Crude oil trading is not for the faint-hearted. It’s fast, reactive, and often unpredictable. Yet, it remains one of the most sought-after markets in the commodity space.

Our analysts have seen a surge in crude oil online trading, especially through mobile-first crude oil trading apps.

But the real question is: Can traders profit from it?

This TRU Insight explores the mechanics behind trading crude oil futures, how this commodity trade flows shape price action, and why the inventories matter more than most think.

From timing the trading hours to understanding global supply shifts, we unpack the strategies that matter. Read on to see what separates the speculators from the specialists.

What is Crude Oil Trading?

Crude oil trading started as a physical exchange between producers and refiners. Over time, it shifted into a financial market where traders speculate on oil prices. Global supply chains, economic shifts, and inventory data influence these trades.

Today, crude oil trading includes futures contracts, spot deals, and digital platforms that make access easier for retail traders.

If you want to stay updated on the commodity market, joining a reputable trading community would be a great help. CommuniTrade has a dedicated space where commodity traders immerse themselves in knowledge with trader-led discussions.

Get access to real market insights, stay updated with TRU analytics plus more trading tools and resources that could improve your trading journey.

What Makes Crude Oil Trading Profitable?

One thing that affects the profitability is the movement.

The market doesn’t sit still, so the shifting and dynamic of prices depend on these factors:

- Frequent price swings. Crude oil prices react fast. That’s why traders should be very keen on when to enter and exit with precision.

- Global relevance. The demand never sleeps. Crude oil is widely used in transport, manufacturing, and energy.

- Supply chain dynamics. There are circumstances when there’s a delay in shipping or even in pipeline disruptions. Consequently, this can trigger price adjustments.

- Futures contracts. This can offer leverage opportunities. However, it also comes with several risks. That’s why timing and strategy matter.

- Extended trading hours. Traders across time zones can take advantage of the open market of crude oil trading.

What are the Pros and Cons of Trading Crude Oil

Before diving into trading, it’s essential to weigh its advantages and challenges.

Here’s a quick breakdown of the pros and cons that shape this volatile yet opportunity-rich market.

| Pros | Cons |

| High liquidity and global market access | High volatility and risk exposure |

| Multiple trading instruments (futures, CFDs, ETFs) | Requires deep market knowledge |

| Potential for short-term and long-term profits | Sensitive to geopolitical and economic shifts |

| Portfolio diversification | Complex pricing and contract structures |

What are the Key Strategies of Crude Oil Trading?

The trading strategies focus on timing, volatility, and price gaps. Each method aims to capture market inefficiencies and convert movement into profit.

Here are the most used approaches:

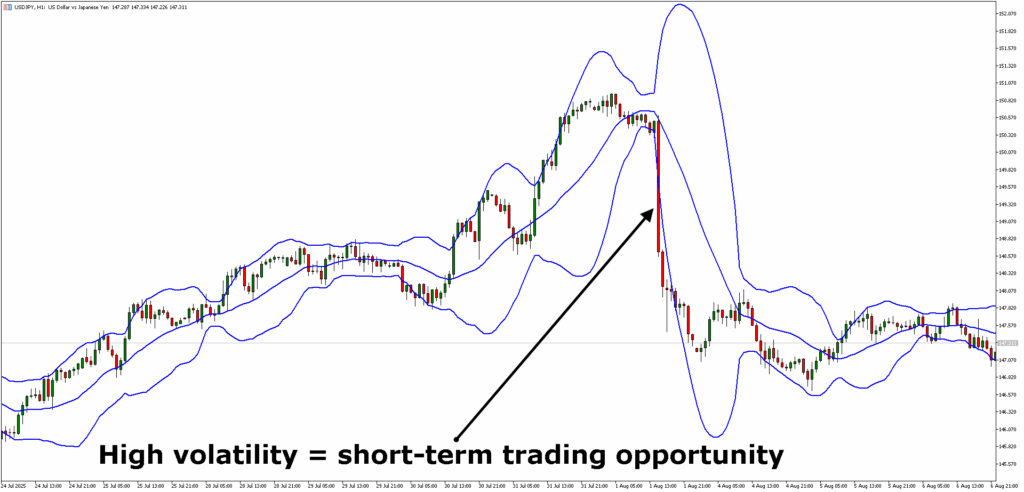

Volatility Trading

Volatility trading lets you profit from sharp price swings caused by supply disruptions, inventory shifts, or global events. These moves aren’t random—they follow patterns.

