NinjaTrader has long been known for its futures trading focus. It’s the kind of platform that gets recommended and often vouched for its flexible platforms, customizable charts, and low-cost pricing options.

All these features make you want to hit the NinjaTrader login, right? Especially with the latest NinjaTrader news that entered the scene of Prop Trading with its newly launched NinjaTrader Prop and Travodate Prop.

That’s why it’s just safe to ask: “What’s behind this integration and is the recommendation as one of the most vouched futures trading really worth it to begin with?”

This TRU Insight goes beyond the surface; it’s a full breakdown of what NinjaTrader brings to the table. Backed by expert analysis, we cover its features, pricing structure, regulatory standing, and what real traders are saying.

NinjaTrader Background Overview

NinjaTrader was founded in 2003. It’s a Chicago-based firm and known for its award-winning titles of software and brokerage services. The company is renowned for its focus on futures trading, and it supports advanced charting, strategy automation, and back testing.

This table provides a summary overview of its services:

| Financial Instruments | Futures, Options on Futures. Commodities and Indices. (No direct stock or crypto trading.) |

| Account Types | Individual, Joint, Individual Retirement, Business, and Demo Account. |

| Trading Platform | NinjaTrader 8, Desktop, Web, and Mobile |

| Minimum Deposit | $0 with $50 margin requirement (live trading account) |

| Margin Requirements | Low Intraday Micro contracts: $50 Standard contracts: $500 |

It’s important to assess all of these features. That’s why an intricate review backed by financial literacy is best found in a reputable trading community. CommuniTrade offers free trading courses to help you navigate the world of trading more safely and more confidently.

NinjaTrader Regulatory and Compliance

This firm’s legal name is NinjaTrader Brokerage LLC, and it’s regulated by two top-tier regulators from the U.S authorities:

- Commodity Futures Trading Commission (CFTC)

- National Futures Association (NFA)

To further verify and access some legal documents, you can visit the NFA’s online database. The NFA ID of NinjaTrader is 0348737, and you can enter this number to check their records.

Our experts commend that this broker operates under strong regulatory oversight. Its backing from top-tier U.S. authorities gives traders added protection through strict compliance enforcement.

Read more: TradersUnited – Foreign Regulatory Agencies

Review of NinjaTrader’s Features

To better understand the pricing and overall services of NinjaTrader, we evaluate each feature and provide an unbiased analysis below:

Account Types & Plans

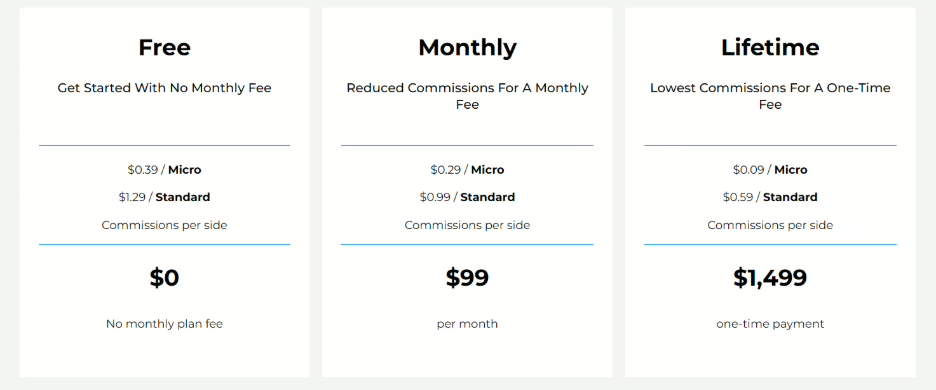

The plans are flexible since they cater to beginners with a choice of a free plan. However, the Lifetime plan’s high upfront cost of $1499 is indeed a potential long-term cost, but some users think that it’s too expensive.

Commissions, Fees & Pricing

NinjaTrader’s commission structure varies by plan. Market data subscriptions and platform add-ons like SuperDOM incur extra monthly costs.

Upon testing the platform, our experts report that while commissions are low, hidden costs like data fees and inactivity charges ($25/month) can add up. Some users feel misled by initial pricing claims, and that’s why it’s safe to check the “All-In Rates” before committing.

Deposits and Withdrawals

NinjaTrader’s deposit process is generally praised for its zero fees on common methods like ACH transfers and incoming wires, providing a cost-effective way to fund accounts. Withdrawals, however, come with a $30 fee and are processed once per 24-hour period. ACH is available for U.S. users, while wire transfers are used internationally.

Trading Platform and Interface

NinjaTrader’s desktop platform is built for futures trading. It supports advanced charting, strategy automation, and custom indicators. However, it’s Windows-only and lacks a mobile version.

Our experts noted that the platform is not recommended for all, especially for beginners who are new to advanced charting tools. While its flexibility is well-regarded, the interface may require a bit of time to get used to.

Order Types, Execution, and Tools

The platform supports a wide range of order types, including market, limit, stop-limit, and OCO (One Cancels Other). It also offers automated trade management (ATM) and strategy builder tools for custom setups. Traders appreciate the execution speed and order flow tools, but note that some features require paid upgrades.

Educational Resources

NinjaTrader provides webinars, video tutorials, and a simulation environment for practice trading. These resources are designed to help traders learn at their own pace and test strategies risk-free.

As reported by traders in our trading community, this helped them build confidence before going live. The ability to simulate trades without risking capital is a standout feature, especially for newer traders.

Customer Support

Support is available 24/5 via live chat, email, and forums. The team is known for remote troubleshooting and personalized assistance. Feedback is mostly positive, but some report slow responses and inconsistent help during account setup or technical issues.

NinjaTrader Prop Trading News

Good news for prop traders, you can now get funded, as they officially launched NinjaTrader Prop and Tradovate Prop on October 1, 2025, under its NT Technologies division.

Funded accounts are up to $200,000 through structured evaluations. Traders can earn up to 90% of profits, with built-in risk controls and TradingView charting across devices. Early feedback from firms like Apex and Take Profit Trader suggests the infrastructure is solid. However, long-term reliability and execution will be key to its reputation as a competitive prop firm.

Frequently Asked Questions

What is the Ninjatrader minimum deposit for a futures account?

There’s no minimum deposit required to open a futures account; you can start with any amount.

How much does NinjaTrader 8 cost?

NinjaTrader 8 is free to use with basic features. For lower commissions and access to premium tools, you can choose the Monthly plan at $99 or the Lifetime license for a one-time fee of $1,499.

Is NinjaTrader good for beginners?

Not exactly. While it offers free simulation and solid educational tools, its focus on leveraged futures trading and complex interface makes it better suited for experienced traders.

Final Verdict: Is NinjaTrader Profitable & Worth Using?

NinjaTrader isn’t built for casual trading. It’s a platform that rewards precision, strategy, and time spent mastering its tools. Traders who know how to work with futures, automation, and custom setups will find it more than capable.

But capability doesn’t equal profitability. The platform gives you the structure to trade well, not shortcuts. If you’re serious about building a system and sticking to it, NinjaTrader can support that. The platform doesn’t promise success; it simply gives you the space to earn it.

If you’re serious about mastering platforms like NinjaTrader, learning within a trusted trading community can make a real difference. CommuniTrade gives you access to verified traders, free trading courses, and expert-led webinar. You’re not just trading, because you’re growing with the right support.