The two sides of Jubilee Metals Share Price are seen with an outlook of past underperformance and positive upside in the future. These two contrasting sides may trigger indecisiveness on whether it’s a good buy or not.

That’s why our analyst performs an intricate review, especially since they are shifting gears on expanding their operation of copper production.

Some strategic pivots of businesses could either propel or fall. So, which way will it take?

This TRU Insight assesses all the factors that you should consider. Despite the positive uptrend of Jubilee Metals’ share price now, risk analysis is still important.

Read on to unveil the true potential of Jubilee Metals Share Price.

Introducing Jubilee Metals Holdings Ltd.

Jubilee Metals Group was founded in 2001 and is led by the Chief Executive Officer, Leon Coetzer. The company is based in London and is also listed on the London Stock Exchange with a ticker symbol of AIM: JLP

It is also noteworthy to classify the distinction of places where the company’s operations take place in South Africa and Zambia, and it is one of the leading metals recovery businesses.

Jubilee Share Price Data and Analysis

Jubilee Metals Group is still actively trading on the Johannesburg Stock Exchange under the symbol JSE: JBL.

The provided table below shows the current data:

| 52-Week Range | ZAR 65.00 to ZAR 137.00 |

| Market Capitalization | ZAR 2.36 Billion |

| P/E Ratio | 47.02 |

| Dividend Yield | 0% (No dividend declared) |

| Average Volume | 1.2 Million shares |

| Revenue (TTM) | ZAR 4.78 Billion |

| Net Income (TTM) | ZAR 50.13 Million |

| Earnings Per Share | ZAR 0.02 |

| Beta (Volatility) | 1.32 |

Jubilee Metals share price has moved within a wide range over the past year. According to our analyst, this just shows that the stock has both strong moments and dips.

It’s also noteworthy to bring up that the lack of transparent data from dividend yield recently shows that they haven’t paid dividends yet.

However, the steady revenue and active trading volume suggest that the investors are still interested. A high P/E ratio also hints that the market expects Jubilee to grow, especially with its copper and chrome projects starting to gain momentum.

If you want to analyze this forecast better, equipping yourself with the right tools and resources from a reputable trading community is a great help.

In CommuniTrade, you can learn more about stocks from trading courses, get real-time updates from trading signals, expert discussion from live webinars, and more resources that can help you in your trading journey.

The Two Outlooks to Consider

The position of the Jubilee stock price today is at the status quo of two outlooks that should be weighed carefully. This comprehensive breakdown lists all the factors to consider with each respective outlook of past performance and future predictions.

