Established in March 2001, Capitec Bank Holdings Limited is a bank controlling company that engages in retail banking services.

Here, let’s discuss Capitec Bank share price, its historical data, market outlook and prediction, and answer whether South Africa’s favorite retail bank can sustain its growth.

Overview of Capitec Bank

Founded by Michiel Scholtz du Pré le Roux in 1999, Capitec was registered on the Johannesburg Stock Exchange (JSE) on February 18, 2002, with the ticker “CPI.”

Capitec offers transactional banking services and loan products, including loans, credit facilities, and credit cards.

It has over 24 million active clients, 880 branches, and more than 16,900 workers. Its shareholders’ funds are ZAR 50 billion for the financial year that ended on February 28, 2025.

Capitec has the following business segments:

- The retail bank segment includes transactional banking services, savings, and loan products for retail bank clients.

- The business bank segment offers loan products that are granted to business bank clients, treasury products, and call and notice deposits.

- The insurance segment provides long-term insurance products to retail bank clients.

Capitec builds solutions and unlocks opportunities, driving South Africa’s economic progress by empowering individuals through accessible financial solutions.

Capitec Bank Share Price Overview

Here are some key figures for Capitec Bank share price (JSE) as of October 17, 2025, according to Investing.com:

| Metric | Value |

| Share price | 388,206c |

| 52-week high/low | High: 397,371c Low: 246,986c |

| Market capitalization | ZAR 449.9 billion |

| P/E ratio | 29.3× |

| Earnings per share | 13,271c |

| Dividend yield | 1.8% |

Capitec Bank share price (388,206c) being close to the 52-week high (397,371c) suggests good momentum.

Its high price-to-earnings (P/E) ratio indicates that investors are willing to pay more for the stock. Its P/E ratio (29.3×) is higher than the industry average of 6.2×.

Based on Capitec’s moving average and other technical indicators, the daily buy/sell signal is Strong Buy, with seven buy signals and zero sell signals.

One of the risks, however, is its highly elevated valuation. This indicates that if growth slows, the downside could be steep.

Capitec Bank’s low dividend yield of 1.8% may also be unattractive to income-focused investors.

This data shows that Capitec Bank shares appear strong technically, with momentum and market confidence. However, the Capitec Bank share price is too high, which may already reflect much of the upside.

Nevertheless, if Capitec can sustain its growth, manage credit risks, and deliver earnings surprises, it could justify the premium share price tag.

Capitec Bank Share Price History

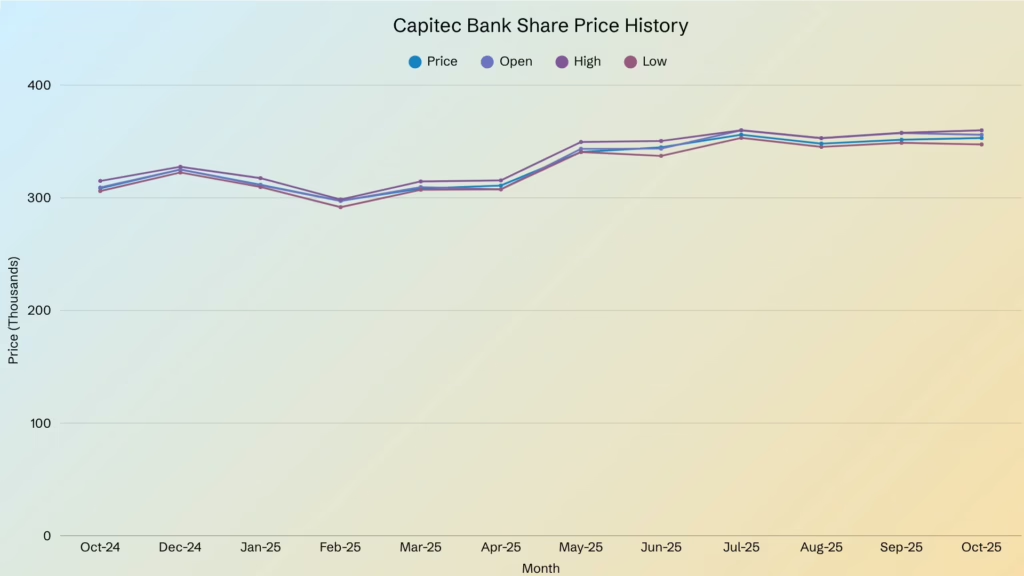

Here is the Capitec Bank share price data from October 2024 to the same month this year, according to Investing.com:

The data shows that there is an overall increase in Capitec Bank share price of approximately 14.5% in one year, from the starting price of 308,466c in October 2024 to 353,125c in October 2025.

