Octodec Investments Limited is a real estate investment trust (REIT) that is listed on the Johannesburg Stock Exchange (JSE) with the ticker “OCT.”

Here, we will analyze Octodec share price, its historical data, market outlook and prediction, and its competitors in the South African real estate market.

What is Octodec Investments Limited?

Octodec is a large real estate owner in Johannesburg and Tshwane. Its diversified portfolio includes 234 residential, office, retail, and industrial properties.

Octodec achieved its REIT status in 2013. After its establishment in 1956, it has been listed on the JSE since 1990 and on the A2X (South Africa) since 2023.

Octodec Share Price (JSE) Overview

Here are some key figures for Octodec on the JSE as of October 15, 2025, according to Investing.com:

| Metric | Value |

| Share price | 1,175c |

| 52-week high/low | High: 1,284c Low: 871c |

| Market capitalization | ZAR 3.13 billion |

| P/E ratio | 9.0× |

| Earnings per share | 130c |

| Dividend yield (%) | 11.0 |

The current share price of 1,175c is lower than the 52-week high of 1,284c, but it is still higher than the 52-week low.

The current share price is 10% below the 52-week high, suggesting a limited downside and potential upside if market sentiment improves.

Octodec’s market capitalization of ZAR 3.13 billion shows that it has a mid-market presence.

Its price-to-earnings (P/E) ratio of 9.0x, which is lower than the JSE REIT sector average of ~10x-12x, possibly reflects undervaluation or market caution about growth prospects.

Octodec’s dividend yield of 11.0% is exceptionally high, suggesting a strong income-generating investment. However, sustainability depends on the stability of the cash flow.

Now, let’s look into how Octodec share price changed year-to-year.