Past Underperformance

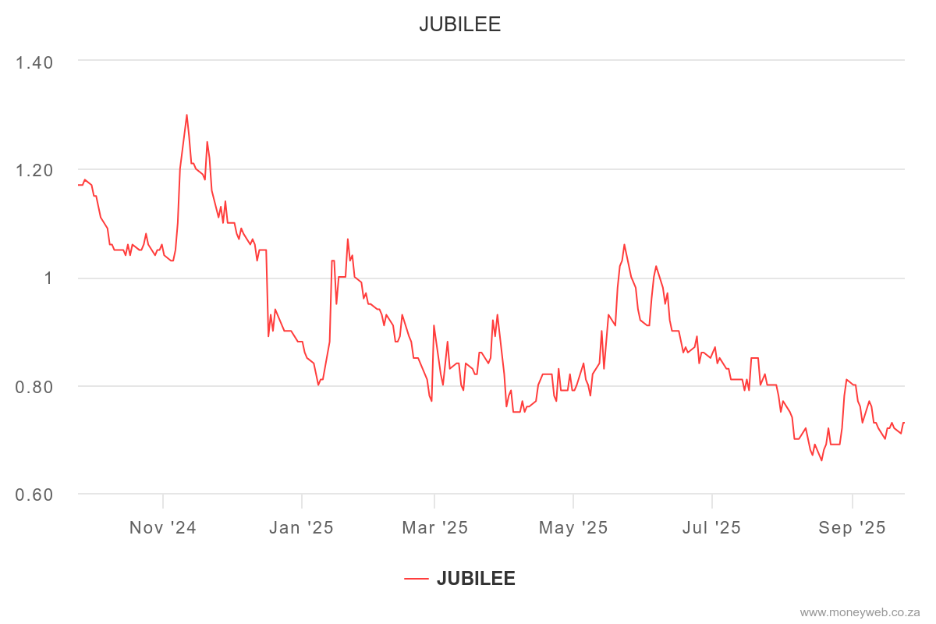

As shown in the chart analysis below, the JBL share price forecast is seen with sharp movements of both uptrend and declining momentum.

The underperformance is significantly shown over the last three months, and here are the factors that contribute to Jubilee Metals share price performance:

Operational Difficulties

Copper production of Jubilee is highly dependent on electricity, and the power interruptions have negatively impacted Jubilee’s stock performance. The power outage, particularly in Zambia, is where their operating facilities of the Roan copper production are designated, and they were consequently compelled to do a partial closure.

These power constraints, alongside the infrastructure challenges of Jubilee Metals, impacted their supply, which caused the company to shift its focus to the previously mined materials.

Strategic Realignments

With Jubilee’s strategic plans of selling its South African chrome and Platinum Group Metals (PGM) for $146 million, the uncertainty follows. This decision is a challenging factor since the chrome prices are volatile and the PGM market is marked with a risky, unpredictable movement due to factors like the increasing demand for electric vehicles nowadays.

Future Uptrend Potential

The future uptrend of the Jubilee metal share price is a subject of debate. While some factors are negatively driven by its ambitious goals of diversifying its assets, this can also be viewed on the other flipside of a potential uptrend.

Our financial analyst examines that Jubilee shifting gears of long-term plans had the potential to propel into possible long-term growth.

Here are some of the positive indicators that are examined:

Increased Revenue

Jubilee Metals Group remarkably performed during the first half of 2025 with a 75.9% increase in chrome revenue. This growth was mainly due to the installation of new processing equipment and strong demand in the chrome market. With these positive results, the company is also planning to target 2 million tons of chrome production per year.

Strategic Pivot

Jubilee is also dedicated to focusing on the copper production in Zambia. They are also aiming to produce 25,000 tons of copper annually. Moreover, the company fuels a long-term strategy for discovering a resourceful storage site in Munkoyo.

Read more: Best 10 Shares to Buy in South Africa to Watch in 2025

Frequently Asked Questions

How do global metal prices influence Jubilee’s stock?

Jubilee revenue depends heavily on the prices of copper, chrome, and PGMs. When these prices go up, the company earns more, and that usually pushes the share price higher.

Can Jubilee’s share price recover after recent drops?

Yes, if the company delivers on its copper production goals and stabilizes operations, especially in Zambia. Nevertheless, the recovery depends on both execution and market conditions.

What does a “resistance level” mean in Jubilee’s stock chart?

A resistance level is a price point where the stock often struggles to go higher. If Jubilee breaks through it, it could signal a stronger upward trend.

Is Jubilee Metals’ Share Price a Good Buy Today and in the Future?

Jubilee Metals Group may not be the most stable stock on the market today, but its long-term potential is hard to ignore. With ambitious copper expansion plans and signs of strategic repositioning, the company is laying the groundwork for a possible turnaround.

While short-term volatility and past setbacks raise valid concerns, investors who understand the risks and watch the technical signals closely may find opportunity in Jubilee’s evolving story. Whether it’s a rebound or a reset, the next chapter is worth watching.

If you want to keep up with Jubilee Metals’ real-time updates, surrounding yourself with the right trading community is the key. CommuniTrade offers a space where stock traders can access stock price updates, live webinars to learn technical analysis, and more trading courses to trade confidently.