Filipinos are no strangers to the call center sector. In fact, this sector created over 120,000 jobs that sustained the country’s labor force during the onslaught of the COVID-19 pandemic in 2021.

While economists celebrate this growth, this saturation has made it easy for scam call center operations to blend in. YouTuber and Whitehat hacker @mrwn caught a notable example of this through his call center scam exposé.

In this TRU Insight, we’ll break down the CCTV Quantum AI scam and Solis Markets fraud operations led by the call center company, named BMJ Data Processing. Read here how the scammers defraud South African victims of over $800,000 a year, and the best practice to keep yourself safe from such a financial tragedy.

Cebu Scam Hub at a Glance

What Happened?

On May 18, 2025, an unnamed foreign Whitehat hacker exposé the Cebu call center scam operation that targeted unsuspecting investors from South Africa, Nigeria, and other struggling countries.

On the viral 22-minute YouTube video, the ethical hacker compromised the company’s CCTV system to exposé the scammers’ illegal activities. This ultimately prompted the local authorities in the Philippines to investigate the alleged investment scam hub.

What Do We Know?

With the promise of guaranteed 20-40% weekly returns and a mix of deceptive sales tactics, the Cebu call center scammers successfully targeted the desperation and vulnerability of unsuspecting victims.

Deceptive sales tactics include emotional manipulation, intimidation, claiming false licenses, and creating a fake crypto trading platform. Upon the hacker confrontation, the scammers were prompted to leave the office. As of the current, they remain at large.

Who Are Involved?

Three days after the exposure, the Cybercrime Investigation and Coordinating Center (CICC) of the Philippines investigated the call center company for allegedly operating as a scam hub.

The CICC and the Department of Information and Communications Technology (DICT) declared their full cooperation with the white hat hacker. Paraiso, CICC officer-in-charge, declared his agency’s commitment to solving the case with the Whitehat hacker, claiming that “whatever findings you [mrwn] have, we will follow it up.”

‘Scammers Panic After Getting Hacked Live on CCTV’—Investment Scam Video Exposé

In the now-viral YouTube video, user @mrwn uploaded several CCTV clips that followed the Quantum AI scam and Solis Markets fraud operation.

This piece of vigilante digital justice was exposé after the hacker accessed the call center’s CCTV, computer systems, and even the floor manager’s Telegram account. This security system infiltration ultimately revealed the scammers’ tactics, structure, scripts, and identities.

Watch the full exposé development:

Note: Filipinos reported that the video is currently unavailable to the Philippine domain due to a defamation claim.

Who is Mrwn?

Mrwn (pronounced as “merwin”) is a Whitehat hacker and content creator known for exposé scams and scammers through his investigative videos on platforms like YouTube. He uses various techniques to reveal the operations of scams and other fraudulent activities, often showing live footage and confronting scammers.

Mrwn came across the Cebu call center scam after its agent tried to scam one of his friends. After that, the hacker started compromising the company’s CCTV and computer systems to get into day-to-day fraud operations.

Prior to the exposé, Mrwn reached out to local authorities to investigate the alleged scam call center. However, his request was either unattended or redirected to other authorities.

A Closer Look at the Cebu-Based Scam Operation

The expose video uploaded by Mrwn walked the public through the CCTV footage and audio recordings inside the alleged scam hub led by call center agents in Cebu.

Let’s have a closer look at the scam operation.

Scammers Guised as Chief Fund Supervisor

Fund supervisors (also known as account managers) are all too common in the financial markets. At their core, they function to provide one-on-one assistance to online traders or investors to manage their accounts, portfolios, or capital.

In the case of the Quantum AI scam, these fund supervisors are at the forefront of the fraudulent activity. These scammers create a false sense of credibility by claiming over 10 years of experience in the market.

According to the script revealed on the viral video, these agents deceive unsuspecting investors by promising professional mentoring, an automated trading system, and access to guaranteed profit from the lucrative cryptocurrency market.

Scammers Sell the Quantum AI System

The video footage and audio revealed that the agents or fund supervisors were selling an automated trading software called Quantum AI.

As heard on the viral video, an agent (who goes by the phone name Melly) urged the unsuspecting victim to open an account with the software for a minimum deposit of USD250.

The agent stated that this software would provide access to “a secondary source of income using the software with automated features.”

Quantum AI was marketed as sophisticated software, claimed to be able to scan more than 1000 assets simultaneously to find the best trading opportunities.

Note: Algo trading (“robot trading”) is arguably the most common entry point for scammers. However, not all are the same—some algo trading software can provide you reliable trading insights and assistance.

To ensure you choose a credible and legitimate platform, join a verified trading community to benefit from the wisdom and experiences of seasoned traders.

Promising Guaranteed High Returns

Investors participate in online trading to grow their capital. In other words, they want to profit from the market.

Quantum AI scammers are well aware of this. In fact, these scammers often lure unsuspecting investors by promising guaranteed high returns. Call center agents promise unsuspecting investors at least 30% profit on a weekly basis.

With the minimum deposit of USD250, an investor could allegedly cash in USD75 to USD100 weekly.

