The Arabic word Islām means surrender. That’s the central religious idea of Islam—surrendering everything to the will of Allah, the sole God of Muslims.

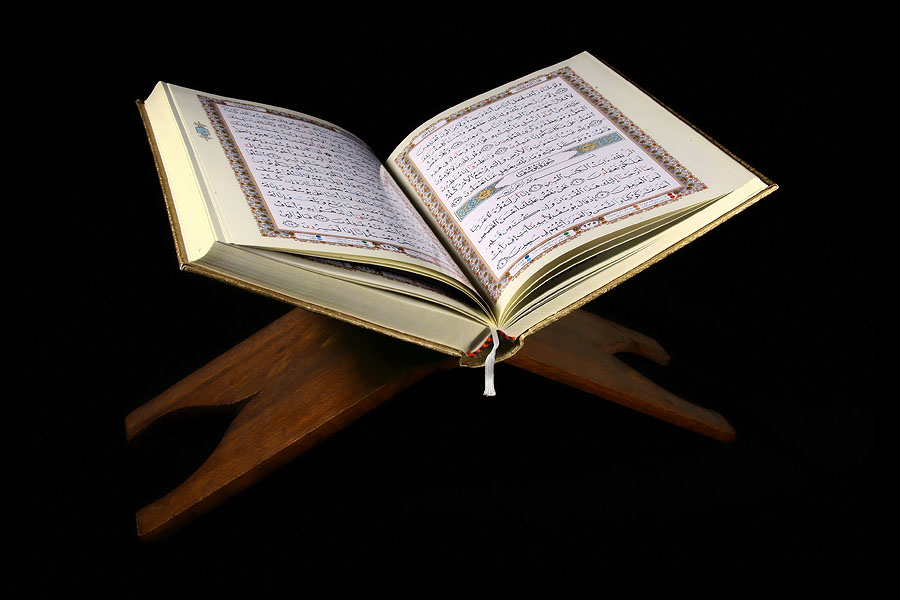

The word of Allah is taught in the Qur’an (English: Koran), a sacred scripture that Muslims must follow. The Qur’an teaches that there’s only one God, calling for a strict adherence to fundamental Islamic practices.

Among the practices that garner traction within the Muslim community is foreign exchange trading, a practice of buying and selling currency pairs in the hopes of profiting from the fluctuating exchange rate.

This article deals with halal forex trading and its permissibility to religion. Read on and discover how Muslim traders participate in the forex market.

What is Forex Trading?

In the financial markets, forex trading is an investment strategy traders use to grow their capital and secure their financial future. When you trade forex, you aim to profit from the difference between the bid and ask price of the market. Bid and ask prices are the buying and selling price of the currency pairs.

If you predict the market will appreciate, you buy a currency pair (like EUR/USD). You’ll profit if you enter a position at a low price point (1.2000) and close it at a relatively higher point (1.3000).

On the other hand, you execute a selling position if you’re certain the EUR/USD market will depreciate.

But how do you know when to enter a buy or sell position? You should have a great understanding of the forex market dynamic, including the market technicalities and fundamentals.

However, Muslim traders’ consideration when trading forex goes beyond skills and knowledge; they must consider their religious beliefs when trading.

Margin trading or leveraging is the most common practice in forex trading, which involves brokers loaning trading money or capital to their clients. This trading type allows traders to open forex trades with a relatively small capital.

Moreover, swing and position trading involve holding an account for more than a day. With this, it’s common that swing and position trades are subject to swaps or overnight fees.

With the involvement of loaning with interest and paying fees, leverage and swap are haram or impermissible to Islam.

What Islam Says on Online Forex Trading?

Making a profit from trading currency pairs is Halal in Islam because it’s a hand-to-hand or spot transaction. However, that doesn’t mean that forex trading, as a whole, is permissible in the Qur’an.

According to Islamic Holy Scriptures, the practice of lending money (Usury) is strictly prohibited in Islam, especially when the practice requires high-interest payments (Riba). Hence, any forex trade that involves any form of Usury and Riba is impermissible, with no gray area for consideration.

With this, it’s safe to assume that margin trading, carry trading, and any trading that involves swaps or fees are haram to Islam. That is because these trading types involve the elements of Riba and Usury.

So, how can you participate in forex trading if you’re following the words of Allah? You should follow Islamic finance principles to ensure your adherence to Islamic practices.

What Makes Forex Trading Halal in the Qur’an?

As mentioned, non-Riba forex trades are halal in Islam. Why?

Forex trading, in its most basic form, is just the buying and selling of currency pairs. This core principle of forex doesn’t go against the practice of Islam. In fact, Islamic law (Sharia Law) partly agrees with this idea.

Here are the four Islamic finance principles Muslim forex traders must keep in mind:

| Gambling is forbidden | According to the Qur’an, Allah explicitly prohibits its followers from participating in any form of Gharar (uncertain transactions) |

| Exchange and contract must be done in one sitting | Exchanges and contracts that are done in the same sitting eliminate swap or other type of transaction fees |

| Interest-based transaction is impermissible | Forex trading is legal if it doesn’t involve any type of Riba or interest elements |

| Unleveraged trades | Any type of leveraging is prohibited in Islam as it calls for high interest |

That’s a lot to consider, right? You should look for a broker that offers Islamic forex accounts to ensure that you’re not doing anything that goes against Allah.

