iXPFX.com claimed to be incorporated and managed by Rhona Life – a FSCA-licensed financial service provider (FSP).

As per its website, this South African brokerage company provides “world-class trading experience” by giving user access to major financial markets including forex, crypto, stocks, and commodities.

Additionally, iXPFX.com is said to have zero commission from its “cutting-edge” trading platforms, attracting investors with seemingly affordable investment products.

iXPFX.com also claimed to provide top-notch and swift customer support. Any user can reach out to an iXPFX agent through the following communication channels:

| Support | [email protected] |

| Compliance | [email protected] |

| Analyst Desk | [email protected] |

| Telephone Number | +44 748 882 2575 |

However, behind all these seemingly impressive features are the controversies surrounding its regulatory compliance and aggressive marketing tactics.

iXPFX.com Claims to be Incorporated with Rhona Life Ltd.

The regulatory compliance of iXPFX.com is the broker’s main controversy.

According to iXPFX.com’s terms and conditions, Rhona Life, an FSCA-authorized financial service provider with FSP number 48061, operates and manages the overall financial service.

Since T&C is a binding document between the company and its traders, such a claim of regulatory oversight can be a deal sealer for many investors – thinking that a government authority got their back when their investment ran into dispute.

Rhona Life (Pty) Ltd Denied iXPFX’s Claim

The compliance officer of Rhona Life Bertie Schamrel denied the company’s association or any agreement with iXPFX.com

Schamrel claimed that iXPFX.com was a scam and that the company had already reported the impersonator to the FSCA.

The British FCA Issued Warning Against iXPFX

The UK’s Financial Conduct Authority claimed that iXPFX.com was providing and promoting unauthorized financial services within the English borders.

Read the complete press release of the UK FCA concerning iXPFX:

The UK FCA is a first-tier financial regulatory body known for exposing unauthorized and potential scams that could harm the United Kingdom’s and the global financial markets.

Making Fake Success Stories to Lure Unsuspecting Investors

Another tell-tale sign that iXPFX is a scam is its aggressive marketing about the benefits of investing in the platform.

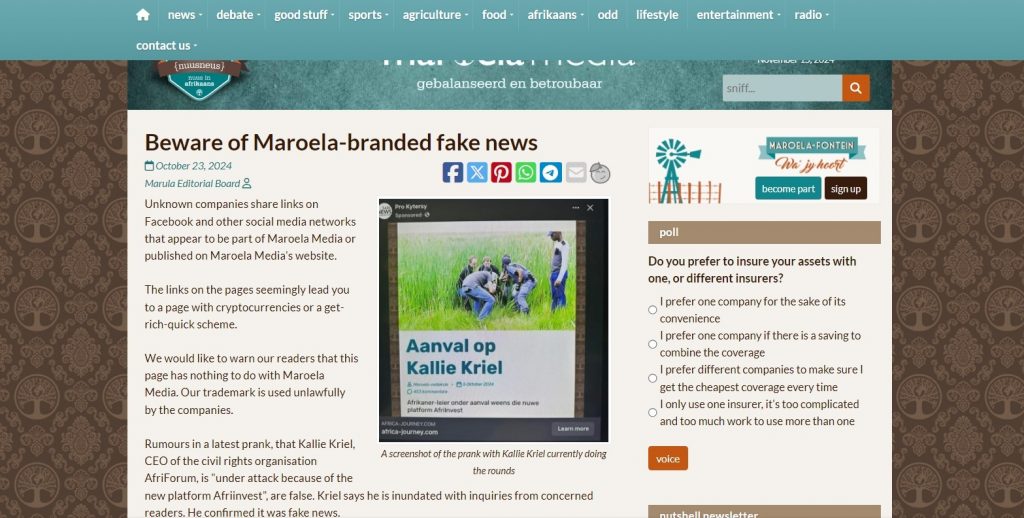

The marketing and spreading of misinformation even extended to touch the divisive and controversial topic of farm murders.

One iXPFX campaign involved impersonating the Maorela Media – a reputable African-based media.

Included in the campaign was a pseudo-Maorela Media article that reported how creating AfriInvest helped Kallie Kriel survive a deadly attack.

According to the article, iXPFX would shield farmers against farm murders and help them secure their financial future. This is possible by investing R4500 and receiving an immediate return within a few weeks.

However, Moraela Media released an explanation regarding the matter, saying that the company has used the prevailing issue to target vulnerable farmers.

According to the media, every link in the fake news article redirects the user to the registration page of iXPFX.com.

IXPFX.com Is Just Another Impersonation Scam

From Rhona Life’s statement to the upright-false marketing controversy, it’s safe to assume that iXPFX.com is just another impersonation scam targeting unsuspecting social media investors.

How to Avoid Impersonation Scam?

With the growing number of social media traders – those who trade using the insights they got from social media; impersonators have found easier ways to conduct their unethical operations.

But this growth in number doesn’t entail the normalization of getting victimized by such schemes.

Here are the three key pointers to avoid impersonation scams.

Research and Crosscheck Licenses and Incorporation

Before engaging with any financial professional or trader, verify their credentials.

Look up their licensing and incorporation details through official channels, such as regulatory websites or financial licensing bodies. In South Africa, the FSCA’s FSP search is your go-to place.

Scammers often present themselves as licensed professionals but lack legitimate certifications or credentials that are not checked out when cross-referenced.

Beware of Personalized Contact

Impersonation scammers often make personalized contact their first step.

They may approach you with specific information about your financial activities or interests to build a rapport and gain your trust.

Be cautious when someone contacts you directly via email, phone, or social media, especially if they claim they can offer you an “inside edge” or “exclusive tips.”

Legitimate traders and firms generally don’t seek out clients through unsolicited messages or overly personal conversations.

Don’t Fall On Too Good to Be True Promises

Scammers commonly lure people with promises of guaranteed returns, insider tips, or suspiciously low-risk opportunities.

These unrealistic promises are designed to trigger excitement and rush you into making decisions without taking the time to research.

Legitimate traders and financial advisors understand that trading involves risk and will emphasize this to clients. If an offer seems foolproof or highly lucrative without clear risk disclosure, take it as a red flag and steer clear.