ICM Capital is a long-standing broker with UK FCA regulations under its belt. But with growing noise online, ranging from “soild ECN trading” to “delayed withdrawals” —the question remains: is ICM Capital truly worth your trust in 2025? That’s exactly what this review sets out to unpack.

We’ve examined real user reports, regulatory backing, platform features, and hidden fees—alongside firsthand insights from the trading floor.

Whether you’re curious about ICM Capital’s minimum deposit, login experience, or red flags often missed in surface-level reviews, this deep dive is built for clarity and truth.

What is ICM Capital?

ICM Capital Limited is a global forex and CFD broker founded in 2009. It is headquartered in London and is currently led by CEO Shoaib Abedi.

The broker offers access to a wide range of financial instruments—from forex pairs to indices, commodities, futures, and even cryptocurrencies.

The allowed currencies for deposits and withdrawals are EUR, USD, GBP, AND SGD.

With its FCA license and ECN-style execution, ICM Capital appeals to traders looking for transparency, though some still raise concerns over fees and platform limitations.

One feature that draws attention? Its ability to offer raw spreads as low as 0.0 pips. However, only under specific conditions do most traders tend to overlook.

So read this comprehensive review to learn more.

Is ICM Capital Legit? Regulatory Background Check

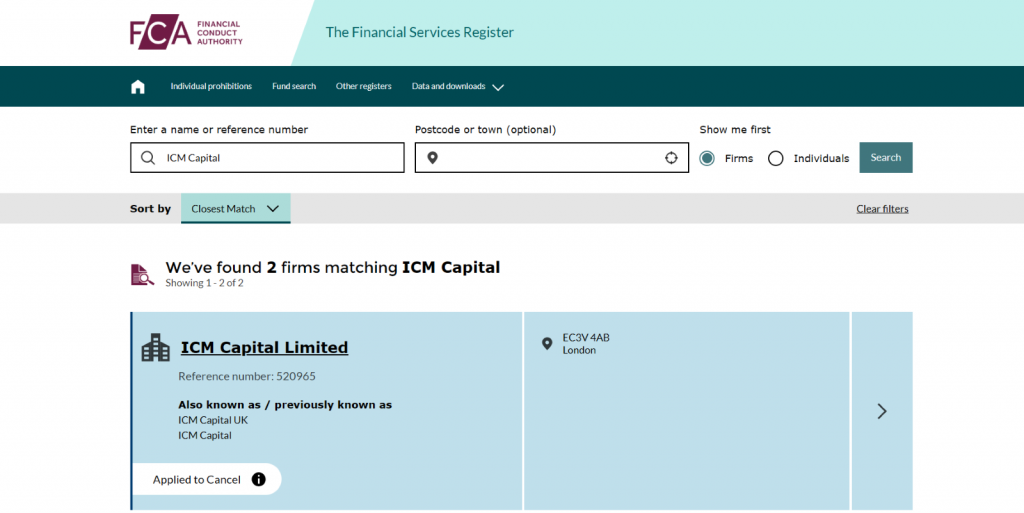

ICM Capital is a registered trading name of ICM Capital Limited, which is officially regulated by the UK Financial Conduct Authority (FCA) under registration number 520965.

In fact, you can verify this directly on the FCA’s official register. The firm operates under strict financial standards, including the segregation of client funds and FSCS protection of up to £85,000 for eligible clients in the UK.

Beyond the UK, it also holds multiple offshore registrations through subsidiaries in Labuan (Malaysia), Mauritius, St. Vincent and the Grenadines, and the UAE under ICM Capital Limited and ICM.com.

While offshore entities may offer higher leverage and fewer restrictions, they come with looser protections. Traders should know exactly which ICM entity they’re signing up with—because your jurisdiction affects how safe your money is.

ICM Capital Key Features

Understanding a broker’s core offerings is essential before making any trading decision. Below is a comprehensive review, focusing on its key features and what traders can expect.

Account Types

ICM Capital offers a range of account types designed to match different trading styles and preferences:

- Direct Account

This is a commission-free account where spreads typically start from around 1.3 pips. It’s well-suited for casual traders and those who prefer swing trading strategies.

- Zero Account

Traders looking for tighter spreads can opt for the Zero account, which offers raw spreads starting from 0.0 pips. A $7 commission per round lot applies, making it a popular choice for scalpers and high-volume traders.

