There’s a strong link between forex trading and GDP. More specifically, GDP growth influences a country’s currency value, affecting forex market dynamics through factors such as interest rates, economic performance, risk perception, trade balance, capital flows, and market sentiment.

For this TRU insight, we’ll delve into the importance of GDP in forex trading and how it shapes currency movements.

Overview

- Gross Domestic Product (GDP) represents the total market value of all goods and services produced in a country.

- A lower actual GDP can depreciate a currency against other currencies.

- A higher actual GDP, conversely, can cause a currency to appreciate against other currencies.

- If the actual GDP is equal to the expected GDP, there is no immediate effect.

What is GDP?

GDP, or “Gross Domestic Product,” is a financial indicator that represents overall financial health and growth. It measures a country’s economic productivity, specifically the total market value of goods and services produced by a country during a certain period.

GDP comprises the value of goods and services produced by the government, businesses, and individuals, along with the net exports—regardless of whether they are used domestically or exported to other nations.

GDP is commonly expressed as the growth rate—the percentage of change at a yearly or quarterly rate. Most economists consider a strong GDP growth rate to be around 2-3%.

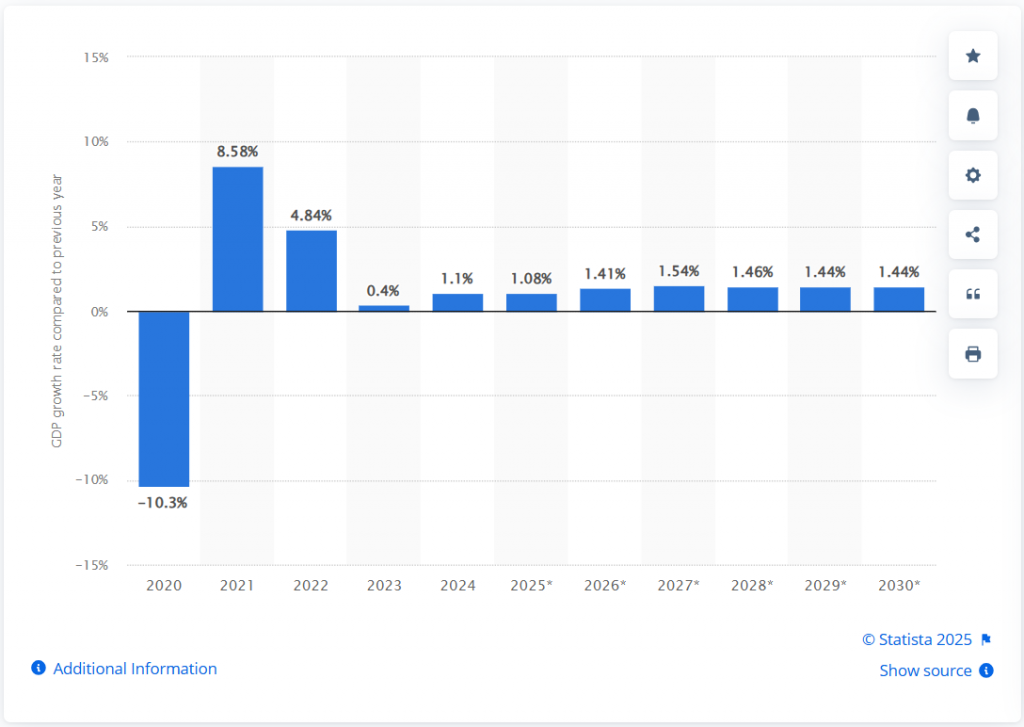

A Note on the 2021 UK GDP

On average, the United Kingdom’s GDP is the sixth largest worldwide. In 2021, the UK’s GDP was £ 2.2 trillion and exhibited a significant growth rate. This high growth rate was a result of the country resuming normal economic operations following the COVID-19 pandemic, which caused its GDP to drop drastically in 2020.

Source: Statistica

Components of GDP

There are four components of GDP—each making up the different channels through which people and companies sell all goods and services.

Consumption

This component encompasses all purchases made by individuals for their personal use. It covers:

- Non-durable goods: e.g., clothing and food

- Durable goods: e.g., appliances and cars

- Services: e.g., lawyers and mechanics

Investment

It describes purchases made by business entities. They are divided into fixed goods and inventory.

- Fixed goods: These are anything bought by a company, such as patent rights, real estate, machinery, and employee salaries. Fixed goods may depreciate or amortize except for land.

- Inventory: This component refers to all goods that companies produce that have not been sold. Since it eventually produces income, an inventory is still included in a business’s value.

Government

In GDP, the government describes expenditures made by governments, such as military spending, infrastructure costs, and paying civil workers.

Since these components are considered goods and services produced in the country, their costs are included in the GDP calculation.

In some cases, infrastructure costs are referred to as government investment.

Net Exports

Net exports include all services and goods produced within the country that are sold to foreigners.

To get net imports, you subtract the import costs from the export profits. Since imports are not produced domestically and the money paid is flowing out of the economy, the costs of international goods and services subtract from a country’s GDP.

How to Calculate GDP

Calculating GDP involves combining the four GDP components listed above. Each country has a national statistics agency that typically performs the calculations, but there are also independent organizations that publish national GDP reports.