Despite the fluctuations in the middle of the period, Capitec Bank share price closed at a higher number than its starting price, showing a moderate upward trend.

The month with the highest Capitec Bank share price was October 2025 (353,125c), while the month with the lowest was February 2025 (297,392c).

The month with the highest volatility was May 2025, with a widespread gap between its high and low of approximately 9,869.

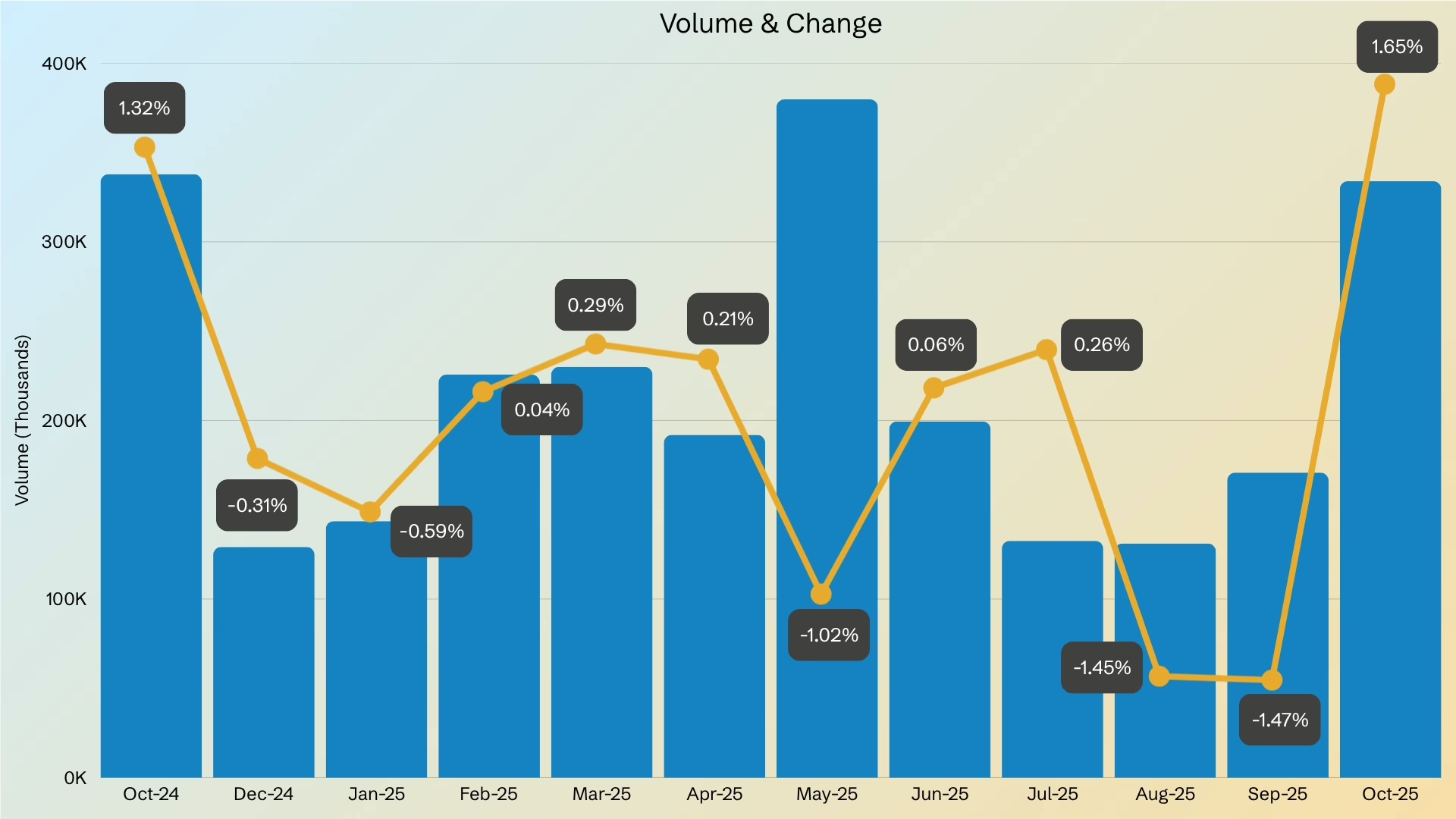

The highest volume was recorded in May 2025 at 379.77K, while the lowest volumes were observed in July and August 2025 at 132.61K and 131.03K, respectively.

Capitec Bank showed alternating gains and losses, which indicates short-term corrections within a long-term uptrend.