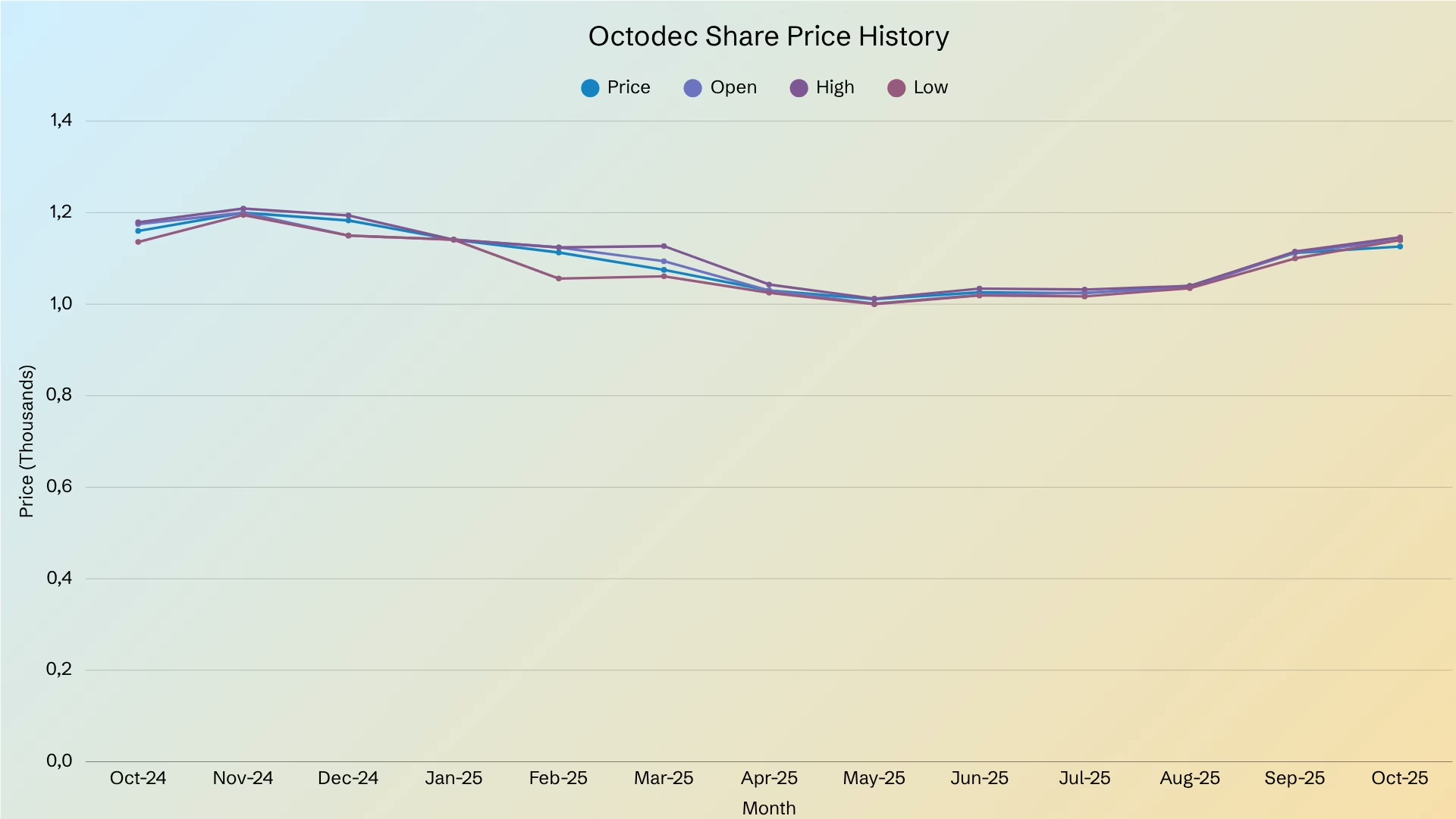

Here is the Octodec share price data from October 2024 to the same month this year, according to Investing.com:

The month with the highest Octodec share price in the period covered is November 2024 at 1,200c. Meanwhile, the lowest share price was observed in May 2025 at 1,011c.

Octodec share price dropped from 1,160c in October 2024 to 1,126c in October 2025, showing a slow downward trend despite short-term recoveries.

Overall, although Octodec share price experienced moderate downward pressure from late 2024 to early 2025, it seems to be stabilizing in the 1,100c range.

