Sasol Limited is a global chemicals and energy company that sources, produces, and markets a range of high-quality products in 22 countries.

Here, let’s discuss the Sasol share price (JSE) today, historical data and performance, and forecasts and predictions.

Overview of Sasol Limited

Sasol develops and commercializes technologies. It also builds and operates state-of-the-art facilities to produce a wide range of high-value products, including chemicals, liquid fuels, and low-carbon electricity.

It has the following business units:

- Operating Business Units include the company’s mining and upstream oil and gas activities.

- Regional Operating Hubs comprise its operations in South Africa, Eurasia, and the United States.

- Strategic Business Units focus on Sasol’s commercial and enhanced customer interfaces with the energy and chemical sectors.

- Group Functions provide fit-for-purpose business support solutions.

The company was founded on September 26, 1950. It was listed on the Johannesburg Stock Exchange (JSE) in October 1979 with the ticker “SOL.”

Then, on April 9, 2023, Sasol was listed on the New York Stock Exchange.

Sasol Share Price Today

Here are some key figures for Sasol on the JSE as of October 22, 2025, according to Investing.com:

| Metric | Value |

| Share price | 9,665c |

| 52-week high/low | High: 12,909c Low: 5,301c |

| Market capitalization | ZAR 62.23 billion |

| P/E ratio | 6.7× |

| EPS | 1,060c |

| Dividend yield | – |

The latest close price (October 22, 2025) is 9,665c, which is lower than its 52-week high. The huge gap between the 52-week high and low suggests significant price movement over the past year and indicates volatility.

Sasol’s current price-to-earnings (P/E) ratio is below the market average, which suggests undervaluation or that investors expect lower future earnings. Its earnings per share (EPS) of 1,060c is high, which indicates that it is generating solid earnings relative to its share price.

Sasol Limited pays dividends unevenly, and the last dividend was paid on March 13, 2024.

Sasol Share Price Graph & Historical Performance

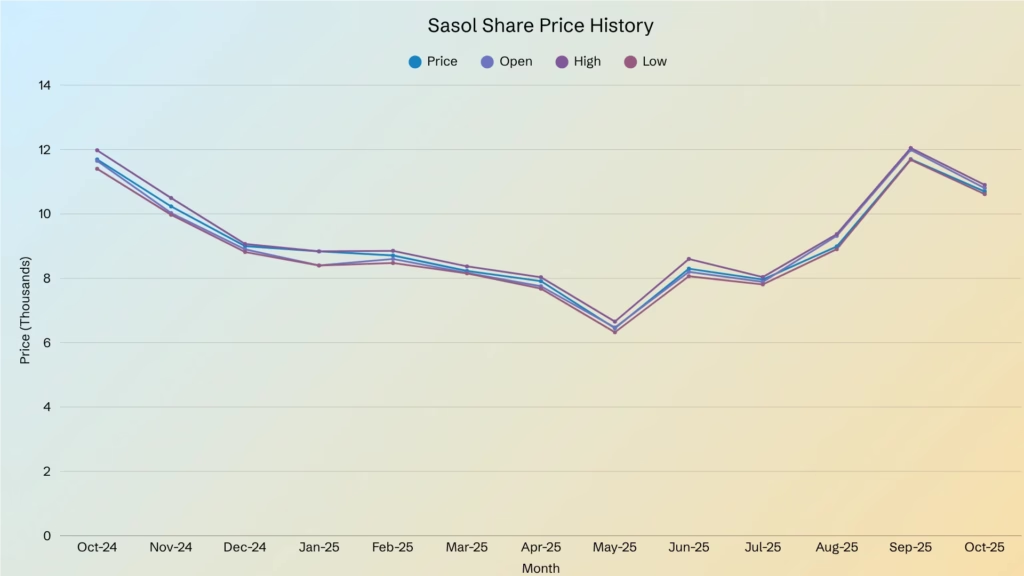

Here is the Sasol historical share price data from October 2024 to the same month this year, according to Investing.com:

The starting share price in October 2024 is 11,694c, and the closing share price for the period is 10,696c. Sasol share price in rand peaked in October 2024 at 11,694c, while the lowest share price was observed in May 2025 at 6,450c.

The share price fell from October 2024 to December 2024. This trend continued until May 2025, when the share price reached its lowest. Sasol share price recovered from June to September 2025, reaching 11,702c. However, it slightly dropped in October 2025 to 10,696c.

Overall, the trend shows a sharp decline from late 2024 to mid-2025, followed by a strong recovery.