The biggest decline was recorded in September 2025 at -1.47%, while the highest gain was observed in October 2025 at 1.65%.

Overall, Capitec Bank shares faced small pullbacks and consolidation but remained resilient. It showed positive momentum with improving investor sentiment in Q4 2025.

Capitec Bank Share Price Forecast

Here are the forecasted revenue, earnings, earnings per share (EPS), and EPS range for the next three financial years, according to Simply Wall St.:

| Financial Year | Revenue (ZARb) | Earnings (ZARb) | EPS | EPS Range |

| 2026 | 52.089 | 16.643 | 14,515.5c | 14,275c – 14,932c |

| 2027 | 59.471 | 19.612 | 17,136.8c | 16,596.4c – 17,797.6c |

| 2028 | 67.646 | 22.788 | 19,866.9 c | 18,896.8c – 20,494.0c |

Capitec Bank Holdings Limited is expected to grow its revenue and earnings by 19.1% and 16.1% per annum, respectively.

Its EPS is forecasted to grow by 16.3% per annum. Meanwhile, its return on equity (ROE) is expected to be 30.3% in the next three years.

Capitec’s revenue and earnings are expected to show an upward trend. Its revenue and earnings are expected to increase by ZAR 28.321 billion and ZAR 7.48 billion, respectively, in the next three years.

Capitec Bank’s forecast earnings growth of 16.1% per year is above the savings rate of 9.8%. However, Capitec Bank’s earnings are expected to grow more slowly than the South African market at 18.1%.

Moreover, Capitec Bank’s forecast revenue growth of 19.1% is expected to grow faster than the South African market at 6.2% per annum. However, its revenue is forecast to grow more slowly than 20% per year.

Factors Affecting Capitec’s Growth Outlook

Capitec’s success is mainly due to these three core pillars:

Digital Transformation and Client Growth

With its 23 million active clients as of April 2025, which had an increase of ~7.4 million since 2019, Capitec has solidified its position as a leader in retail banking.

Its app is used by 12.4 million customers and has driven a 29% jump in transactional and value-added services income to ZAR 14.8 billion.

Capitec’s focus on digital technology has reduced reliance on physical branches and has attracted younger, tech-savvy customers.

Prudent Risk Management

Capitec’s tightened lending criteria and improved credit assessment tools have paid off, despite the rising credit impairments of up to 38% (ZAR 8.7 billion).

Its retail banking credit loss ratio fell to 8.3%, which is lower than the data for prior years (11%).

Capitec’s management aims to reduce the retail banking credit loss ratio further to 7% by early 2025, which is a key indicator of balance sheet strength.

3. Diversified Revenue Streams

Capitec’s non-interest income increased by 22% due to transaction fees and commissions,

The company’s insurance revenue also went up by 14%, contributing 11% of Capitec’s total income. This increase is due to Capitec expanding beyond its terminated Sanlam funeral cover partnership to launch new products like airtime advances.

You may also be asking…

How to buy shares in Capitec Bank?

Capitec is listed on the JSE. Hence, to buy Capitec bank shares, you should use a regulated online broker that trades on the JSE.

Is Capitec a buy or sell?

The daily buy/sell signal is a Strong Buy based on Capitec’s moving averages and other technical indicators.

Is Capitec Bank a good investment?

Yes, it is a good investment due to its strong earnings growth, high ROE, and diversified income streams.

It is suitable for investors who want both capital growth and dividend income. It is also ideal for those who are comfortable with some risk and volatility.

How volatile is Capitec’s share price?

Historical Capitec share price shows that Capitec’s daily price ranges can be wide, which shows the stock’s volatility. Moreover, its 52-week range is broad, suggesting long runs upward and corrections downwards.

Capitec, as a bank in South Africa, is exposed to macroeconomic shifts that amplify volatility. Hence, Capitec is not a stable stock.

Conclusion: Can Capitec Sustain Its Growth?

The Capitec Bank share price reflects the market’s confidence in one of South Africa’s strongest retail banks.

Capitec demonstrates resilience and innovation with its consistent earnings growth, digital footprint, and a diversified income stream.

Capitec’s risk management and focus on technology-driven banking services also support its sustainable long-term performance.

However, its high valuation and exposure to South Africa’s broader economic volatility suggest that future gains may be more measured.

Although short-term fluctuations are possible, Capitec’s solid fundamentals and leadership in digital banking position it to sustain growth and justify its premium share price over time.

Overall, the Capitec Bank share price outlook remains positive, supported by resilient financial results, strategic innovation, and investor confidence. However, investors should balance optimism with awareness of valuation and market risks.

If you want to keep informed about the fluctuating Capitec Bank share price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.