Kumba Iron Ore has established itself as one of South Africa’s leading iron ore producers. Yet, in a surprising turn, forecasts suggest that the Kumba share price may decline annually.

Analyst sentiment is mixed: while some recommend a “buy,” others lean toward “sell,” with the majority suggesting a “hold.” This conflicting noise can leave investors uncertain about how to execute their market orders.

That’s why our financial analyst cut through confusion, offering a balanced perspective on Kumba stock price. By combining fundamental and technical analysis, and factoring in historical trends, current news, and market indicators, we arrive at a clear and grounded prediction for Kumba’s future performance.

Kumba Share Price Forecast & Analysis

On November 20, 2006, Kumba Iron Share Price was listed on the Johannesburg Stock Exchange (JSE) under the stock symbol KIO.

The table below is the price overview of the Kumba iron share price in rands:

| Metric | Value |

| 52-Week Range | 25,502 – 40,555 |

| Market Capitalization | 101.36 billion |

| P/E Ratio | 6.9x |

| Dividend Yield | 11.6% |

| Average Volume (3-month) | 749.5K |

| Revenue (TTM) | 67.26 billion |

The current state of these metrics presents a mixed outlook. The low P/E ratio and high dividend yield might look good to investors who want value and steady income, but the falling share price and lower revenue suggest the company is facing some challenges. While the dividend is generous, it’s important to be careful and look at the bigger picture before investing.

The share price is close to its lowest point this year, which shows that the market isn’t too confident right now. Trading activity has also slowed down, meaning fewer people are buying or selling the stock. So even though the dividend is appealing, recent performance and business issues mean investors should think twice before investing in it.

Kumba Iron Ore Stock Chart

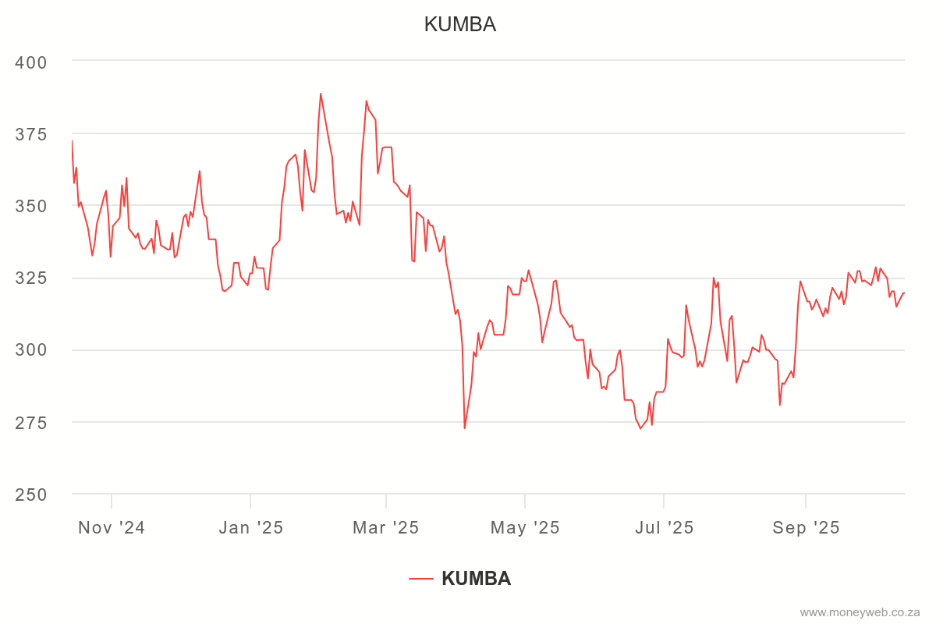

To better understand the movement of the Kumba share price, you can read futher the chart below.

The 1-year range uses standard technical indicators and market data. Our experts examined the historical price movements and tested support/resistance levels to provide a reliable forecast.

Price Trend & Volatility

This shows how the Kumba share price moved over time. In early 2025, the price dropped sharply from around R375 to below R275, which means the stock lost a lot of value quickly. After that, from May to September, the price slowly recovered and stayed between R300 and R325, showing the market was unsure and waiting for stronger signals before making big moves again.

Support & Resistance Levels

Support and resistance are like price “floors” and “ceilings.” The support level at R275 is where the price stopped falling and bounced back in April. The resistance level at R375 is where the price struggled to go higher earlier in the year.