Due to these specific requirements, most Islamic forex trades are done locally with an Islamic brokerage firm. This localization provides Muslim traders with peace of mind, knowing that the services they are using are Shariah-compliant.

What Are Islamic Trading Accounts?

Islamic trading accounts are the accounts used by Muslim traders. This is a trading account dedicated to traders who strictly adhere to the teachings of the Qur’an.

An Islamic account is also known as a No-Swap account. With this trading account, all trades executed don’t accumulate, collect, or pay any type of interest. This makes Islamic forex trading potentially halal.

What does that mean in forex language? That means no leverage, carry, or futures contracts available in an Islamic trading account.

When you create an Islamic trading account, you’re investing ethically. This simply means that your trades follow the principles of fairness and transparency.

This principle goes beyond the adherence to Islamic religion; it’s about values that every investor must have and share with one another.

How to Create an Islamic Forex Account?

Creating an Islamic trading account is as simple as opening any trading account. The only added consideration is to look for a Sharia-compliant forex broker— and make sure they really do!

Here are the steps to take to create an Islamic trading account.

Step 1: Look for Sharia-Compliant Forex Brokers

First things first, you should look for forex brokers that offer Islamic trading accounts. This is extremely important to ensure that your forex trades are halal.

Here are the key characteristics of an Islamic forex account:

- No Interest

- No Swaps

- Unspeculative

- Immediate Trading

Step 2: Check The Broker’s Legitimacy

This goes without saying: Always check and verify brokers’ regulatory compliance. This practice should be in your step when opening any forex trading account—whether it’s Sharia-compliant or not.

Doing this not only ensures your trading is halal; it also instills confidence while you’re trading because you know that the operation of your potential broker is monitored by a financial authority body.

Creating an Islamic trading account with a broker regulated by a reputable regulator can protect you in any case where you’ve run into a dispute with your broker.

Here are the common and most popular financial service regulators worldwide:

| Financial Sector Conduct Authority (FSCA) | https://fsca.co.za/ |

| Australian Security and Investment Commission (ASIC) | https://asic.gov.au/ |

| Cyprus Securities and Exchange Commission (CYSEC) | https://www.cysec.gov.cy/ |

| Monetary Authority of Singapore (MAS) | https://www.mas.gov.sg/ |

| Danish Financial Supervisory Authority (Danish FSA) | https://www.dfsa.dk/ |

Step 3: Open An Islamic Forex Account

Once you’re done verifying and finalizing everything about a Sharia-compliant broker, the next step is to open the account.

To open an account, you must fund the required amount to your desired account; this deposited fund can be used to trade forex.

Advantages of Halal Forex Trading

Halal forex trading may sound too restricting to some traders. However, for Muslim traders, it is a way to profit from the fluctuation of currency exchange while still living their Islamic principles and values.

You Trade Follows Allah’s Will

If you’re reading this article, then you must be concerned with the permissibility of your investment. The primary advantage of Halal forex trading is its adherence to the will of Allah.

When you avoid interest-based trading, or the moment you sign up with Shariah-compliant forex brokers, your trading adheres to the will of Allah.

You’re Managing Your Risk

According to Islamic principles, it is important to avoid Gharar at all costs. In Islamic finance, Gharar means excessive uncertainty or risk in any transaction.

Halal forex trading typically involves no leveraging, meaning you only trade with the capital you have. This reduces the risk of significant financial loss and promotes a more stable and secure trading environment.

You Avoid Emotional Trading

Halal forex trading encourages a disciplined approach free from speculative practices that can degrade a trader’s psychology. By adhering to ethical guidelines, traders can avoid the emotional pitfalls associated with high-risk trading strategies.

Ultimately, trading forex based on the word of Allah could lead to more consistent and rational decision-making.

Disadvantages of Halal Forex Trading

While trading with Islamic accounts offers significant benefits for those adhering to the Qur’an’s teaching, it also comes with certain drawbacks, especially for those with limited trade resources.

It’s More Expensive

Halal forex trading is more expensive than usual forex trading because it prohibits the use of leverage.

Leverage allows traders to control larger positions with a smaller amount of capital, making big forex positions accessible to forex traders.

So, without leverage, the potential for profit is limited to the amount of capital you have. This makes trading less lucrative and more costly in terms of capital requirements.

Only Limited Opportunities

The restrictions of Halal trading mean fewer opportunities to engage in profitable trades.

The absence of leverage, the necessity to avoid interest, and the requirement to stay away from speculative practices can limit the types of trading strategies you can employ.

This can make it more challenging to achieve significant returns compared to conventional forex trading.

Deeper Look at Haram Islamic Practices

When you open a halal forex trading account, it’s fundamental to be familiar with the reason why some financing practices are haram to the Qur’an.

