Navigating the complicated nature of anti-money laundering (AML) compliance can be a challenging task. This is especially true for institutions that are called to report any suspicious activities through platforms such as goAML.

Some compliance officers may not be familiar with the system. Even fewer have taken the time to explore its intricacies and discover its full potential.

For this TRU insight, we aim to make it easy for you to understand why goAML is vital for combating financial crimes, such as money laundering. We’ll also explore its key features and how it aids compliance efforts worldwide.

Overview

- The NCOD developed the goAML software system for Financial Intelligence Units (FIUs) worldwide to combat financial crimes, including money laundering.

- goAML offers three solutions: collection, analysis, and data exchange.

- Among the nations that use goAML are those in Africa, Asia, Europe, Oceania, and the Americas.

What is goAML?

The United Nations Office on Drugs and Crime (UNODC) developed “go Anti-Money Laundering” (goAML) through its Information Technology Service (ITS) as a software solution for Financial Intelligence Units (FIUs). It was mandated to strengthen Anti-Money Laundering and Counter-Financing of Terrorism (AML/CFT) initiatives.

goAML was developed in collaboration with the Global Programme Against Money Laundering, Proceeds of Crime and the Financing of Terrorism (GPML).

The goAML system was first launched in 2006 as part of the UNODC’s comprehensive efforts to provide FIUs globally with operational tools to combat financial crimes.

The figure below shows the 14 key features of goAML:

As a global standard for reporting suspicious transactions, it facilitates efficient and secure information exchange between Financial Intelligence Units (FIUs) and reporting entities (REs), such as fintechs and banks.

The primary users of the goAML website are Financial Intelligence Units (FIUs) in several countries that rely on the system to collect, process, analyze, and develop solutions against Suspicious Activity Reports (SARs), Suspicious Transaction Reports (STRs), and Threshold Transaction Reports (TTRs).

Meanwhile, other regulated entities, such as casinos, virtual asset service providers (VASPs), and financial institutions, use goAML to submit mandatory reports in compliance with local and international AML/CFT laws.

The goAML Solution

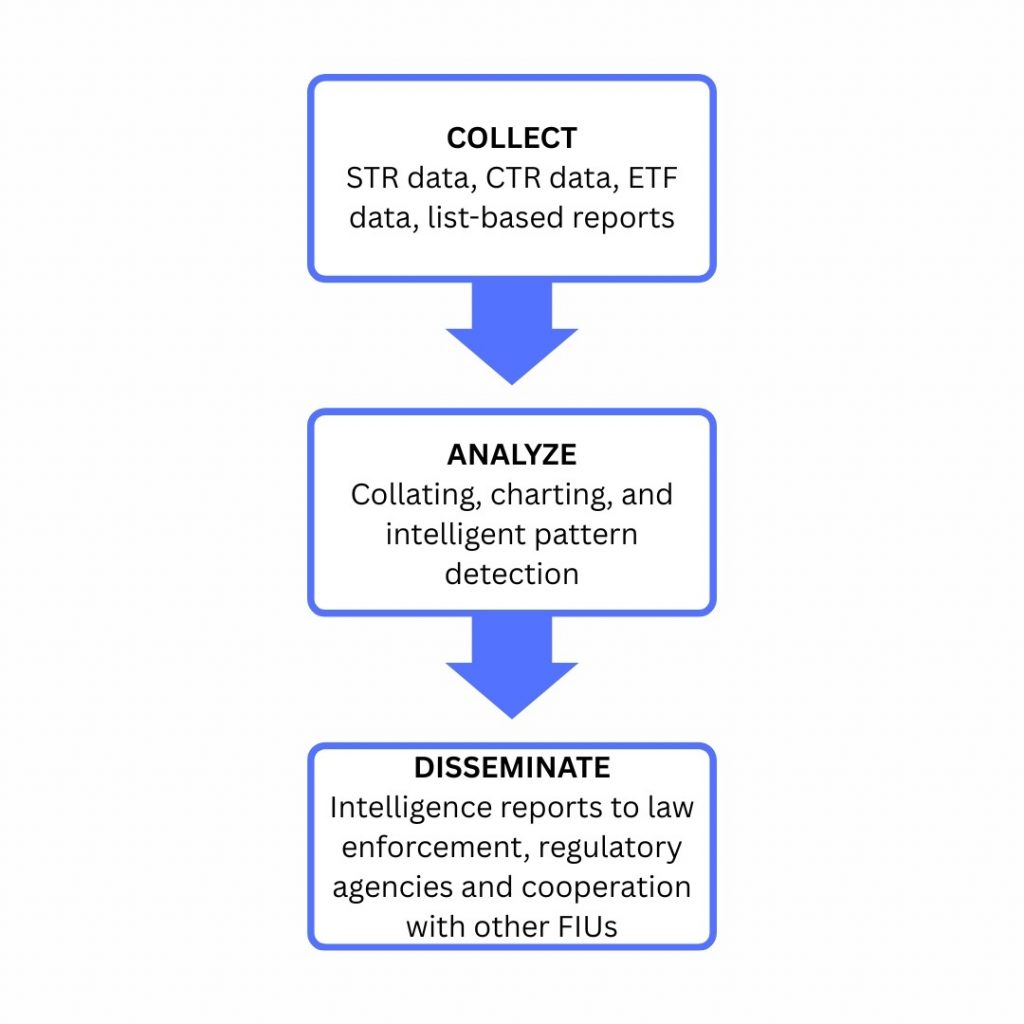

As per the United Nations Office on Drugs and Crime (UNODC), the system’s application offers three solutions:

Collection

After going through the goAML login, the FIUs from obliged entities and financial institutions submit data in the app.

goAML streamlines the data collection process by providing an automated, standardized, and secure method for reporting suspicious transactions.

