The South Africa mining industry faced a challenging year. The sector experienced a sharp 11% drop in its total primary sales to R792 billion from R883.5 billion and other declines in its key financial metrics.

Moreover, it doesn’t take an industry expert to notice the industry’s underperformance. Mining companies dominated headlines because of mass layoffs, falling stock prices, climate-related incidents, site accidents, and major organizational restructuring.

Despite these setbacks, the mining sector remained resilient and maintained its top producer status for platinum, gold, and chromium. The industry is hopeful that 2025 will see remarkable growth, especially with new investor-friendly reforms installed by the Government of National Unity.

Below, we discuss how the industry navigated its challenges and plans to attract more investors.

A mixed performance for the South Africa mining industry

While the mining sector has had generally low financial metrics, it still delivered diverse per-asset performance. Commodities like gold, palladium, and chromium hit new highs this year.

Gold peaked at R 46,000 per troy ounce earlier in 2024, and its five-year forecast remains exceptionally high. Analysts predict that gold’s ceiling price will go as high as ~ ZAR 52,000 an ounce, or a 25% increase from current levels.

Additionally, technological advancements in mining and electronics will maintain gold as an integral part of SA economy.

Meanwhile, others suffered because of the complex macroeconomic backdrop. Platinum prices experienced a consistent downtrend, as SA’s top mining companies scrambled to stabilize production.

Impala Platinum, one of SA’s top PGM miners, reported a full-year revenue decrease of 19% in 2023 and a 3% fall in its share price by the second half of the year. Despite these setbacks, the company was still able to maintain solid production and contributed 55% of South Africa’s total platinum production in 2023.

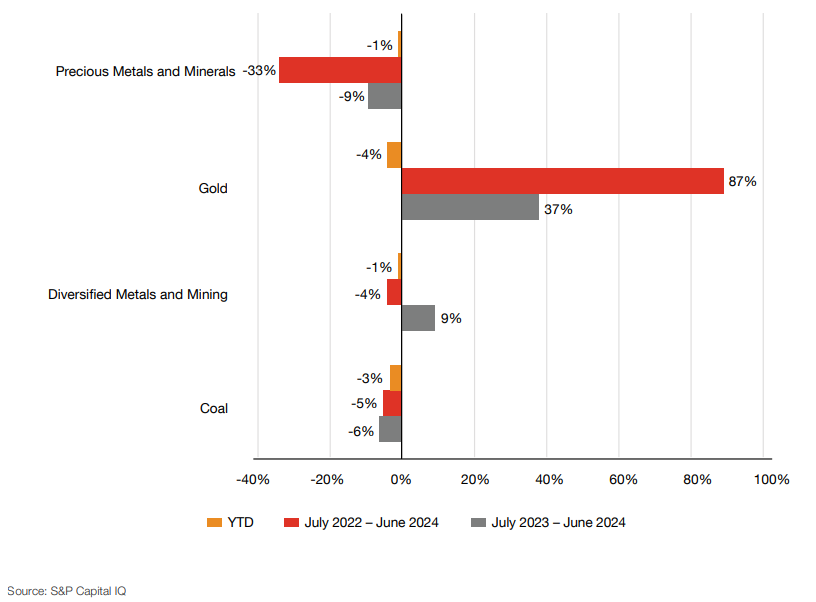

Source: S&P Capital IQ via PWC

The figure above shows minerals’ varied performance. While gold and diversified mineral miners experienced share price growth, coal and PGMs saw a decline. These low share prices resulted from a declining market and oversupply, particularly affected by geopolitical conflicts in the Middle East.

Despite these challenges, SA mines experience stable production. According to Professor Glen Nwaila, Director at Wits Mining Institute, SA has become more attractive to investors because of the surge in demand for raw materials.

How the mining sector faced its challenges

According to PWC South Africa, the mining sector’s major challenges include regulatory uncertainty, energy shortages, and disruptions in transport.

Despite these challenges, investors and analysts have complimented mining companies for their fast decision making and adaptability.

Full compliance to ESG

The Mining Charter is often criticized for revising its policies frequently. This has created a sense of instability and unpredictability, scaring away investments in the sector.

Furthermore, the creation of a new government may lead to investors assuming ongoing political instability. Mineral and Petroleum Resources Minister Gwede Mantashe assured investors that the mining industry is “alive and kicking”. Meanwhile, the private sector has reiterated their commitment to help resolve these issues and fully comply with the Environmental, Societal and Governance goals in the country.

Transition to renewable energy

While Eskom has managed loadshedding for the past 6 months, mining companies are still committed to transitioning into renewable energy.

Werner Duvenhage of Rio Tinto Iron and Titanium Africa said that SA’s transition to renewable energy is incredibly slow, but miners are ready to fasttrack development.

“We must become more aggressive in developing renewable energy,” said Duvenhage. “We want policies that will assist us to be aggressive in developing renewable energy systems.”

Commitment to fix failing railroads

South African road and rail infrastructure has long plagued the efficiency of the mining business. According to Warren Beech CEO Beech Veltman, SA mines can supply stable production; however, because of the failing road infrastructure, mines cannot get their products to the market.

The failing road system, coupled with rising fuel costs, tolls, and cost of employment, has caused exponential increase in capital and are likely factors that scare investors away.

Enthusiastic partnership with GNU

Industry players are hopeful but remain cautious about the economic improvement level and policies the new government may implement.

Recent reforms from the GNU have highlighted investor-friendly reforms to attract international business into the country.

According to JSE Group CEO Leila Fourie, the outcomes of the GNU have positively impacted the sentiment towards South Africa. Still, she says the government will have to demonstrate quick wins in policy very quickly to sustain the momentum.

The Mines Minister has since acknowledged mining challenges at the Mining Indaba Conference 2024. He affirmed the government’s commitment to providing a continuous power supply, promoting miners, and ensuring policy certainty.

Investment Outlook for 2025

The mining industry has long been the foundation of the South African economy. Investors and analysts are expecting a positive 2025 for the sector, especially with increased demand for haven minerals such as gold and PGMs.

Improved private-public collaboration

During the Mining Indaba Conference 2024, miners were much more positive about the Mines Minister’s talk than the year before.

In a column, former mining CEO Bernard Swanepoel writes that the “tide is turning” for SA’s mining industry. Businessmen and investors would be pleased with the new regime, which is aware of its past failures and sees the need to engage and do better.

Skills development

Industry players have also highlighted the importance of investing in local research, skills development, and innovation. Backed up by the Wits Mining Institute, investors are encouraged to invest in research to enhance the efficiency of mining.

Technological advancements

Miners are also positive about the developments being made in artificial intelligence, process automation, and workplace productivity initiatives. These trends will see further improvements in 2025, with the goal of improving mine safety.

How to choose the right mining investment

When selecting a mining stock to invest in, investors should consider the following:

- Low all-in sustaining costs. Mining companies with low AISC are more profitable and more resilient to price fluctuations.

- A stable asset portfolio. Companies should have a long-life asset portfolio that can sustain production in the future.

- A consistent record of strong returns. Companies release their financial reports yearly, investors can access these reports and check if they have a sustained record of strong returns on shareholder equity and improving dividends

- Compliance with ESG. Companies with a good ESG record allow for reliable operations and avoid government sanctions.

- Mines resources that have future demand. Minerals such as gold, silver, and palladium are forecasted to have improved demand for at least the next five years. Beginner investors can take advantage of this to expose themselves to commodity investments.

Learn more about investments in South Africa

Keep up-to-date with news, developments, and analysis on South African investments on CommuniTrade. Ask questions, verify your analysis, start thought-provoking discussions with traders.

Sign up here.