This is a tell-tale sign of an investment scam. While the cryptocurrency market is indeed lucrative due to its volatility, it’s nothing without its risks that could hinder profitability. Any investor should know that guaranteed returns are simply impossible in the financial markets.

Emotional Manipulation

The emotions of unsuspecting victims were one of the cards that these scammers played. To defraud the victims of their hard-earned money, these scammers rake into the victims’ vulnerability, often their desperation for a better financial future.

You can hear the agent guilt-tripping its target victim, Mr. Norman.

“I know that you’ve been struggling right now, Mr. Norman. But let me ask you—do you want to be in that situation forever? You don’t want to put your family in a better situation?”

This emotional trigger could force the victim to give in to the scheme, implying that doing so signified his desire to improve his family’s financial situation.

Yet, the victim refused to continue the service as he claimed to struggle to feed his own family, let alone allow R3700 rand to go into his investment account.

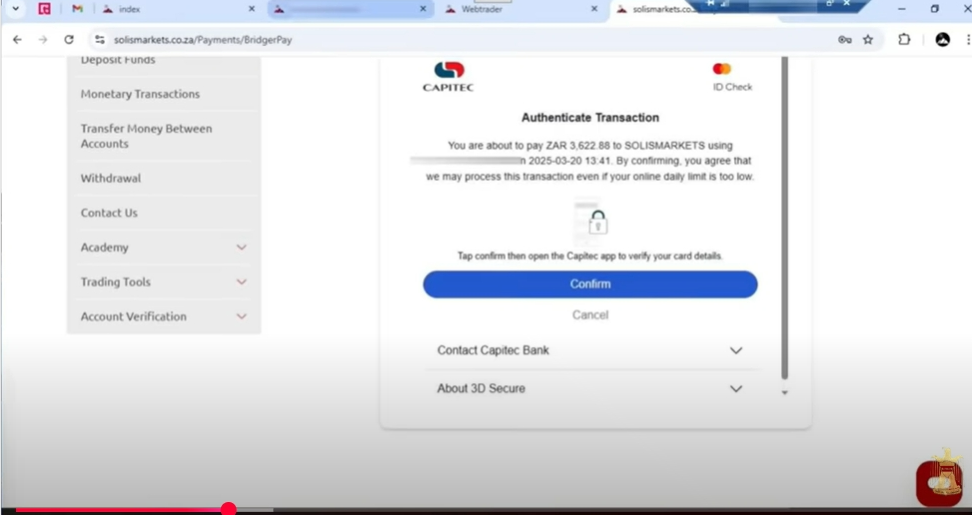

As insidious as the situation is, the agent tried to process the payment and charged Norman’s card without his consent.

Client Intimidation

Another unethical sales tactic of the scammers was the display of aggressive behavior or intimidation. This tactic creates a sense of urgency and fear to corner and scam the victim.

In the case of Melly and Mr. Nyembe, Melly employs intimidation by threatening to close Mr. Nyembe’s investment account. This threat is coupled with a reprimand for Mr. Nyembe’s perceived negligence:

“Every time we call you, you keep saying you’re on the road, you’re doing something else. You’re busy. I am also a busy person, Mr. Nyembe, and I have clients I need to assist.”

Fake Investment Platform

The video also exposed a sophisticated scam operation where agents have access to a fraudulent investment platform.

The scammers manipulate the platform’s charts to display false profits, deceiving victims into believing their investments are growing. This visual deception is a key tactic used to build trust and encourage further deposits.

After the initial investment, victims are handed over to a retention manager. This manager’s role is to maintain the illusion of profitability. They present fabricated profits from supposed automated trades, further convincing victims of the platform’s legitimacy and encouraging additional deposits.

Read more: What Is Investment Ponzi Scheme: South African Financial Terrorists

Denial of Withdrawal

When victims attempt to withdraw their supposed profits, the scammers employ various excuses to prevent the withdrawal. Common tactics include citing unexpected taxes, invoking bonus conditions, or presenting other fabricated reasons.

These obstacles are designed to delay or completely block the withdrawal process and retain control over the victims’ funds.

What is the solismarkets.co.za?

Solis Markets (solismarkets.co.za) is the investment platform that receives the funds deposited by unsuspecting victims.

