AECI Limited is a chemical solutions and explosives group of companies that has become a global leader in chemical and explosives manufacturing.

For investors interested in the South African market, tracking the AECI share price is essential for assessing both domestic industrial trends and global commodity cycles.

This article provides a comprehensive look at AECI’s current share price, its recent performance and history, analysts’ forecast, and whether it is an attractive investment.

Company Overview: AECI Limited

AECI Limited is a diversified group of companies with regional and international businesses in Asia, Europe, North America, South America, Australia, and Africa.

It has been implementing a strategy of streamlining, divestments, cost optimization, and focusing on higher-margin segments.

History & Background

AECI, originally known as African Explosives & Industries Limited, was founded on March 21, 1924, marking 2024 as the group’s 100th anniversary in the industry.

It was established in conjunction with a notable boom in the mining industry in South Africa due to the increased demand for natural resources across the world.

Since its establishment, AECI has swiftly positioned itself as a leader by pioneering the use of mining explosives.

Business Segments

The group is involved in various business segments:

- Mining solutions – This segment offers commercial explosives, initiating systems, and blasting services right through the value chain to chemicals for ore beneficiation and tailings treatment solutions.

- Water and process – This segment provides integrated water treatment and process chemicals, as well as equipment solutions, for a diverse range of applications in Africa.

- Food and beverage – This segment supplies ingredients and commodities to the dairy, beverage, wine, meat, bakery, health, and nutrition industries.

- Chemicals – This segment distributes specialty chemical raw materials and related services for use across a broad spectrum of customers in the manufacturing and general industrial sectors.

- Property and corporate – This segment handles property leasing and management in the office, industrial and retail sectors, and corporate functions, including the treasury.

Recent Challenges

AECI has faced several challenges in 2023 and 2024 that explain its earnings volatility and cautious investor sentiment:

- 2024 losses: AECI reported a net loss in 2024, with a negative net income of ZAR −283 million, which led to a negative P/E ratio. This data highlighted how sensitive AECI’s profits are to cost pressures and demand swings.

- Revenue dip in 2025 forecasts: Sales are projected to fall from ~ZAR 36.5 billion in 2024 to ~ZAR 32.6 billion in 2025. This slowdown raises questions about demand for mining solutions and chemicals.

- South African operating environment: Persistent electricity load-shedding, high energy costs, and logistics bottlenecks (notably at ports) have created structural challenges for industrial firms like AECI.

- Earnings instability: Headline earnings per share (HEPS) improved by ~132% in H1 2025 (604c) vs H1 2024 (260c). However, the sharp rebound comes after a weak base, which suggests that recovery is still fragile.

AECI has also navigated periods of low demand in the mining sector, supply chain disruptions, currency volatility, and regulatory pressures. These have impacted margins, earnings, and investor sentiment. margins, earnings, and investor sentiment.

AECI Share Price Performance on the JSE

Here are some key figures for AECI on the Johannesburg Stock Exhange (JSE) as of September 22, 2025, according to Investing.com:

| Metric | Value |

| Share price | 10,317c |

| 52-week high/low | High: ~ 11,159c Low: ~ 8,073c |

| Market capitalization | ZAR 10.89 billion |

| P/E ratio | 26.5× |

| Earnings per share | 390c |

| Dividend yield | 3.1 |

The current AECI share price (~10,317c) is higher than the 52-week low, which means it has gained from its lows. However, it is still below the 52-week high, indicating some room for upside.

The P/E ratio of 26.5x indicates that people are paying ZAR 26.5 for each rand of profit AECI has been making.

This number is fairly high, suggesting that investors can expect future profits to grow well. However, if profits do not grow, then investors may think the stock is expensive.