- Islamic (Swap-Free) Account

This account type is designed to comply with Sharia law, replacing overnight swap fees with an administrative fee. It is available on the MT4 platform for eligible clients.

Minimum Deposit

ICM Capital minimum deposit is set at USD 200 across all accounts—accessible for new traders while maintaining professional-grade access to forex, commodities, indices, and crypto.

Leverage

- Up to 1:30 for FCA‑regulated retail clients under MiFID II limits.

- Up to 1:200 for professional traders or through offshore entities

Withdrawal Methods

Clients can withdraw funds using bank wire transfers, credit or debit cards, Skrill, Neteller, and selected cryptocurrencies.

ICM Capital does not charge withdrawal fees, but third-party providers may apply their own charges. Processing times vary depending on the method used, ranging from immediate to up to five business days.

Trading Platform

ICM Capital offers MetaTrader 4 (MT4) exclusively, available on desktop, web, and mobile. It’s known for reliable execution, EA (Expert Advisor) support, and deep liquidity access.

While the platform lacks newer options like MT5 or cTrader, MT4 remains industry-standard. Traders can access their accounts through the ICM Capital login portal and easily download MetaTrader 4 for Windows, Mac, iOS, or Android directly from the official site.

Read more: 5 Best Brokers for MT4 (MetaTrader 4) in South Africa

Educational Resources

For beginner-to-intermediate traders, ICM supplies webinars, MT4 guides, Trading Central tools, daily market commentary, and a glossary. However, it does not offer structured academies or advanced courses.

Customer Support

ICM Capital supports clients 24/5 via live chat, phone, email, WhatsApp, and dedicated account managers. Support is consistently multilingual and award‑winning, though some users report occasional slow responses

What are the Pros and Cons of ICM Capital?

ICM Capital offers regulated trading and strong platform stability, but it’s still important to weigh both its strengths and limitations:

| Pros | Cons |

| Regulated by the FCA, offering strong fund protection and oversight. | Limited to MetaTrader 4 only, no access to MT5 or cTrader. |

| Provides segregated client funds and FSCS coverage up to £85,000. | Educational tools are basic and lack structured learning programs. |

| Offers a solid range of forex, commodities, indices, and crypto. | Leverage for retail clients is limited to 1:30 under FCA rules. |

| Transparent pricing with raw spreads and commission-free options. | No access to copy trading or social trading features. |

| Multiple funding and withdrawal methods, including crypto support. | Some offshore accounts may have lower investor protection. |

While these pros and cons can help shape your decision, gaining perspective from active traders who’ve used platforms like ICM Capital can offer deeper, experience-based insights—something you’ll often find discussed in communities like CommuniTrade.

FAQ

Is there an inactivity fee of ICM Capital?

Yes, if your account remains inactive for six to twelve consecutive months, you may be charged a monthly fee ranging from $25 and $50. It depends on your location and regulatory terms.

How can I login to ICM Capital?

You can log in through the ICM Capital login portal by visiting their official website and selecting “Client Login.” From there, you can manage your account, fund your wallet, or access MT4.

Does ICM Capital support cryptocurrency trading?

Yes, ICM Capital allows trading in select cryptocurrencies such as Bitcoin and Ethereum. These are available alongside forex, commodities, and indices on the MT4 platform.

Is ICM Capital a scam or legit?

ICM Capital is a legit broker, regulated by the FCA and compliant with financial standards such as client fund segregation and FSCS coverage. However, always verify you’re signing up through the official site and not through impersonators.

Final Verdict: Is ICM Capital Review Overall Worth It?

ICM Capital offers a solid foundation for traders seeking a regulated broker with transparent pricing and the reliability of MetaTrader 4. However, the platform may not be ideal for those looking for more advanced tools, broader asset classes, or newer technologies like social trading or MT5. Whether it’s the right broker for you ultimately depends on your trading goals, risk appetite, and platform preferences.

For traders still exploring their options or seeking unfiltered insights beyond official reviews, it can be helpful to join trading communities like CommuniTrade. Here, you’ll find not just broker comparisons, but also real-world feedback, beginner-friendly resources, and trading tools curated by peers and seasoned investors—serving as a practical starter pack for anyone serious about navigating the markets with more clarity and context.