promised consistent, high returns over a 24-month period, regardless of market conditions. In the highly volatile forex market, such promises are unrealistic, as legitimate trading firms cannot guarantee returns due to unpredictable market fluctuations.

Lack of Financial Transparency

Throne Legacy Capital failed to provide verifiable financial statements, trading reports, or documentation to back up its claims. In legitimate investment firms, financial transparency and regular audits are standard practices, offering investors peace of mind and a way to verify earnings.

Heavily Focused on Recruitment

The core structure of Throne Legacy Capital’s earnings relied on recruiting new members rather than actual investment returns. This characteristic of MLMs can become problematic and resemble a Ponzi scheme, where payments to existing members depend almost entirely on new recruits rather than any profit-generating activities.

When evaluating an investment opportunity, always verify the company’s licensing, registration, and background. Regulatory oversight and transparent operations are indicators of a legitimate investment firm, while promises of guaranteed returns and reliance on recruitment often signal potential scams.

How to Avoid Ponzi Schemes?

Unfortunately, the enthusiasm for lucrative opportunities in the financial markets made it easier for fraudsters to penetrate the scene.

This makes investment scams, like Ponzi schemes, a common lurking risk for online traders and investors. Here are some practices to mitigate the risk of falling victim to these investment scams.

Research the Company’s Background

Always research a company’s registration, licensing, and regulatory compliance. Cross-check any claims of association with credible financial entities and be wary of entities that exaggerate their credentials or affiliations.

Be Skeptical of High, Guaranteed Returns

In volatile markets like forex, there is no guaranteed return. Promises of fixed, high returns over specific timeframes are typically a red flag. Reliable investments should outline potential risks alongside their profit potential.

Analyze the Revenue Model

Understand how the company generates income. If the business model relies primarily on recruitment rather than actual investments or trade activities, it may be a Ponzi scheme. Legitimate trading platforms will derive income from real investment returns, not solely from new investors.

Avoid Pressure to Recruit

Ponzi schemes often rely on aggressive recruiting practices to keep the income flowing. If you feel pressured to recruit others to earn rewards or achieve higher ranks, this may be a sign of an unsustainable investment structure.

Protecting Yourself from Ponzi Schemes

While the forex market offers potential for substantial returns, it is also susceptible to scams targeting unsuspecting investors.

Throne Legacy Capital’s downfall highlights the importance of conducting thorough research and due diligence, especially in an era where digital platforms can easily fabricate an image of legitimacy.

By staying vigilant and skeptical of unrealistic promises, investors can better protect themselves and their finances from falling victim to Ponzi schemes.