An important aspect to consider when computing the GDP is what to exclude from the calculations. Several significant transactions are usually excluded from GDP but are rather analyzed through other fundamental analysis techniques. These transactions include:

Imports

Agencies typically do not include imports in GDP, as these transactions involve money flowing out of the country and products manufactured abroad.

Goods and services produced by foreign countries located within the country are also not included in the GDP. Rather, they are included in the computation of Gross National Product (GNP). There is not much difference between the two values, but GNP represents the value of the goods and services produced by a nation.

Taxes

Businesses collect taxes, such as sales taxes, but these are not included in GDP since they are not considered income for businesses. Instead, these taxes are usually accounted for in government expenditures later.

Forex traders use transfer payments, such as welfare and social security, to gauge unemployment rates in the country. In the UK, these payments are reported monthly through the Claimant Count reports.

How Does GDP Affect Forex Trading?

Three scenarios reflect how GDP affects forex trading:

Situation 1: Actual GDP is Higher Than Expected GDP

When a nation’s actual GDP surpasses market expectations, it shows a more robust economy than expected.

Forex traders perceive this as a positive economic result, which boosts their confidence in the country’s currency.

Having a perception of a strong economy attracts investors from foreign countries, as they seek higher returns and lower risks in a positive market. This perception also results in the demand for the country’s currency rising in the forex market, leading to its value appreciating against other currencies.

Traders may also adjust their positions to gain a position in a stronger currency with the expectation of a better profit.

Suppose you are trading USD/EUR, and the actual GDP is higher than expected in the U.S., suggesting a stronger economy. You will see this as a positive sign for the U.S. dollar (USD) against the Euro (EUR).

Since you and other traders expect interest rate hikes from the Federal Reserve, the demand for the USD is likely to increase in the forex market, which will cause it to appreciate against other currencies. This demand increase will also encourage more traders to enter more positions in the USD, as they will anticipate further gains and exit positions in the EUR.

Situation 2: Actual GDP is Lower Than Expected GDP

If the actual GDP fails to meet market expectations, it suggests weaker economic performance and potential challenges in the economy.

As a result, traders will lose confidence in the country’s currency and become hesitant to hold or use it, fearing uncertainties and economic instability.

The demand for the currency would then decrease in the forex market, leading to its value depreciating against other currencies. In this case, traders might adjust their positions to exit the weaker currency as they expect further losses.

Assume that you want to trade EUR/USD, but the actual GDP is lower than anticipated in the Eurozone. Since this situation suggests a weaker economy, you may view the Euro (EUR) negatively and expect possible delays in the European Central Bank’s (ECB) tightening policies.

The demand for the EUR will then decrease in the forex market and depreciate against other currencies. As a result, you and other traders will expect further declines and exit positions in the EUR. You are more likely to enter more positions in the currencies against it instead—in this case, the USD.

Situation 3: Actual GDP is Equal to Expected GDP

If the actual GDP matches market expectations, the impact on forex trading may not be immediate. However, traders will continue to closely monitor the situation, as other factors can still influence currency movements.

While GDP aligns with expectations, market participants focus on factors like other economic indicators, geopolitical events, central bank policies, and global market sentiment.

Any unexpected movements in these areas can quickly affect market sentiment and lead to significant currency movements.

Suppose you want to trade a new currency pair (e.g., AUD/NZD) after trading EUR/USD. If the actual GDP matches expectations in Australia without any economic surprises, you are more likely to shift your attention to other factors like:

- Australian dollar’s (AUD) performance

- Trade balance

- Reserve Bank of Australia’s policies, and

- Commodity prices

You will now make your trading decisions for the AUD based on a combination of these factors instead of solely relying on the Australian GDP.

Learn More: TradersUnited – Buying and Selling Currency Pairs in Forex

Stay On Top of Market Trends With CommuniTrade

GDP is one of the most significant factors affecting market movements in the financial industry. To maximize your profits, it’s essential to understand its influence on forex trading and adjust your position to where you can make the best profit.

Learn the essentials of forex trading with our experts at CommuniTrade. Join millions of traders worldwide and keep up with the market trends so you get the best payout from your trading strategies.

What are you waiting for? Be a member today!

FAQs

How do I trade GDP?

Before you can place trades in markets that GDP announcements can influence, you should first become familiar with GDP figures over a certain period. Also, learn how and why various markets, such as forex, react to these announcements.

You can carefully view charts to gain an idea of where to place trades and align it with your growing knowledge of expected responses to GDP numbers.

Where can I find GDP reports?

You can find GDP announcements directly from the Bureau of Economic Analysis. On their website, you can view these reports in their News section. Note that GDP announcements are made at the end of every three months, following every quarter.

Can a GDP report still be useful if it does not create trading opportunities?

Yes—that’s because the report’s fundamental analysis can direct you toward other trading signals. You can examine which economic activities affected the GDP rate and compare it to those of different countries.

The information you find in that part of the report can still be valuable when you trade forex using fundamental analysis.

Master Fundamental Analysis With CommuniTrade

CommuniTrade boasts a thriving online community guided by the expertise of seasoned industry professionals. Not only will you get reliable insights from first-hand experiences, but you will also benefit from various educational resources that will help sharpen your skills in forex trading essentials such as fundamental analysis.

Learn how to do trading the right way with CommuniTrade