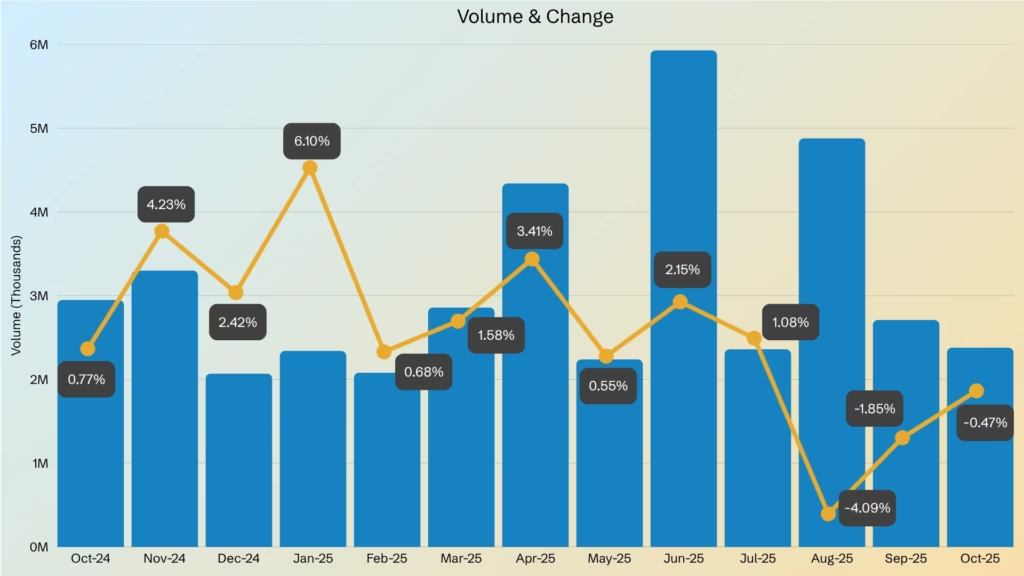

Trading volume peaked in June 2025. Meanwhile, the lowest volume was observed in December 2024 at 2.07M.

On the other hand, the biggest monthly gain was noted in January 2025 at 6.10%, while the biggest monthly loss was observed in August 2025 at -4.09%.

The longest positive streak is from February to April 2025, showing three consecutive months with gains.

Sasol Share Price Forecast

Here are the forecasted revenue, earnings, EPS, and EPS range for Sasol for the next three financial years, according to Simply Wall St.:

| Financial Year | Revenue (ZARb) | Earnings (ZARb) | EPS | EPS Range |

| 2026 | 247.620 | 14.971 | 2,777.9c | 1,927.3c – 3,309.6c |

| 2027 | 261.824 | 19.473 | 3,135.2c | 1,840c – 3,693.5c |

| 2028 | 284.950 | 23.778 | 3717.6c | 2,400c – 4,218c |

Sasol’s earnings and revenue are expected to grow by 34.2% and 4.5% per year, respectively. Meanwhile, the EPS is expected to grow by 32.1% per annum.

Sasol’s forecast earnings growth of 34.2% per year is above the savings rate of 9.8%. Its earnings are also forecast to grow faster than the South African market (17.6% per year).

Moreover, Sasol’s earnings are forecast to grow significantly over the next three years. However, its revenue of 4.5% per year is forecast to grow more slowly than the South African market at 6.1% per year.

On the other hand, Sasol’s return on equity (ROE) is expected to be low in the next three years at 14.4%.

You may also be asking

Is Sasol a buy or sell?

Among the 10 analysts from TradingView, 5 recommended strong buy, one recommended buy, and four recommended hold. Similarly, among the nine analysts from Investing.com, five recommended buy, while the remaining four recommended hold.

Who is the largest shareholder of Sasol?

The largest shareholder of Sasol Limited is Public Investment Corporation (SOC) Ltd., holding 17.96% of Sasol shares. It is followed by Industrial Development Corp. of South Africa Ltd. at 8.284% and Standard Bank Group Limited at 2.16%.

Why is the Sasol share price dropping?

One of the factors that led to the Sasol share price dropping is Morgan Stanley’s downgrading of Sasol from overweight to equal weight. This led the share price to fall by 8.14% that week, extending monthly losses to almost 20%.

Other possible factors include operational challenges, global market pressures, dividend suspension, and environmental and regulatory risks.

Will Sasol share price recover?

Yes, it is expected to recover. Sasol’s earnings and revenue are forecast to increase by 34.2% and 4.5% per year, respectively. In addition, Sasol’s EPS is expected to grow by 32.1% per year.

Conclusion

The Sasol share price has experienced notable volatility over the past year, highlighting internal challenges and broader market dynamics.

From a sharp decline in late 2024 to early 2025 to a promising recovery in the latter half, Sasol has demonstrated resilience amid operational setbacks and global economic pressures.

With earnings rebounding, free cash flow improving, and analysts forecasting strong growth in EPS and revenue, Sasol presents a compelling opportunity for long-term investors.

However, caution is warranted due to ongoing environmental risks, dividend suspension, and sector-specific headwinds.

Overall, the analysts’ sentiment leans toward buy, but your strategy should align with your risk tolerance and investment goals.

If you want to keep informed about the constantly changing Sasol share price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.