Northam Platinum Holdings Ltd is an independent integrated platinum group metal (PGM) producer based in South Africa. It is registered on the Johannesburg Stock Exchange (JSE) with the ticker “NPH.”

Here, let’s discuss the current Northam share price, its historical data, and market outlook and prediction.

Company Overview: Northam Platinum Holdings Ltd

Northam Platinum Ltd’s primary products are platinum, palladium, and rhodium, whose main consumers are the motor manufacturing and jewelry industries.

It operates through two segments: the Zondereinde mine, the Booysendal mine, and the Eland mine.

The Zondereinde mine is a mature mine that has successfully mined PGM ores from the narrow tabular Merensy and UG2 Reefs since 1992. It covers 9,257 hectares and is underlain by the UG2 and Merensky Reefs.

The Booysendal mine is an established multi-modular mining complex. It covers 17,950 hectares and hosts UG2 and Merensky Reefs, which outcrop over a strike length of 14.5km and a dip at 10° to the west.

Lastly, the Eland mine is a shallow hybrid UG2 mine. It is located in the south-eastern portion of the western limb of the Bushveld Complex, 70 km north of Johannesburg and 12 km east of Brits, in the North-West Province of South Africa.

Northam Share Price Performance Overview

Here are some key figures for Northam on the JSE as of October 28, 2025, according to Investing.com:

| Metric | Value |

| Share price | 27,075c |

| 52-week high/low | High: 32,662c Low: 9,602c |

| Market capitalization | ZAR 101.3 billion |

| P/E ratio | 56.5× |

| Earnings per share | 402c |

| Dividend yield | 0.8% |

| Hourly buy/sell signal | Strong Buy |

| Daily buy/sell signal | Neutral |

| Moving averages range | MA5 to MA200 |

| 14-Day relative strength index | 61.073 (Buy) |

| MACD | -20.720 (Sell) |

| 5-Day average | 27,223.00 (Buy) |

| 10-Day average | 27,313.61 (Buy) |

| 200-Day average | 28,380.65 (Sell) |

Northam Platinum share price (JSE) of 27,075c reflects a strong recovery and current premium. This data signals strong market optimism, but it also shows valuation risk.

Its price-to-earnings ratio is 56.5x, which shows investors expect strong earnings growth. However, the stock may also be overvalued based on its current earnings.

The earnings per share (EPS) at 402c is modest relative to the Northam share price. Hence, it does not justify its high valuation.

According to Simply Wall St., Northam, at 27,075c, is 20.5% overvalued, meaning it is below the estimated fair market value of 22,465c.

Northam’s market capitalization of ZAR 101.3 billion shows that it is a large-cap PGM producer on the JSE. It also has a low dividend yield (0.8%), which is unlikely to attract dividend-focused investors.

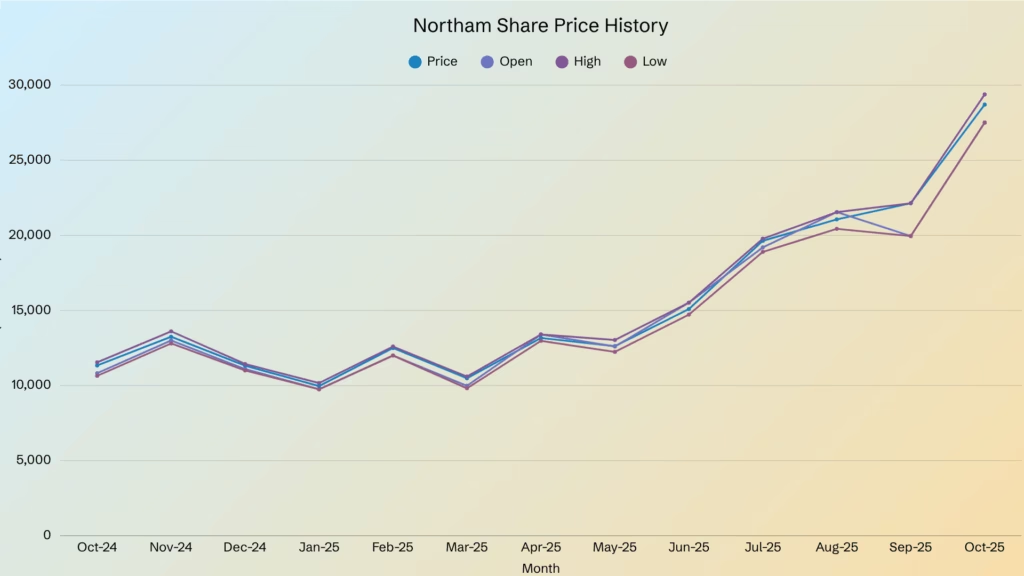

Here is the Northam Platinum share price history from October 2024 to October 2025, according to Investing.com:

The starting Northam share price (JSE) in October 2024 is 11,337c, and the ending price in October 2025 is 28,710c.

