Fintech companies have been transforming the financial experiences of unbanked and underbanked South African citizens. Finance 27, as an online lending platform, provides South Africans with access to quick loans of up to R8,000 that they can repay within 65 days.

In this Finance 27 review, we’ll unravel everything you need to know about this lending platform, including its regulatory compliance, loan products, interest rates, and loan application.

What Is Finance 27?

Finance 27 is a micro-finance institution that provides alternative loan solutions to South Africans. Ultimately, Finance 27 aims to connect underserved citizens, including those without formal bank accounts, to services that address their financial needs.

With its accessible loan products, a South African can access funds for unexpected expenses or to bridge the gap between paydays. Finance 27 offers loan products of up to R8,000 with interest rates of up to 37%.

Despite its reputation, many users reported complaints about this online lending platform.

According to several online reviews, Finance 27 continues to debit borrowers’ bank accounts, process transactions for canceled loans, and send repayment demands for already settled loans.

Check the table below for Finance 27’s contact information.

| Legal Name | Finance Twenty Seven Micro Finance Institution (PTY) Ltd |

| Address | Unit 13 Kingfisher Building, Hazeldean Office Park Silver Lakes Road, Silver Lakes Pretoria |

| [email protected] | |

| Website | www.finance27.co.za |

| Telephone | +2712 9411572 |

Is Finance 27 Regulated?

Finance 27 is accredited by the National Credit Regulator of South Africa, with a license number of NCRCP7084.

Established under compliance with the National Credit Act 34 of 2005, NCR aimed to regulate, monitor, and impose laws that govern the operations of credit providers that operate in the country. This government agency ensures that all loan products adhere to a reasonable loan structure, including a fair interest rate and a reasonable repayment timeframe.

While this NCR accreditation is important, compliance with the Financial Sector Conduct Authority (FSCA) is crucial for ensuring consumer protection and maintaining market integrity in South Africa.

The FSCA oversees financial institutions to ensure they adhere to ethical practices, fair treatment of customers, and transparent communication of product terms, fees, and risks.

Related: Financial Sector Conduct Authority Helps You Invest Better : Finance 27 Review: Is It Legit and How to Apply in 2025Finance 27 Loan Products

Finance 27 provides eligible South Africans with two quick loan products, including its famous short-term or same-day loan and payday loan. For the borrower’s convenience, Finance 27 automatically debits the loan repayment from the connected bank account.

Let’s learn how the two differ in terms of loan structure, including loan amounts, repayment timelines, and interest rates.

Finance 27 Short-term Loan

| Loan Amount | Up to R6000 |

| Repayment Period | 61 to 65 days |

| Interest Rate | 1.48% |

| Fee | 17.36% |

| Payout Speed | Instant, within 24 hours |

Also known as the Same-Day Loan, Finance 27’s Short-term Loan allows you to access necessary funds instantaneously in any case of financial emergency, like rent payment, medical bills, or travel funds, among other needs.

Finance 27 Payday Loan

| Loan Amount | Up to R8000 |

| Repayment Period | 61 to 65 days |

| Interest Rate | 38% Maximum Annual Percentage Rate (MAPR) |

| Payout Speed | Instant, within 24 hours |

Living paycheck to paycheck is difficult. What more when you encounter a financial emergency while waiting for your next paycheck?

Finance 27 allows you to bridge the gap between your paychecks with a loan product of up to R8000, which will be repaid on your next payday.

Finance 27 Loan Interest Rate and Fees

The exact amount of Finance 27 interest rate and loan fee depends on the principal loan amount. This is because the interest rate and fees imposed by this lending app are percentage-based.