Historical Trends: AECI Share Price History

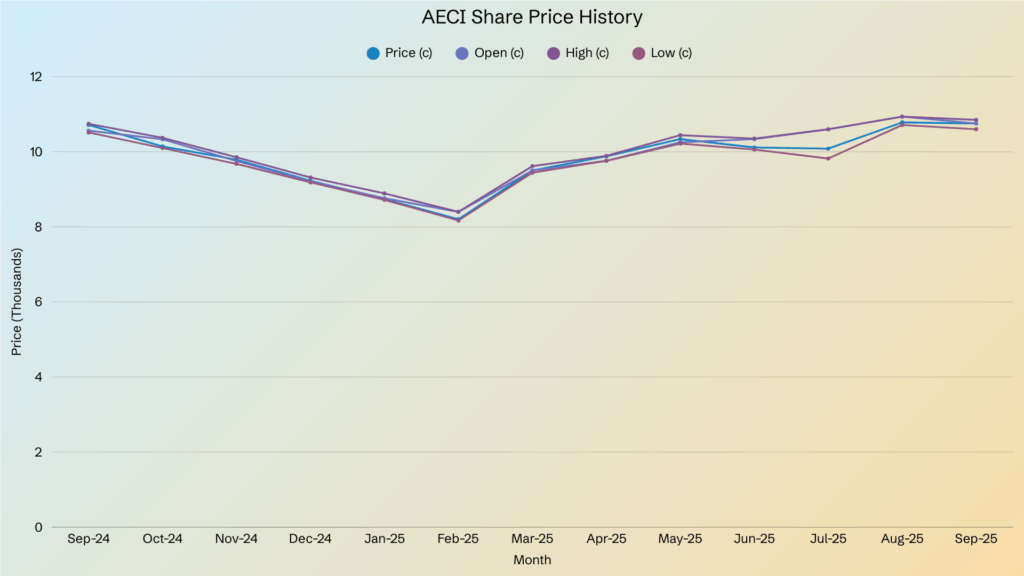

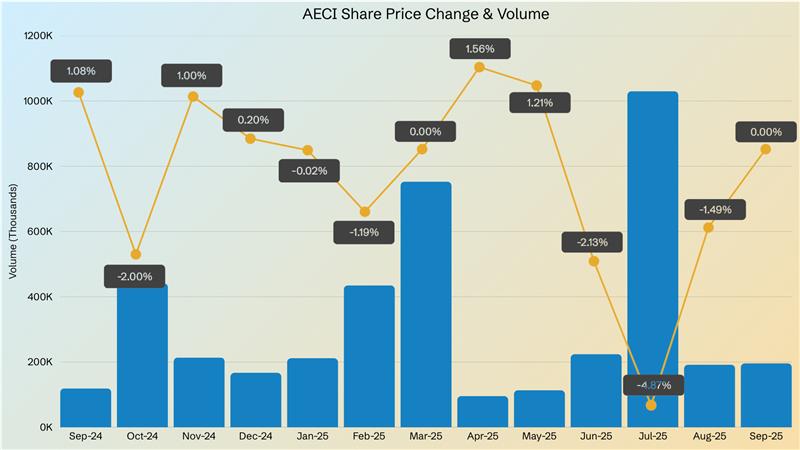

Here is the AECI share price data from September 2024 to the same month this year, according to Investing.com:

Many months have had a relatively wide day range. For example, the day range in July 2025 is 9,820c to 10,599c, with a difference of 779c.

This data shows volatility and that buyers and sellers were pushing the price around.

The lowest AECI share price was 8,203c in February 2025, while the highest AECI share price was 10,782c in August 2025.

The historical data for AECI share price shows that the volume of shares traded varies significantly.

Overall, the trend indicates that the price has moved up and down, but it is generally lower than the 52-week high price.

Market Outlook: AECI Share Price Predictions

In Investec’s company research on AECI Limited for H1 of 2025, they determined that AECI’s H1 results were solid enough, aligning with their expectations.

However, with the increase in price of 26% YTD, Investec believes that a steady turnaround is underway.

Investec kept their FY25E and FY26E dHEPS at 1,200c and 1,500c per share, respectively.

However, they downgraded their recommendation for AECI to “Hold” after the recent trend, according to Investec’s stock rating based on the expected total return (ETR) in rand:

- Buy: ETR > 15%

- Hold: ETR = 5% to 15%

- Sell: ETR < 5%

The following table contains the AECI share prices for 2023 and 2024, as well as the estimated data for 2025, 2026, and 2027: :

| 2023A | 2024A | 2025E | 2026E | 2027E | |

| Revenue (ZARm) | 37,500.0 | 33,598.0 | 32,577.6 | 34,146.4 | 35,609.6 |

| EBITDA (ZARm) | 3,645.0 | 3,034.0 | 3,359.8 | 3,907.5 | 4,294.6 |

| EBITA (ZARm) | 2,592.0 | 1,950.0 | 2,332.8 | 2,914.5 | 3,311.6 |

| PBT (normalized, ZARm) | 2,118.0 | 1,530.0 | 2,160.8 | 2,721.5 | 3,154.1 |

| Headline earnings (ZARm) | 1,200.0 | 755.0 | 1,287.5 | 1,623.9 | 1,883.5 |

| HEPS – FC (c) | 1,116.7 | 710.4 | 1,200.1 | 1,499.7 | 1,723.5 |

| FCFPS-FD (c) | 1,957.9 | 615.3 | 691.2 | 1,161.7 | 1,378.5 |

| NAVPS (c) | 11,758.3 | 11,327.7 | 12,702.9 | 12,325.8 | 13,502.7 |

| DPS (c) | 219.0 | 219.0 | 300.0 | 400.0 | 500.0 |

| PE (normalized, x) | 9.8 | 15.5 | 9.2 | 7.3 | 6.4 |

| Price/NAVPS | 0.9 | 1.0 | 0.9 | 0.9 | 0.8 |

| EV/sales (x) | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 |

| EV/EBITDA (x) | 3.7 | 4.4 | 4.0 | 3.4 | 3.1 |

| FCF yield (%) | 17.8 | 5.6 | 6.3 | 10.6 | 12.5 |

| Net debt/EBITDA (x) | 1.2 | 1.4 | 0.4 | 0.0 | (0.2) |

| Return on equity (ROE, %) | 9.8 | 6.3 | 9.6 | 12.3 | 12.9 |

| Free cash flow | 2,104.0 | 654.0 | 741.5 | 1,257.9 | 1,506.5 |

| Dividend yield (%) | 2.0 | 2.0 | 2.7 | 3.6 | 4.5 |

This data shows that AECI’s revenue dropped from 2023 (ZAR 37.5 billion) to 2024 (~ZAR 33.6 billion).