In this section, we look deeper at the concepts of Riba, Usury, and Gharar.

Riba

In Sharia law, Riba represents the exploitative charging of interest to any form of loan.

Riba is believed to be associated with unjust, exploitative gain made from loaning assets. This provision protects the wealth and well-being of Allah’s followers by eliminating unjust and exploitative charging of interest. By making Riba haram, the Sharia law ensures the equitability of any financial transactions.

How would Islamic financial transactions make a profit without interest?

Islamic banking has employed a financing structure called Murabaha. With this structure, both parties of the trade agree to the markup of an asset. This makes Murabaha not an interest-bearing loan because of the usage of markup.

To ensure your trades are Ribe-free, you should look for forex brokers that offer swap-free Islamic accounts. Remember, the fixed amount fee you pay for holding positions overnight is Riba; you wouldn’t want to pay any type of swap if you follow the Qur’an.

Did you know?

The only type of loan allowed in the Sharia law is through Qard-e-Hasan. This is a financing structure that offers an interest-free loan.

Usury

In Sharia law, Usury is the lending of money at an unreasonably high-interest rate. Abstaining Usury protects Muslim investors from predatory lending, the type of loaning that charges way above what the law allows.

In forex trading, the issue of Usury is tied with leveraging and carry trading.

Borrowing money for forex trading in itself is halal. What makes leveraging and carry trading haram is the string attached to the loan transactions.

Here are the two things you need to remember about leverage or margin trading and carry trading:

- Leveraging or margin trading is a strategy used by traders to magnify their potential profit by borrowing trading money from their brokers and investing it in the forex market.

- Carry trading is used to take advantage of the interest-rate differential between the two currencies in the pair. It involves the selling or borrowing of a low-interest currency and investing it in a higher-interest currency.

Both these trading types involve borrowing an asset from financial service providers. Again, the action of lending itself is not haram. However, leverage and carry trading involves interest fees, which can be unreasonably high.

Moreover, it’s mentioned that a Muslim trader leverage their trades to increase their potential profit. So, leveraging doesn’t only constitute Usury; it’s also a form of Riba.

Gharar

Literally, Gharar means uncertainty. In Islamic finance, it represents any risks rooted in unethical, harmful, and speculative financial practices.

A forex trade that’s too speculative because of ambiguity and chance-reliant is considered Gharar and haram according to the word of Allah. Hence, it’s usually associated with gambling because the result of the activity is uncertain.

By prohibiting Gharar, Muslim traders are protected against adverse losses, misunderstanding, and distrust between the parties concerned in the financial transactions.

Forex Trading: Gambling or Not?

One may argue that forex trading is considered gambling because traders subject their investments to excessive amounts of risk. This type of practice is deemed damaging to one’s wellness.

But if we look closely at it, we will see that forex trading is risky because of its inherently volatile nature. But gambling is dangerous because it’s done without any rational strategy—gamblers simply hope for instant gratification from their luck or chance-reliant bets.

On the other hand, it’s a golden rule in forex trading to never enter any trade without any certain reason. Without research, market analysis, and knowledge, a trader should never trade forex.

So, no. Trading is far more different than gambling. It requires skills, strategies, analysis tools, and a great understanding of the dynamic market. It’s more certain than the game of chance or gambling.

If you’re a Muslim and are concerned with the permissibility of forex trading, rest assured gambling is out of your concern. To make your trades halal, just use an Islamic forex account.

Frequently Asked Questions (FAQs)

Is Forex Trading Haram?

At its core, forex trading is halal or permissible in Islam if the practice of trading adheres to the principle of the Sharia law.

Haram forex trading involves the following practices:

- Loan with interest

- Pledge on a loan

- Short selling

- Speculative trading

- Gambling

Are There Any International Forex Trading Platforms?

Yes, halal forex trading platforms operate even outside the Arabic countries. Many popular brokerage firms offer Islamic trading platforms to cater to Muslim traders.

Among the most famous Sharia-compliant forex brokers are:

- AvaTrade

- eToro

- Exness

- Plus500

- FXTM

Is MetaTrader 4 Halal?

Trading in MetaTrade 4 can be halal. However, remember that MT4 is only a trading platform, a tool to monitor the market and execute your trade orders. The permissibility of your forex trade depends on your broker and trading practice.

Is Stock Trading Halal?

A Muslim trader must only trade a company’s stocks that apply Islamic principles through its business operations.

If you’re concerned with whether you’re adhering to the teachings of the Qur’an, you can study the interpretation of Islamic finance scholars. Among the primary responsibilities of these scholars is to provide guidelines for Sharia-compliant investing and trading.

Halal Forex Trading: Is It Permissible to Trade Forex?

The discussion revolving around the permissibility of halal forex trading has been trending for years now, especially now that the world has seen the significance of forex trading for generating passive income.

To ensure that your forex traders are halal, avoid interest-based transactions like leveraging, carry trading, and any trading involving swap fees.

Traders United is not a religious authority on Islamic trading and the information presented is based on expert analysis. To ensure your trading is halal, you may consult with an Islamic religious entity who can review your trading.