Seasoned commodity traders in our trading community, for example, rely on momentum indicators like Bollinger Bands and RSI to pinpoint volatility-driven setups with precision.

The formula? When volatility spikes, it signals potential entry points for short-term trades.

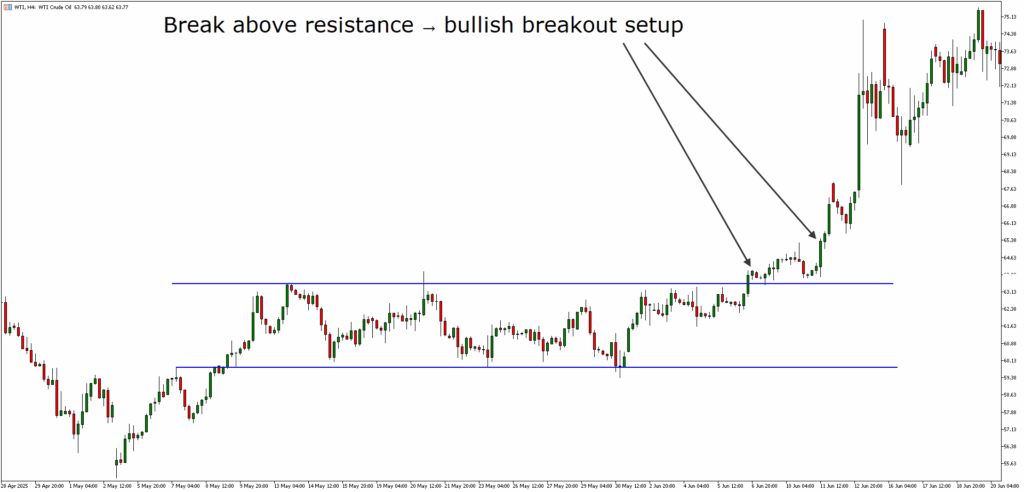

Breakout Trading

Breakout trading focuses on price levels where crude oil pushes beyond support or resistance. These moves often follow inventory reports or announcements from the Organization of the Petroleum Exporting Countries (OPEC).

As a trader, you should monitor these zones closely. When price breaks with strong volume, it often signals momentum and opens the door for short-term entries.

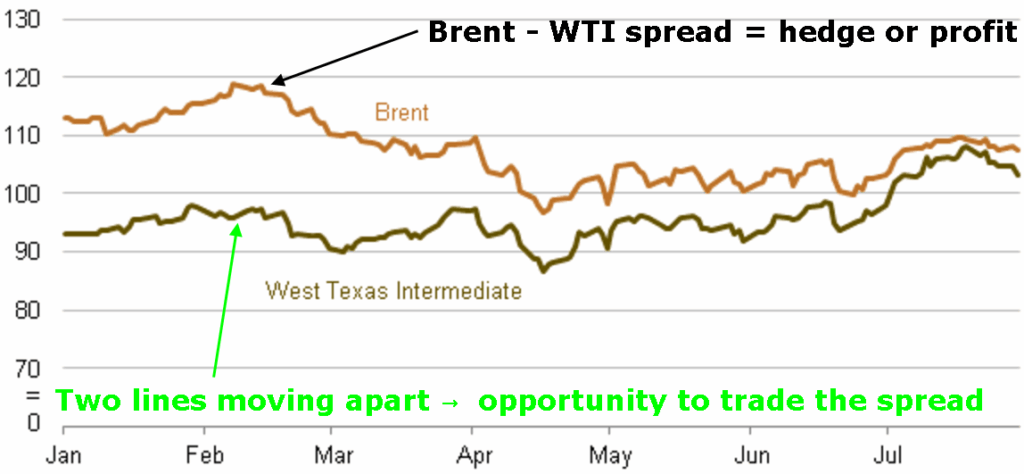

Spread Trading

Spread trading involves buying one crude oil contract and selling another to profit from the price difference. A common example is trading Brent crude against West Texas Intermediate (WTI).