The revenue is expected to stay at a lower amount in 2025 (~ZAR 32.6 billion) before a slight increase in 2026 (~ZAR 34.4 billion) and 2027 (~ZAR 35.6 billion).

A similar dip was seen in AECI’s EBITDA in 2024. Nevertheless, Investec expects a strong recovery in 2025, 2026, and 2027.

A sharp decrease was observed in AECI’s HEPS, HEPS on a fully diluted basis (HEPS/FD), and free cash flow per share (FCFPS) in 2024.

However, Investec expects a strong comeback in 2025, 2026, and 2027, indicating a turnaround.

The HEPS/FD and FCFPS also showed recovery in 2025, with expected further improvements in 2026.

The net debt/EBITDA, which refers to how long it would take for AECI to pay off all its debt, showed strong improvement in 2025. By 2026, AECI is expected to have almost no debt.

AECI’s return on equity (ROE) was weak in 2024 and showed improvement in 2025. By 2026, their ROE is estimated to exceed their earlier years.

Lastly, AECI’s dividend per share showed steady data in 2023 and 2024 and is forecasted to increase continuously in 2025, 2026, and 2027.

Overall, 2024 was a weak year for AECI, with drops in revenue, EBITDA, and cash flow.

Nonetheless, 2025, 2026, and 2027 are expected to be AECI’s turnaround years, with an estimated strong recovery in HEPS, improved EBITDA, better cash flow, and reduced debt.

With an increase in earnings and recovery of free cash flow, dividends are also expected to increase, as AECI has more room to pay dividends.

How to Invest in JSE AFE

Based on the data above, AECI shows promise, with an expected increase in revenue, free cash flow, HEPS, and dividends.

If you want to start investing in the stock market today, here are different ways you can invest in JSE:AFE:

1. Stockbrokers

A stockbroker is a member of the JSE who arranges investments on your behalf to get a profitable return for you.

As a new investor, you should be clear about your investment goals.

This will help you in selecting a stockbroker firm that is a good fit with your investing goals, learning style, and educational needs.

Note, however, that a stockbroker will not buy or sell directly for you. You will only play your buy and sell orders with stockbrokers, and they will execute the trade on your behalf.

2. Financial Advisors

A financial advisor is a skilled professional who can help you fulfill your financial plans, such as retiring in 10 years.

Your financial advisor will help you determine how much you should save for your goal, the types of accounts you will need, and what kind of insurance you should have.

Another aspect of the role of a financial advisor is educating you on what is involved in your future goals.

These topics typically include saving and budgeting at the start and may progress to investment, insurance, and tax matters as your relationship progresses.

3. Financial Service Providers

Financial service providers, including investment managers and insurance companies, are businesses that offer financial advice and go-between services.

These businesses usually offer indirect ways to invest in equity markets, which involves leaving decisions about where to invest to investment professionals.

Many financial service providers still require working with a stockbroker to build their portfolios and buy and sell shares that they manage on your behalf.

You May Also Be Asking

What Exchanges is AECI Listed on?

AECI is listed on the Johannesburg Stock Exchange (JSE) under the ticker “AFE.”

What is the Share Price of AECI Mining Explosives Division?

There is no separate listed share for the mining explosives division. Rather, it is part of AECI Limited’s consolidated business, and the company’s share price reflects all segments.

How does the AECI Share Price Compare to the Sasol, Valterra JSE, and BHP Share Prices?

The share prices of Sasol Ltd., Valterra Platinum Ltd., and BHP Group Ltd. as of September 19, 2025, are 11,552c, 104,672c, and 45,078c, respectively.

This data shows that the AECI share price (10,374c) is much lower than those of Valterra and BHP. However, its share price is only slightly lower than that of Sasol.

The Bottomline

The AECI share price continues to reflect both the company’s challenges and its recovery potential within the South African industrial and mining sectors.

2024 was a weak year marked by revenue declines and earnings pressure.

However, forecasts for 2025 to 2027 suggest a strong turnaround, with improving HEPS, EBITDA, free cash flow, and dividend growth.

AECI’s efforts to streamline operations, reduce debt, and focus on higher-margin businesses are expected to strengthen its long-term investment case.

For investors tracking the JSE:AFE listing, AECI represents a stock with cyclical exposure to mining and chemicals but also resilience through diversification.

With the share price currently trading below its 52-week high, there may still be upside potential—provided that global demand and local operating conditions stabilize.

In summary, AECI is not without risks. Still, it offers investors exposure to South Africa’s industrial backbone with the possibility of steady earnings recovery and stronger shareholder returns in the coming years.

If you want to keep informed about the fluctuating AECI share price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.