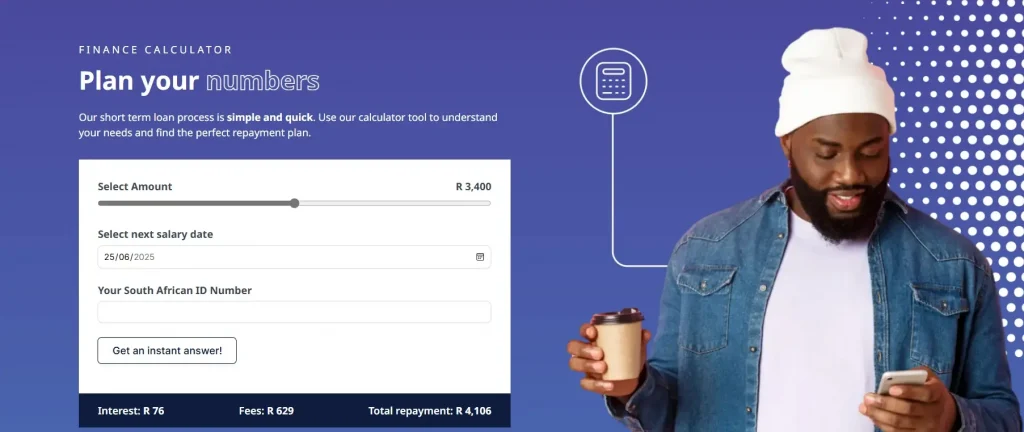

To see the interest rates and fees of your preferred loan, you can use Finance 27’s loan calculator app. It shows you the costs incurred relative to your principal loan amount.

This calculator ensures that borrowers are well-informed about their financial responsibilities when requesting a loan.

What Happened When You Failed to Settle Your Finance 27 Loan?

Like any credit or loan service, an unpaid loan is subject to a penalty fee and an increased interest rate. In Finance 27, the platform imposes a penalty fee of R69 and an additional 5% interest rate for late loan payment settlement.

Additionally, the borrower’s credit rating will be affected, which can result in increased screening and potential rejection during loan applications.

Who Are Eligible for Finance 27 Loan?

Finance 27 serves South African citizens aged 18 years old and older. To ensure eligibility, the lending app will request the applicant a copy of their South African ID and ID number.

Requirements such as a source of income or allowance and access to an FSCA-authorized bank account are necessary to assess the borrower’s capabilities to fulfill their loan responsibilities.

How to Apply for a Finance 27 Loan?

Follow these four easy steps to avail of a Finance 27 loan:

Step 1. Create Your Finance 27 Account

The platform only provides credit and lending services to finance 27 users. Thus, you must first create your free Finance 27 account before you can start your loan application.

To create your Finance 27 account, you must visit its website (https://finance27.co.za/), locate the Register button, and fill in all the necessary account information.

Step 2. Calculate Your Loan

Use the loan calculator on the Finance 27 platform to determine the amount you wish to borrow and the relative interest rate and fees for it.

Step 3. Submit your South African ID and Finish Application Form

Complete the online application form with your personal and financial details. Personal details include your name, address, and age. Your financial details encompass both your professional and banking information.

Step 4. Wait for Loan Approval

Submit your application and wait for the approval process.

Once approved, Finance 27 will transfer your loan amount to your bank account on the same day.

Should You Loan to Trade?

Taking a loan to fund your trading activities is not generally advisable. Considering the complex and dynamic nature of the financial markets, you cannot guarantee a profit from it.

The moment you face trading losses, you’ll be subject to graver financial stress as you have to repay your loan on top of recovering from the financial tragedy.

But if you want to invest your loan money, you can participate in fixed-income investments like bonds. Such an investment instrument provides investors with consistent and guaranteed returns in the form of fixed interest and dividends. Explore how expert traders approach fixed-income investment in CommuniTrade.

Frequently Asked Questions (FAQs)

Is Finance 27 Legit and Regulated?

Finance 27 is not regulated by the FSCA. However, it’s accredited by the National Credit Regulator (NCR) of South Africa, ensuring that its operations and fee provisions are aligned with the interests of consumers.

How Long Does Finance 27 Process the Loan Disbursement?

Irrespective of your loan product, your loan amount is typically sent or disbursed to your preferred bank account within the day, if not instantly.

How Long Does Finance 27 Take to Approve a Loan?

One promising feature of Finance 27 is its instant loan approval. The platform ensures that all eligible applicants are approved instantly, thereby preventing a high turnover rate.

Is a Finance 27 Loan Good Choice in 2025?

As a fintech company, Finance 27 positions itself as a bridge between underserved South Africans and the solutions to their financial needs. However, despite its tenure and reputation in the SA market, many users reported frustrations with its inconsistent lending service.

When taking out loans, ensure that you’ve done your research regarding the company, including their interaction with their clients, to avoid getting harassed by unethical lenders. By joining a community like CommuniTrade, you can access the support, insights, and practical experiences of like-minded individuals to help you make informed financial decisions.