This strategy helps you hedge regional risks and capture shifts in global trade flows. It’s not about predicting direction but about trading the relationship between two benchmarks.

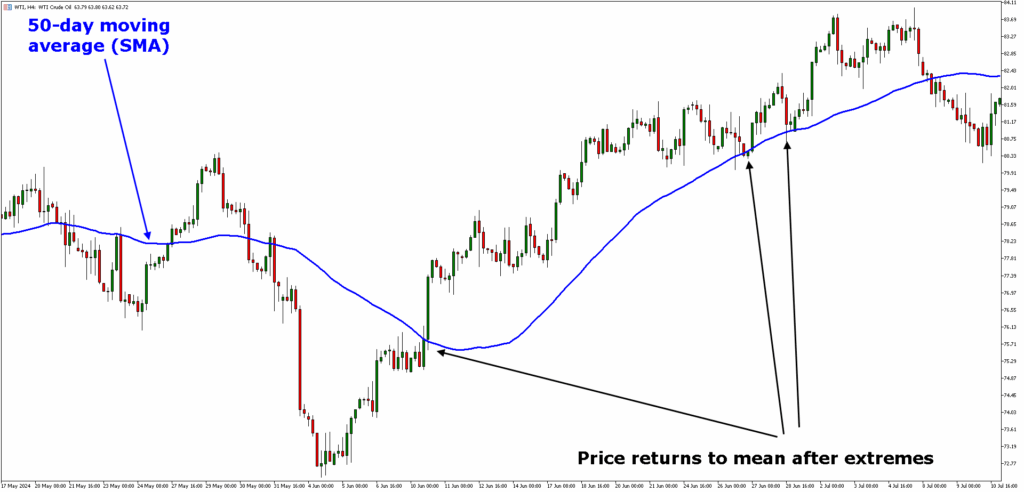

Mean Reversion

Mean reversion assumes that crude oil prices eventually return to their average. When prices move too far from the mean, it creates a potential reversal setup.

Use moving averages to identify these extremes. Once confirmed, you can position for a pullback toward the historical norm.

Calendar Spread

Calendar spreads involve trading crude oil futures with different expiry dates. You buy one contract and sell another to profit from seasonal demand shifts or changes in the futures curve.

This strategy allows you to manage exposure across time rather than price alone. It’s especially useful around refinery maintenance periods or seasonal consumption cycles.

Crack Spread Trading

Crack spread trading measures the margin between crude oil and refined products like gasoline or diesel. It reflects how profitable it is for refiners to convert crude into finished fuels.

When refined products outperform crude, the spread widens. You can trade this to speculate on demand or hedge refining exposure.

Statistical Arbitrage

Statistical arbitrage uses quantitative models to detect price gaps between correlated crude oil benchmarks, typically Brent and West Texas Intermediate (WTI).

When the spread deviates from historical norms, you enter expecting it to revert. This strategy is data-driven and requires precise timing.

Physical Arbitrage

Physical arbitrage means buying crude oil in one region where it’s cheaper and selling it in another where prices are higher. It’s a logistics-heavy strategy that includes transport and storage costs.

If the price gap covers your operational expenses, you move barrels and lock in the margin. This is how physical traders capitalize on global inefficiencies.

Frequently Asked Questions (FAQ)

What is the best crude oil trading app in 2025?

Top apps include Interactive Brokers, Plus500, and Pocket Option for futures and CFDs.

What are crude oil trading hours?

Most platforms offer nearly 24/5 access. WTI and Brent futures trade Sunday to Friday with short maintenance breaks.

Is Trading Crude Oil Profitable in 2025 and the Future?

Crude oil trading continues to offer real potential for traders who understand its mechanics. With high liquidity, global relevance, and constant price movement, it can be rewarding for the right traders who understand the crude oil market.

That’s why it’s important for crude oil traders to read trade flows, track inventory shifts, and time their entries well.

Profitability isn’t guaranteed, but with the right strategy and discipline, it’s achievable.

If you want to equip yourself with the right knowledge resources about crude oil commodity, CommuniTrade is a space worth joining. Verified traders share practical insights, and the platform offers educational tools to help you stay sharp.

It’s built for traders who want to learn, exchange ideas, and make better decisions with credible support.