Pan African Resources announced an 18% increase in dividend per share in FY 2024, climbing up to R0.22 from R0.18 dividend per share. Analysts expect a further rise in payouts with the company’s consistent and low-cost production. Currently, the Pan African share price ranges between R7.66 – R7.90.

Edison Investment Research predicts that Pan African Resources will have the second-highest dividend yield among South African mining companies in the next 12-24 months.

Read more for the company’s share price data, financial health, and stock forecast.

Pan African Resources share price data

Pan African Resources is a South African based gold mining company and is listed as PAN on the Johannesburg Stock Exchange (JSE:PAN).

The current Pan African Resources share price range is between R7.66 and R7.90, with a dividend yield of 2.83%.

PAN also announced a R0.22 dividend per share and a total dividend of R489 million due to the company’s exemplary performance this year.

Meanwhile, PAN qualified for the Van Eck Gold Miner’s GDX index, an exchange-traded fund managed in the US, after reaching a multi-million market capitalization. The company’s current market cap is at R17,271,638,097.

Please refer to the table below.

| ZAR (South African Rand) | USD (US Dollar) | |

| Market capitalization | 17,271,638,097 | 981,746,147 |

| Price range | 7.66 – 7.90 | 0.44 – 0.45 |

| ESP-TTM | 77.62 | 4.41 |

| Dividend yield | 2.83% | |

| Authorized shares | 3.5 billion | |

| Issued shares | 1.92 billion |

Pan African Resources reports strong full-year results

The company performed much better than expected for the year ended June 2024, reporting a 30% increase in profit.

Cobus Loots, CEO of Pan African Resources, notes that the US dollar gold price started surging late in the financial year, and therefore, the full impact of the higher price will be reflected in the year ahead.

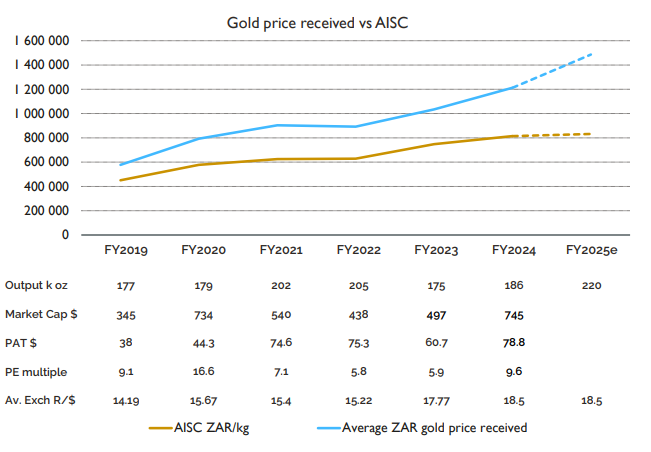

Source: Pan African Resources annual results presentation

PAN raised bullion output by 6.2% to 186,039 ounces with significant gold recovery from surface operations. Meanwhile, revenue rose by 17% to $274 million, and attributable earnings increased by 30% to $79 million.

The company also reported a highly competitive increase in Return on Equity (ROI) by 24%—the highest increase among its mining competitors. Harmony Gold reported an ROI increase of 22.9%, Perseus Mining 22.7%, and DRD Gold 20.2%.

PAN also reported all-in sustaining costs (AISC) at USD 1,354 per ounce, which was marginally above the guidance of $1325 per ounce.

Loots also expects the new project Mogale Trailing Retreatment (MTR) to be completed under budget and ahead of schedule, with a payback period of under 3 years. Notable improvements were also seen at Barberton Mines and Elikhulu Tailings Retreatment Plant, with production increasing by 13.5% and 8.4%, respectively.

Additionally, due to strong cash flow expectations, the dividend policy remains at 40% of cash flow, with a proposed 52% payout this year.

PAN has had a strong financial year and is positioned to continue growth in the next years.

Forecasts and guidance

Pan African Resources is on a solid path to deliver value to its shareholders.

According to the Edison Investment Research, PAN’s gold production will like top 250,000 ouncer per year starting 2026, while normalized headline earnings per share will surpass 7 US cents per share.

Edison analysts believe that “the possibility exists for materially increased dividend payouts as production increases, operating costs flatten, and capital expenditure falls away.”

While Pan Africa is viewed as the “cheaper” option to its competitors, the company has been on an upward trend for the past two years. Looking forward, the mining company expects to see significant output from the MTR operations and the potential Soweto Cluster, which could add 50,000 ounces a year.

“Let’s get up and running at MTR,” says Loots. “Let’s demonstrate that this plant can do the 800,000 tons. We’ll get there in the next month or so, and then we’ll look to expand this area, and the Soweto Cluster by itself could also be interesting for us.”

About Pan African Resources

Pan African Resources (JSE:PAN) is a mid-tier gold producer based in and operating in South Africa. The company has a production capacity of 200,000 ounces of gold per annum.

According to its official website, the company operates a portfolio of high-quality, low-cost operations and projects in SA. It is also the first mining company to commission a utility-scale renewable plant at Evander, which was followed by a large renewables plant at Barberton.

Pan African positions itself as a safe, sustainable, high-margin, and long-life producer of gold. Its current operations are Elikhulu, BTRP and Sheba Fault, Mogale Trailing Retreatment (MTR), Mogale Socio-Economic Development and Environmental Rehabilitation, Evander Underground, Fairview Mine, and Baberton Mine.

Want to know how to analyze stock trends?

Get up-to-date quality education on CommuniTrade. Ask questions, verify your analysis, and start thought-provoking discussions with other traders. Sign up here for free.