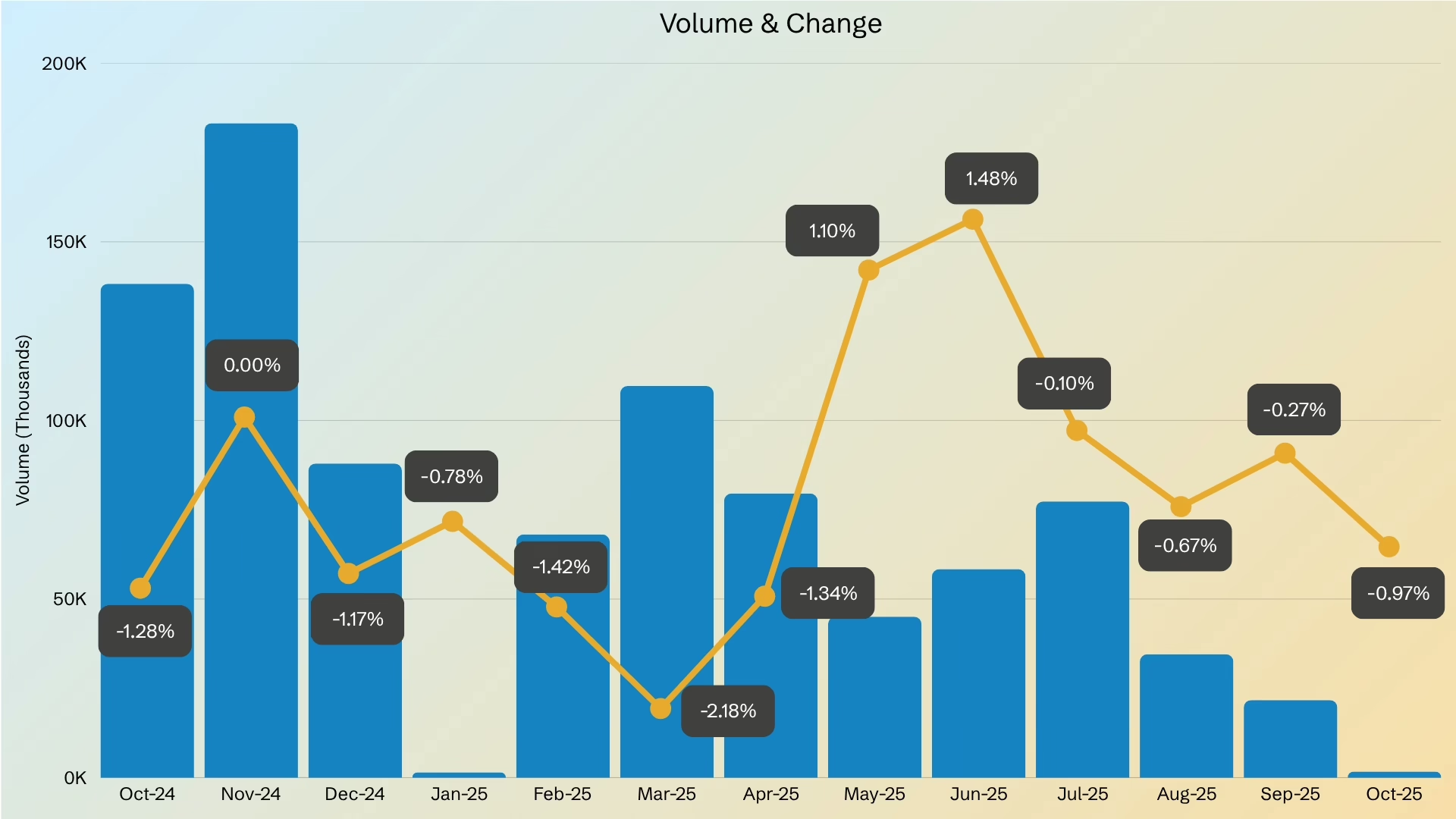

The highest volume was observed in November 2024 at 183.22K, while the lowest was noted in January 2025 at 1.49K. Meanwhile, the overall change is a –2.93% decline year-on-year.

Octodec Share Price Market Outlook and Prediction

The table below shows the 5-year Octodec share price prediction. We used October as the reference month for each year.

| Year | Opening Price (c) | Closing Price (c) | Minimum Price (c) | Maximum Price (c) | Change (%) | Earnings Growth (%) |

| 2026 | 1,249.442 | 1,243.855 | 1,239.809 | 1,251.558 | -0.45 | 7.6 |

| 2027 | 1,327.786 | 1,319.820 | 1,316.826 | 1,328.751 | -0.6 | 14.2 |

| 2028 | 1,404.538 | 1,399.897 | 1,393.380 | 1,405.809 | -0.33 | 20.9 |

| 2029 | 1,481.345 | 1,473.222 | 1,469.893 | 1,482.727 | -0.55 | 27.6 |

| 2030 | 1,559.506 | 1,554.321 | 1,553.388 | 1,559.506 | -0.33 | 34.3 |

According to Wallet Investor, the 52-week range is forecast to be 1,116.846c-1,252.243c. They also forecast the 45-day and 90-day moving averages at 1,170.501c and 1,175.469c, respectively.

The forecast shows small annual price declines from -0.3% to -0.6%, which suggests a stable but range-bound share price.

Despite the small annual declines, the overall share price trend shows a gradual upward trend from the closing price of 1,243.855c in 2026 to 1,554.321c in 2030.

This trend indicates long-term resilience and possibly reflects long-term property value growth and dividend investment effects.

The forecast shows that there would be slight declines in 2026 and 2027 due to post-interest rate normalization and the slow recovery of the property sector in South Africa.

However, analysts expect that the Octodec share price will stabilize by 2028. By 2029 and 2030, the share price would reach 1,550c, which suggests renewed investor confidence and steady dividend-driven results.

Octodec share price forecast shows minimal annual fluctuations, making it ideal for income-focused investors who prioritize stability over rapid capital gains.

The forecast data shows that from 2026 to 2030, the Octodec share price is expected to remain stable with marginal annual declines but long-term resilience.

Although its growth potential is limited, Octodec has consistent dividend payouts and steady income streams. The gap between the minimum and maximum Octodec share prices also remains narrow (~1%), making Octodec a defensive REIT investment.

