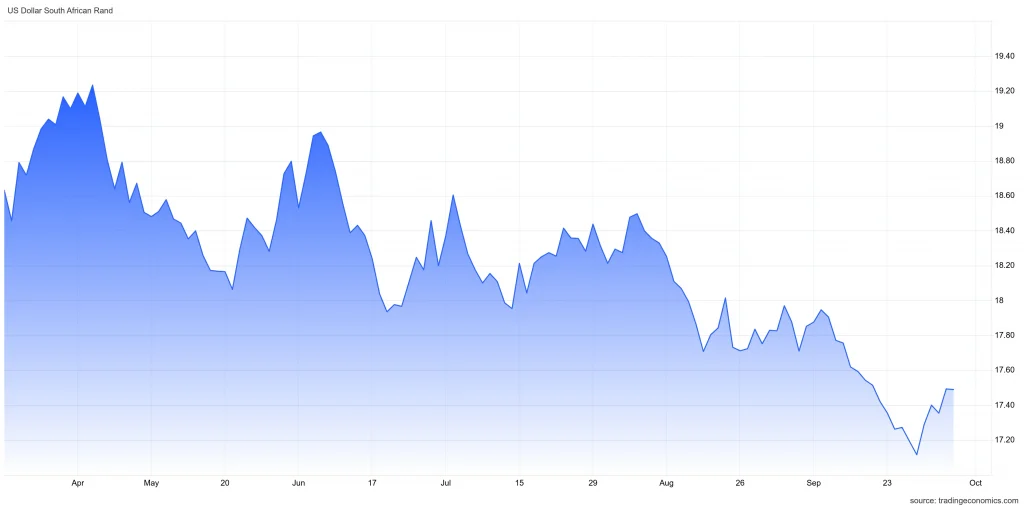

South Africa’s reforms are wooing investors – the rand gained 5% to the dollar, local currency bonds are outpacing its peers in the Emerging Market Index, and the JSE hit record highs with an 86000-point all-time high.

This comes as a positive outcome for the newly-formed Government of National Unity – a coalition government that was formed in an attempt to stabilize South Africa’s sinking economy.

JSE Group CEO Leila Fourie says international investors are starting to sit up and take notice of South Africa. This is the strongest year for the JSE with all sectors on the exchange trading green and a 10% increase in its all-share index – a new high since 2013.

The Top 40 stocks (which include Prosus NV, FirstRand, and Harmony Gold) on the JSE traded up 2%, with mining stocks benefiting the most from the boost in sentiment.

Below, we delve into the possible reasons behind the local stock market’s strongest year, and what needs to be done to keep the momentum going.

Investor-friendly Government of National Unity

The Government of National Unity, a coalition government composed of the previously opposing African National Congress and Democratic Alliance, was formed after the country’s 2024 Election. The coalition’s goal is simple – stabilize the South Africa economy and create jobs for its citizens.

Since its formation, its delegation has been courting international investors to look at South Africa “anew.”

The coalition was initially met with cautious optimism. Political analyst Asanda Ngoasheng described it as “not a bad idea,” but that the new formation made sense from an economic perspective.

In an interview with journalist Jeremy Maggs, JSE CEO Fourie states that the GNU’s market-friendly reforms have convinced the international public in a very positive way. After the coalition’s announcement in June 2024, all-share index went up by 9.2%.

Local and international markets are responding well to the market, with record inflows in the equity market right after the GNU’s formation.

Fourie, however, noted that the government must deliver to sustain the positive momentum.

No power cuts for 6 months

In 2023, critics forecasted South Africa’s electricity crisis to continue until 2025. These sentiments, coupled with the infrastructure reality in the country, have made foreign investors cautious of South Africa’s chance of standing still in the economy.

However, according to Eskom’s chairman, Mteto Nyati, the country’s electricity crisis has been “fixed.” This breakthrough results from the government’s recovery plan and Eskom’s aggressive power plant maintenance.

Eskom is South Africa’s state-owned public utility company responsible for overseeing the country’s power supply.

This power improvement has resulted in investors’ restored confidence in the South African economy. This uninterrupted power supply has helped local businesses and enterprises boost their production without the need for further machinery investments.

This milestone complements the South African Reserve Bank’s 1.2% economic growth projection due to the country’s improved power supply.

Global interest rate cuts

This year, the global economy has seen different central banks splash their respective country’s interest rates. One notable example is the US Fed’s 2024 rate deduction since the Covid-19 pandemic.

Additionally, the European, Canadian, and Swiss central banks have also implemented rate cuts this year.

In the context of South Africa, the majority of economists share a positive outlook for the country’s interest rates. Following September’s 25 basis point (bp) cut, Reserve Bank is expected to further cut its rate to 125bp by the end of March 2026.

Over time, global interest rate cuts have proven to help developing economies thrive. Lower interest rates make it easier for economies like South Africa to circulate their currencies, whether domestically or internationally.

An improved Rand

In August 2024, the South African rand became the best-performing currency against the US dollar among approximately 150 currencies tracked by Bloomberg. This marked Rand’s first winning run since 2011.

This economic growth is the result of the country’s business-friendly coalition implemented in July 2024. Today, the South African coalition government triggered foreign investment waves and positive market sentiment that have not been seen in more than a decade.

Strengthening South African Economy: Short-term or Not?

Are we being too quick to celebrate the rand improvement or does this actually start the growth that South African investors have been waiting for?

While there are a lot of fundamentals to boost this growth, the country is still being challenged by inflation and debts—the main factors that drag the economy down. Without major policy change, the strength of the rand may become fragile anytime soon.

Keep up-to-date with the development and any news related to South African rand and its economy by joining CommuniTrade. Here, you’re free to ask questions, verify your analysis, and even initiate discussion with trading experts and analysts.