The total return in 1 year is +152%, and the average monthly change is +8.7%. The data shows that the Northam share price entered a strong bullish phase through mid to late 2025.

The Northam share price peaked in October 2025 at 28,710c, while the lowest share price was observed in January 2025 at 9,967c.

The months with the highest monthly volatility were February, March, and April 2025, which showed ±25% swings.

On the other hand, the most stable months were May, August, and September 2025, which showed the smallest movements at -4%, +7.3%, and +5.1%, respectively.

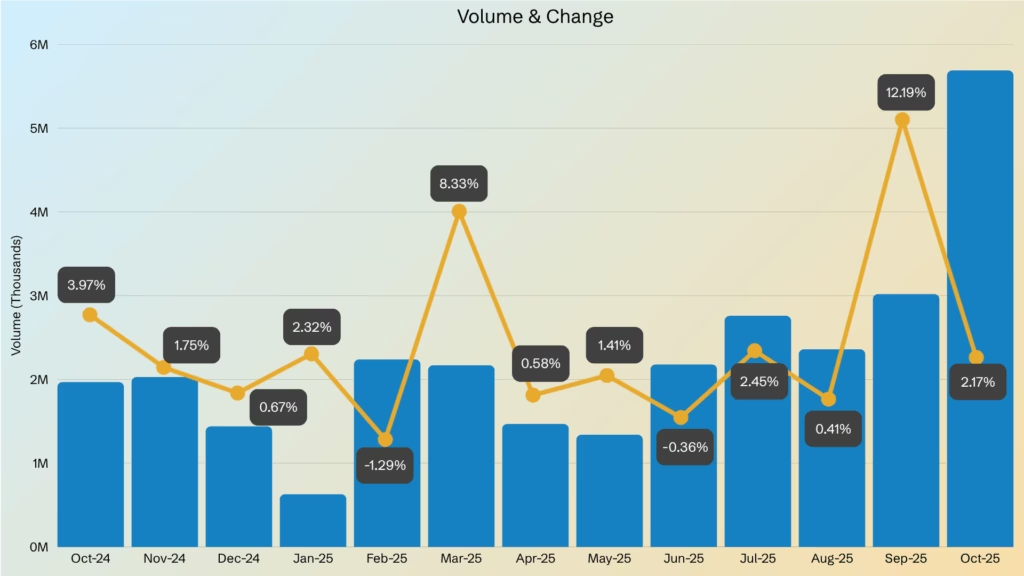

The trading volume peaked in October 2025 at 5.09 million, while the lowest trading volume was observed in January 2025 at 0.63 million.

September 2025 had a big breakout, with trading volume at 3.02 million and a change of +12.9%. It was also accompanied by a high Northam share price at 22,140c, which is a strong confirmation of an upward breakout.

October 2025 had a high trading volume of 5.69 million with a modest change of +2.17%. This may indicate distribution/profit taking or institutional accumulation with heavy trading positions.

Northam Share Price Predictions

Here are the forecasted revenue, earnings, EPS, and EPS range for Northam for the next three financial years, according to Simply Wall St.:

| Financial Year | Revenue (ZARb) | Earnings (ZARb) | EPS | EPS Range |

| 2026 | 45.848 | 10.863 | 2,609c | 2,259c – 3,204c |

| 2027 | 48.686 | 11.735 | 2,885c | 2,639c – 3,224c |

| 2028 | 56.718 | 10.614 | 2,988c | 2,723c – 3,253c |

Northam is forecast to grow its revenue and earnings by 16.2% and 38.5% per year, respectively. Moreover, EPS is forecast to grow by 38.7% per year. Return on equity is also expected to be 23.7% in 3 years.

Northam’s earnings growth is above the savings rate of 9.8%. Its earnings are also expected to grow faster than the South African market at 17.8% per annum.

Northam’s revenue is also expected to grow faster than the South African Market at 6.2% per year.

You may also be asking…

What is Northam Platinum’s dividend yield?

Northam Platinum Holdings Ltd’s current dividend yield is 0.8%.

What’s Northam Platinum’s market cap?

Northam Platinum Holdings Ltd’s current market cap is ZAR 101.3 billion.

Who is the CEO of Northam Platinum Holdings Limited?

The CEO of Northam Platinum Limited has been Paul Anthony Dunne since 2014.

Conclusion

The Northam share price has shown impressive growth over the past year, delivering a 152% annual return and signaling strong investor confidence in South Africa’s PGM sector.

With a market capitalization of ZAR 101.3 billion and forecasted annual earnings growth above 30%, Northam Platinum Holdings Ltd continues to stand out as one of the country’s most dynamic mining stocks.

However, investors should also remain cautious of its high valuation (P/E ratio of 56.5×) and modest dividend yield (0.8%), which suggests that much of its future growth potential may already be priced in.

Overall, while the outlook remains positive, sustained performance will depend on PGM price stability, cost efficiency, and global demand recovery.

If you want to keep informed about the changes in Northam Platinum Holdings Ltd’s share price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.