The core strength of Octodec is its earnings growth, which analysts forecast to be 7.6% in 2026 to a projected 34.3% in 2030, showing that Octodec is expected to accelerate significantly in 5 years.

Overall, the Octodec share price is forecasted to remain stable over the 5-year period, with limited short-term volatility and minimal downside risk.

However, the earnings growth trend is decisively positive, which suggests that operational performance and income generation will strengthen sharply.

The fact that earnings growth outpaces Octodec share price movement may indicate possible undervaluation.

Octodec Share Price vs Competitors

Are you wondering, how does Octodec compare to other REITs?

Here is a table showing Octodec’s competitors, their share prices, market capitalization, earnings per share (EPS), P/E ratios, and dividend yields:

| Name | Price (c) | Market Cap (Adjusted) | EPS (c) | P/E Ratio | Dividend Yield (%) |

| Octodec Investments Ltd. | 1,175 | 3.13 B | 130 | 9.0x | 11.0 |

| Newpark REIT Ltd | 480 | 0.480 B | 50 | 9.7x | 11.5 |

| Oasis Crescent Property Fund | 2,051 | 1.332 B | 206 | 9.7x | 5.8 |

| Spear REIT Ltd | 1,115 | 3.569 B | 183 | 6.9x | 7.3 |

| Heriot Reit Ltd | 1,600 | 5.108 B | 432 | 3.7x | 7.9 |

| Emira Property Fund | 1,300 | 6.202 B | 493 | 2.6x | 9.6 |

| Burstone Group Ltd | 847 | 6.697 B | -280 | -3.0x | 10.9 |

| SA Corporate Real Estate Fund Managers Ltd | 330 | 8.705 B | 25 | 14.2x | 7.8 |

| Attacq | 1,446 | 9.958 B | 215 | 6.6x | 6.1 |

| Fairvest Ltd | 1,825 | 10.918 B | 67 | 10.4x | 7.7 |

| Redefine Properties Ltd | 530 | 35.518 B | 64 | 8.2x | 3.9 |

Octodec share price is at a moderate price level compared to its competitors. It is more affordable than large REITs like Fairvest or Redefine but more expensive than smaller REITs like Newpark.

Octodec’s market capitalization of ZAR 3.13 billion is below that of Redefine (ZAR 35 billion) and Fairvest (ZAR 10.9 billion), ranking it among mid-tier REITs.

In terms of EPS, Octodec’s EPS is higher than those of Newpark (50c) and SA Corporate (25c) but lower than those of Heriot (432c) and Emira (493c).

Octodec’s P/E ratio of 9.0x is below the sector average (~9.5x to 10x), which implies slight undervaluation.

In terms of dividend yield, Octodec has a top-tier yield at 11.0%, alongside Newpark (11.5%) and Burstone (10.9%). This reinforces Octodec’s reputation as a dividend-driven REIT that is ideal for income-focused investors.

Overall, Octodec Investments Limited stands out as a high-yield and value-oriented REIT in the South African property sector.

You may also be asking…

Is Octodec a good investment?

Yes, it is a good investment considering its upward share price forecast and its exceptional earnings growth in the next 5 years.

Who are Octodec’s main competitors?

Octodec’s main competitors include Newpark REIT Ltd., Oasis Crescent Property Fund, Spear REIT Ltd., Heriot Reit Ltd., Emira Property Fund, Burstone Group Ltd., SA Corporate Real Estate Fund Managers Ltd., Attacq, Fairvest Ltd., and Redefine Properties Ltd.

What is Octodec’s dividend yield?

Octodec’s current divident yield is 11.0%.

Conclusion: Should You Add Octodec to Your Portfolio?

According to the current data, Octodec shares and their market environment have been showing resilience for the past 12 months.

Forecasts show that there will be a positive trend in the future. This shows that Octodec may be a good investment due to the positive market outlook.

With a strong dividend yield (11.0%) and a possible undervaluation due to a low P/E ratio (9.0×), Octodec share price may experience an upward momentum.

Hence, it may be an attractive option. However, make sure to evaluate the current market conditions and price stability before buying.

To keep informed about the fluctuating Octodec share price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.