A more recent resistance level was observed around R325, where the price has repeatedly struggled to break higher since May 2025. This suggests it might be difficult for the stock to climb unless strong buying momentum emerges.

Read more: https://blog.tradersunited.org/support-and-resistance-trading-guide/

Kumba Iron Ore Fundamental Analysis

To better understand what’s driving the movement of the Kumba share price, we also looked into the key fundamental factors that affect Kumba Iron Ore’s performance.

These include financial health, earnings forecasts, market sentiment, and operational news updates. Below is a breakdown of these fundamentals, carefully reviewed by our analysts to give you a full picture of the company’s outlook.

Company & Management

Before it became known as Kumba Iron Ore, the company’s story began with its predecessor, Kumba Resources, which was listed on the Johannesburg Stock Exchange (JSE) in 2001. Following a strategic unbundling in November 2006, Kumba Iron Ore Limited was officially established as a standalone entity focused on iron ore mining.

Today, its headquarters are based in Rosebank, Johannesburg, with global commercial offices in Singapore and London, reflecting its international footprint. Since January 2022, Mpumi Zikalala has led the company as CEO and chairs its main operating arm, Sishen Iron Ore Company (Pty) Ltd (SIOC).

Financial Health

We looked at Kumba Iron Ore’s financial health by reviewing its interim and annual results from 2024 and the first half of 2025. These reports give us a clearer picture of how the company is doing:

- Financial Health (H1 2025)

Kumba Iron Ore is in good financial shape, with a strong balance sheet and plenty of cash on hand. However, lower iron ore prices and high dividend payouts have made it harder for the company to grow profits. This means that while the company is stable, it is facing some pressure on earnings.

- Earnings

For the first half of 2025, Kumba expects basic earnings per share to be between R21.24 and R22.79, which is slightly lower than last year. The drop is mostly because the company earned less from selling iron ore, even though they worked to cut costs.

- Profitability

Kumba’s return on capital employed (ROCE) is 48%, which proves its making smart use of its resources. Its EBITDA margin is also strong at 46%, meaning it’s still making good profits despite market ups and downs.

- Liquidity

The company has a solid cash position, with R16.1 billion in net cash at the end of June 2025. This gives it the flexibility to handle challenges and invest when needed.

- Shareholder Returns

Kumba has a history of paying generous dividends. For H1 2025, it paid out 1,660 cents per share. While this is great for shareholders, it also means less money is being reinvested into the business, which has slightly reduced earnings over time.

Kumba Iron Ore News Updates

To get a clearer picture of what’s influencing the performance of the Kumba share price, we’ve highlighted a few key events below. These give a balanced view of the company’s recent activity, helping explain both the ups and downs in its share price.

Operational Challenges

Kumba continues to face major setbacks due to South Africa’s unreliable logistics system, especially rail and port services run by Transnet. These disruptions have led to the following results:

- Rail and port inefficiencies

- Production cuts due to logistics

- Growing stockpiles at mines

- Higher unit costs

- Revenue risk from transport delays

Strategic Plans

To manage these challenges, Kumba is reshaping its operations to match current logistics realities while investing in technology and working with stakeholders to improve infrastructure. More details on these plans are outlined below:

- Aligning output with logistics limits

- Engaging with Transnet and the government

- Advancing UHDMS technology

- Extending mine life

- Strengthening cash position

- Maintaining dividend strategy

Read more: https://blog.tradersunited.org/guide-to-market-analysis/

Frequently Asked Questions

Who is the majority shareholder of Kumba Iron Ore?

Kumba Iron Ore is majority-owned by Anglo American plc, which holds a 69.7% controlling stake in the company.

Is Kumba Iron Ore affected by global iron prices?

Yes, in the short term, its average export price fell to $91/ wet metric ton, which directly impacts its earnings and revenue.

Final Verdict: What is Kumba Share Price Prediction?

After weighing all the facts, it’s clear that Kumba Iron Ore’s share price is likely to remain under pressure in the short term. While the company shows strong financial stability and continues to reward shareholders with generous dividends, ongoing logistical issues and weaker iron ore prices are holding back growth.

Technical analysis also points to resistance around R325, suggesting limited room for upward movement unless market conditions improve. For now, the most sensible approach is to hold, watch how the company navigates its challenges, and reassess when clearer signs of recovery emerge.

To better understand stock price movements, traders can sharpen their skills at CommuniTrade. It’s an all-in-one learning hub offering expert-led webinars that use practical tools for mastering both fundamental and technical analysis.