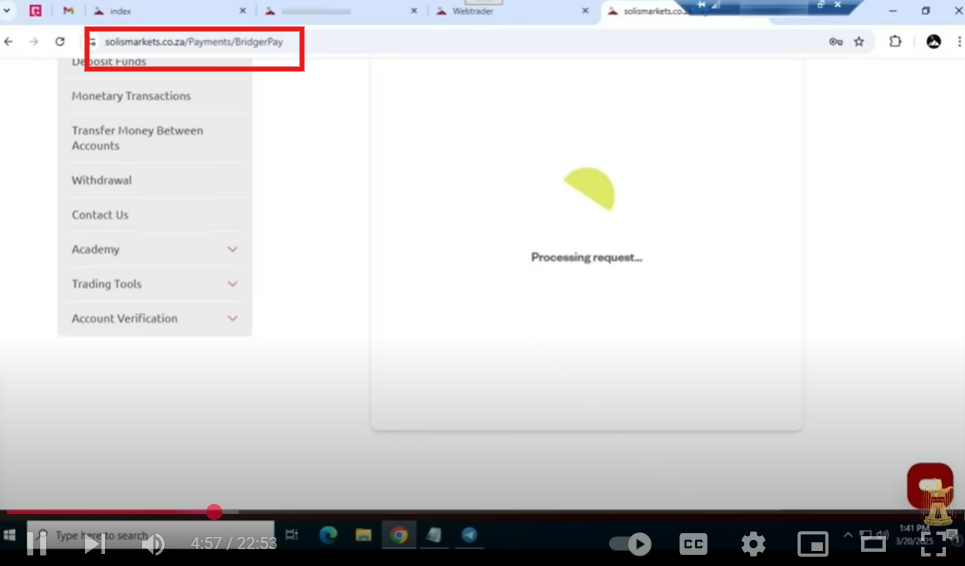

When an agent tried to process an unauthorized fund transfer from Mr. Norman’s card, the search engine showed the payment gateway of Solis Markets (http://solismarkets.co.za/payments/bridgerpay).

Additionally, the Quantum AI and Solis Markets scam also went to the names of Bitcoin Code, BTC Boutique, and Virtual Wealth Exchange.

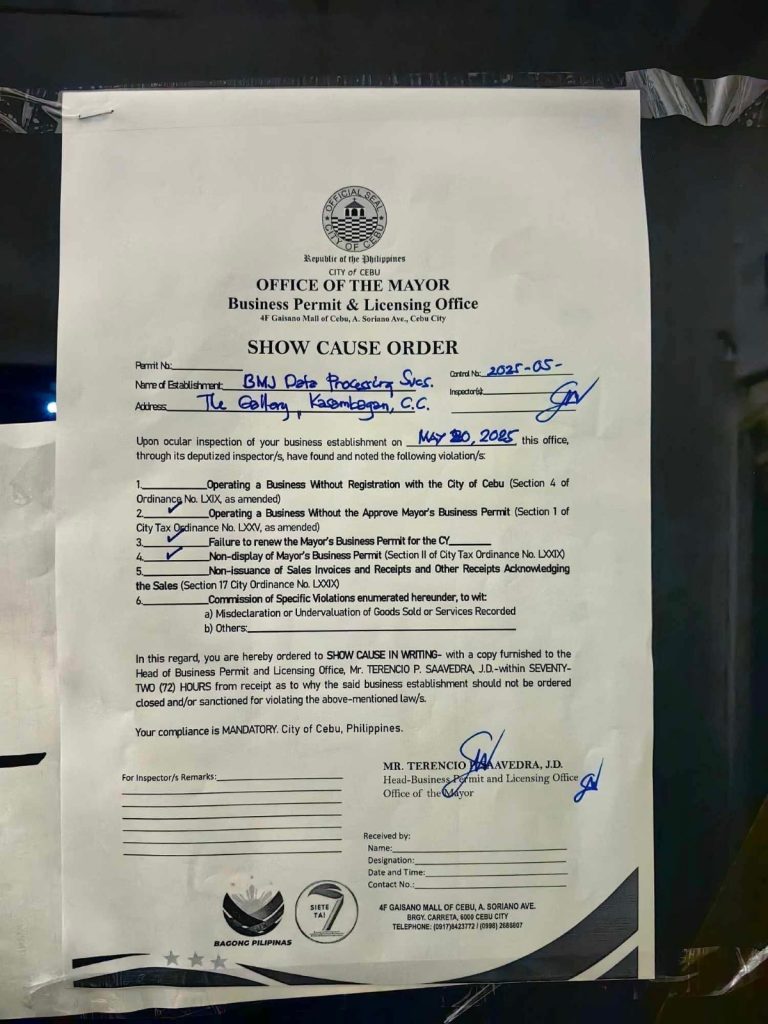

What Happened to BMJ Data Processing Services?

BMJ Data Processing Services was indeed the BPO company involved in employing individuals for the Solis Market and Quantum AI scams. This company was headquartered on the 2nd floor of the Skyrise Building, Cebu IT Park.

Two days after the viral exposé, the company was served a show cause order in response to the alleged scam operations and its unregistered operation.

However, the Police authorities were welcomed by an abandoned floor when they raided the location.

How to Protect Yourself from Such Investment Scams?

Unfortunately, many countries have been experiencing wealth inequality for centuries now. Taking the masses’ desperation to secure a better financial future, businesses see an opportunity to operate their financial services in the country.

While credible financial companies are undeniable, there’s still a growing number of financial services trying to deceive unsuspecting investors.

Fortunately, there’s a way to remain safe despite this silently growing epidemic – that’s by finding an impartial online dispute resolution system.

With the TRU Dispute Resolution Service (DRS), you have access to a regulated avenue to express your grievances. Report scam incidents to TRU DRS, verify brokers before you make a deposit, and tap into the genuine experiences of the community members to stay informed.