Thanks to automated reporting, standardized reporting formats, and centralized streamlining of data submission, obligated institutions can provide immediate feedback to FIUs on potential wrongdoing.

Financial institutions and other reporting entities typically send reports to FIUs in several forms. What goAML does is standardize the reporting cases and formats.

According to UNODC, the suggested reporting formats for reporting entities are:

- Cash Transaction Reports (CTR)

- Electronic Funds Transfer Reports (EFT): This includes International Funds Transfer Reports.

- List-based reports: This includes reports generated from lists of actual terrorist identities.

Analysis

goAML plays a crucial role in enabling FIUs to evaluate financial data and identify anomalies, patterns, and activities associated with financial crimes, such as money laundering and terrorist financing.

FIU analysts conduct profiling, rule-based analysis, and risk score, and goAML is the tool that helps FIUs link, consolidate, and aggregate data for further recognition, risk scoring, and detection of potential criminal activity patterns.

Data Exchange

The goAML portal not only facilitates the seamless receipt of SARs, STRs, and TTRs, but it also supports qualitative analysis.

The system solution involves collecting data, conducting rule-based analysis, and profiling before escalating the report to law enforcement and seeking feedback.

It facilitates a rapid exchange of information among REs, FIUs, law enforcement agencies (LEAs), and judicial authorities while ensuring the confidentiality of the information gathered.

Data is exchanged in two ways:

- FIU and the intelligence or judicial authorities within the structure of national coordination

- FIU and regional (through FIU.net, etc) and international (e.g., Egmont Secure Web) institutions

To summarize, here is how goAML’s data exchange process goes:

What Countries Use goAML?

Estimates show that over 60 countries currently use goAML. The countries that adopted goAML include:

- Africa: Angola, Ghana, Botswana, Mauritius, Kenya, Morocco, Nigeria, Namibia, Senegal, South Africa, Seychelles, Uganda, Tanzania, Zimbabwe

- Asia: Iraq, Brunei, Bangladesh, Kuwait, Jordan, Pakistan, Nepal, United Arab Emirates, Sri Lanka

- Europe: Belgium, Austria, Cyprus, Croatia, Denmark, Germany, Finland, Ireland, Latvia, Italy, Malta, Luxembourg, Netherlands, Monaco, Sweden, Portugal, Switzerland

- Oceania: New Zealand

- The Americas: Trinidad, Bermuda, Dominican Republic, Haiti, Tobago, Jamaica

Large countries, such as the United States, China, and Russia, have not adopted the goAML system. Instead, these nations have their own financial intelligence systems to combat financial crimes, which are:

- United States: The Financial Crimes Enforcement Network (FinCEN)

- Russia: The Federal Financial Monitoring Service of the Russian Federation (Rosfinmonitoring)

- China: The China Anti-Money Laundering Monitoring and Analysis Center (CAMLMAC)

Main Challenges for goAML

Although goAML is a powerful tool for combating money laundering, its platform faces several operational and implementation challenges.

Among its widely discussed issues include:

Data Overload

FIUs often struggle to process the enormous volume of SARs and STRs submitted through the system.

Complex Integration

The technical integration within RE’s compliance systems can be complicated. It often needs significant time and resources to ensure connectivity remains seamless.

User Expertise

Another challenge revolves around the users themselves. Users have varying levels of technical expertise, which often results in inconsistent quality in the submitted reports.

Customization Limitations

The customization limitations of the goAML website can hinder its ability to fully meet the individual operational and regulatory requirements of some jurisdictions.

Addressing these issues requires ongoing support, cooperation, and capacity building between reporting entities, FIUs, and UNODC.

Learn More About Anti-Money Laundering Schemes on CommuniTrade

As the fight against financial crimes progresses, so does the innovation behind tools like goAML.

Related: FSCA Tightens Grip, Fining Unauthorized Trading Signals – TradersUnited

Money laundering is a serious financial crime that affects millions of people. Getting the right insights on combatting it properly is essential to ensure you only entrust your money to reputable brokers and service providers.

CommuniTrade is more than an online community. We offer a space to ensure that you only get reliable information from educational courses and online forums regarding the financial industry. Learn and engage with industry experts and share your own experiences to help others with their financial goals.

What are you waiting for? Become a member and stay informed on trustworthy anti-money laundering platforms like goAML.

FAQs

How do I print a report before submitting it to the FIU’s goAML portal?

To print reports before submitting them, go on the goAML portal, click the “PREVIEW” button, and then click the “PRINTER” icon found at the top of the preview window.

Which do I select as a registration option: as an “Organization” or as a “Person?”

Organizations are required to select the “Register as an Organization” option upon registration on the system. After registering, the reporting entity can allow internal users to register on the goAML system and select the option to register as a person.

Can I delegate my FIU goAML reporting tasks to third parties?

Yes, you can delegate these responsibilities to a third party.

This delegation would only be possible if the delegated party already created an account on the platform through the “Register as an Organization” option.

Note that these third parties must be registered on the goAML portal and approved by the Supervisory Authority.

Learn and Earn With CommuniTrade

Knowing which company can help you against financial crimes like money laundering is essential for you to safeguard your finances against scams and suspicious individuals.

But it’s not enough to simply keep what you have in your pocket. CommuniTrade helps you learn the fundamentals of the financial industry and increase your profits with the proper guidance of experts in the field.

We aim to give you a fulfilling financial journey and maximize your earnings in trades or any other financial endeavor that you may have.

Be in the know and watch your earnings grow at CommuniTrade!