FP Markets has been around for a while. But lately, it’s been gaining more traction among traders who want more than just a basic platform.

From its ECN pricing model to its multi-platform access, there’s a lot to unpack, especially when you factor in its global reach and the growing interest in its client portal and demo account options.

This review covers everything from minimum deposit requirements to spreads, fees, and withdrawal processes.

If you’ve been wondering whether FP Markets is worth your time, this breakdown might just give you the clarity you need.

- What is FP Markets?

- Is FP Markets a Regulated Broker?

- FP Markets Account Types and Respective Fees

- FP Markets Tools and Other Features

- Trading Platform

- Withdrawals and Payment Methods

- Educational Resources

- Customer Support

- What are the Pros and Cons of FP Markets?

- Frequently Asked Questions (FAQs)

- Is FP Markets a trusted broker in 2025?

- What is the minimum deposit required to start trading with FP Markets?

- Does FP Markets offer copy trading or automated strategies?

- Does FP Markets have a demo account?

- Does FP Markets have a bonus?

- Final Verdict: Is FP Markets the Right Broker for You?

What is FP Markets?

FP Markets is a multi-asset broker offering access to forex, CFDs, commodities, indices, shares, and cryptocurrencies.

Founded in 2005 by Matt Murphie, the company is headquartered in Sydney, Australia. It now operates globally with over 300 employees and multiple regulatory licenses.

However, it makes you wonder: Is It Really Worth It, and Is It Even Safe?

This type of query is best answered with the right trading community. If you’re just starting or looking to sharpen your trading skills, CommuniTrade is where verified traders get access to exclusive perks.

From market insights to live analysis and educational tools. It’s the right environment that can help you grow your financial literacy with confidence.

Is FP Markets a Regulated Broker?

Yes, FP Markets is regulated across multiple jurisdictions. It holds licenses from tier-1 and tier-2 financial authorities. This means that their adherence to compliance is further reassured, and client protection is overseen with legal frameworks.

Below are the following financial authorities along with their respective license number in case you want to do further background checks:

- ASIC (Australia) – AFS License No. 286354

- CySEC (Cyprus) – License No. 371/18

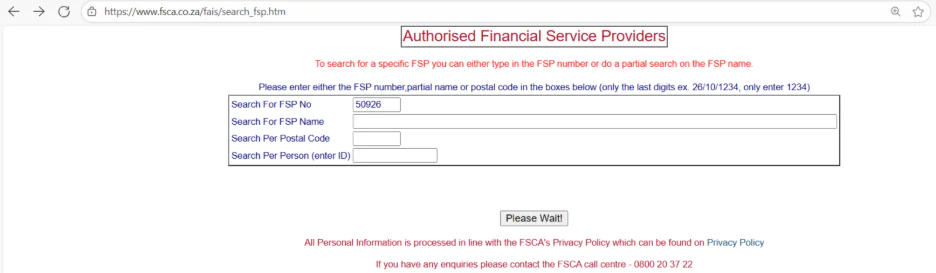

- FSCA (South Africa) – FSP No. 50926

- FSC (Mauritius) – License No. GB21026264

- FSA (Seychelles) – License No. SD130

To verify a specific broker, you can enter the FSP number on the official Financial Authority website, such as this FSCA website:

Read more: How to Find Financial Service Providers with FSCA Regulation in 2025

FP Markets Account Types and Respective Fees

FP Markets offers a range of account types tailored to different trading styles, each with its cost structure, leverage options, and platform access.

Our specialists reviewed the latest updates and client feedback to help you compare them side by side.

| Account Type | Minimum Deposit | Trading Fees | Leverage |

| Standard Account | AUD 100 | No commission, spreads from 1.0 pips | Up to 1:500 |

| Raw Account | AUD 100 | $3 per lot (each way), spreads from 0.0 pips | Up to 1:500 |

| IRESS Account | AUD 1,000 | DMA model, commission starts at 0.06% | Variable (based on asset) |

| Islamic Account | AUD 100 | Swap-free, admin fees may apply | Up to 1:500 |

| MAM/PAMM Account | AUD 100 | Depends on the manager’s structure | Up to 1:500 |

To help you further decide which account type specifically suits you, here is a guide of each account type along with their best ideals:

- Standard Account – Best for beginners or casual traders who prefer zero commission and a simple cost structure.

- Raw Account – Ideal for scalpers and high-volume traders who want tighter spreads and faster execution.

- IRESS Account – Designed for advanced traders focused on equities and DMA access with full market depth.

- Islamic Account – Suitable for traders who follow Shariah law and need a swap-free trading environment.

- MAM/PAMM Account – Tailored for fund managers and investors looking to manage multiple accounts under one strategy.

FP Markets Tools and Other Features

Here are also the common features that you should reassess when it comes to reviewing a broker:

Trading Platform

FP Markets supports MetaTrader 4, MetaTrader 5, cTrader, and TradingView, each tailored for different trading styles.

MT5 and cTrader stand out for algorithmic trading, advanced charting, and multi-asset access, alongside spreads starting from 0.0 pips and execution powered by Equinix NY4 servers.

Read more: cTrader vs MT4: A Comparison for Modern Traders in 2025

Withdrawals and Payment Methods

FP Markets supports multiple funding options, including credit/debit cards, bank transfers, PayPal, Neteller, Skrill, and crypto.

Most withdrawals are processed within one business day. However, some users noted delays during peak periods, especially with international bank transfers.

Educational Resources

FP Markets offers structured learning through its Academy, including webinars, eBooks, tutorials, and podcasts. Beginners appreciate the step-by-step guides, while intermediate traders benefit from live market insights.

Some users mentioned the content could be more interactive, but overall feedback remains positive.

Customer Support

Support is available 24/7 in multiple languages via live chat, email, and phone. Most users rate the service as responsive and helpful, especially during account setup and platform navigation.

A few reviews flagged slower response times during high-volume trading hours, but overall satisfaction remains high.

What are the Pros and Cons of FP Markets?

FP Markets continues to earn high marks for its platform reliability, customer service, and trading conditions. Nevertheless, just like any broker, it has areas that may not suit every trader.

Here’s a guide for you to weigh what you can and can’t tolerate:

| Pros | Cons |

| Regulated by multiple authorities, including ASIC, CySEC, and FSCA. | Some users report delays in international bank withdrawals |

| Offers ECN pricing with spreads from 0.0 pips | The IRESS platform requires a higher minimum deposit (AUD 1,000) |

| Supports MT4, MT5, cTrader, TradingView, and IRESS platforms | Limited bonus offerings compared to other brokers |

| Fast and responsive customer support (24/7) | Occasional login issues reported, though quickly resolved |

| Over 10,000 trading instruments across forex, CFDs, and commodities | Educational content could be more interactive for advanced users |

| VPS hosting and the Autochartist tool are available | No fixed leverage on IRESS accounts |

| Transparent fee structure and no deposit fees | MAM/PAMM accounts depend on the manager’s terms, which vary |

Frequently Asked Questions (FAQs)

Is FP Markets a trusted broker in 2025?

Yes, it’s regulated by multiple financial authorities and has a strong reputation for transparency and reliability.

What is the minimum deposit required to start trading with FP Markets?

The minimum deposit is AUD 100 or equivalent in your local currency.

Does FP Markets offer copy trading or automated strategies?

Yes, FP Markets supports copy trading via Myfxbook AutoTrade and Signal Start, along with algorithmic trading on MT4/MT5.

Does FP Markets have a demo account?

Yes, FP Markets offers a free demo account with $100,000 in virtual funds. This allows traders to practice in real-time market conditions.

Does FP Markets have a bonus?

FP Markets does not currently offer deposit bonuses, as it prioritizes transparent pricing and regulatory compliance across its licensed jurisdictions.

Final Verdict: Is FP Markets the Right Broker for You?

FP Markets offers a solid trading environment backed by regulation, platform diversity, and competitive pricing. It’s a great fit for traders who value ECN execution, access to multiple platforms, and a wide range of instruments.

However, it may not suit those who prefer fixed leverage or expect bonus incentives. Beginners will appreciate the simplicity of the Standard Account, while more experienced traders may find the Raw and IRESS accounts better aligned with their strategies.

If you’re still weighing your options, it helps to be part of a community that filters out the noise. CommuniTrade is where verified traders and investors exchange insights, share credible opportunities, and stay sharp with educational tools.