The Shoprite Group is the largest and fastest-moving consumer goods retailer in Africa. Its core business is in food retailing and is complemented by pharmaceuticals, furniture, hospitality, digital commerce, ticketing, and financial and cellular services.

Here, let’s discuss Shoprite share price, historical data, and the key factors that drive its movement.

Overview of Shoprite

As the group’s original and flagship brand, Shoprite is a full-service supermarket, a one-stop shop for all the needs of the customers, such as bills payment, government grant payouts, and monthly prescription medication collection.

Established in 1979, Shoprite started with the purchase of an eight-store grocery chain. In 1983, the Shoprite Group opened its first branch outside the Western Cape, that is in Hartswater in the Northern Cape.

It then expanded into Africa in 1990 with the opening of its first non-RSA supermarket in Namibia.

Currently, the Shoprite Group has 1,068 corporate and 275 franchise outlets in 17 countries across Africa. It comprises the following divisions:

- Shoprite Checkers supermarket group: consists of 380 Shoprite supermarkets, 132 Checkers supermarkets, 24 Checkers Hypers, 148 Usave stores, 20 distribution centers supplying group stores with groceries, 199 OK Furniture outlets, 14 OK Power Express stores, 46 House & Home stores, and 125 Hungry Lion fast food outlets.

- OK Franchise division: procures and distributes stock to 26 OK MiniMark convenience stores, 24 OK Foods supermarkets, 75 OK Grocer stores, 43 Megasave wholesale stores, 26 OK Value stores, and 81 Sentra stores and buying partners.

Shoprite Share Price Overview

Here are some key figures for ShopRite on the Johannesburg Stock Exchange (JSE) as of October 10, 2025, according to Investing.com:

| Metric | Value |

| Share price | 27,987c |

| 52-week high/low | High: 31,569c Low: 23,421c |

| Market capitalization | ZAR 151.3 billion |

| P/E ratio | 20.5× |

| Earnings per share | 1366c |

| Dividend yield | 2.8 |

The current Shoprite share price (27,987c) is higher than the 52-week low, which means it has gained from its lows.

Shoprite has been growing earnings at an annual rate of 11.73%, which is the same as the market earnings growth. EPS has grown by 12.09% annually.

Its revenue has been growing at an average rate of 10.8% per annum. Moreover, its return on equity (ROE) is 24.5%, and its net margin is 2.9%.

Shoprite Share Price Historical Data

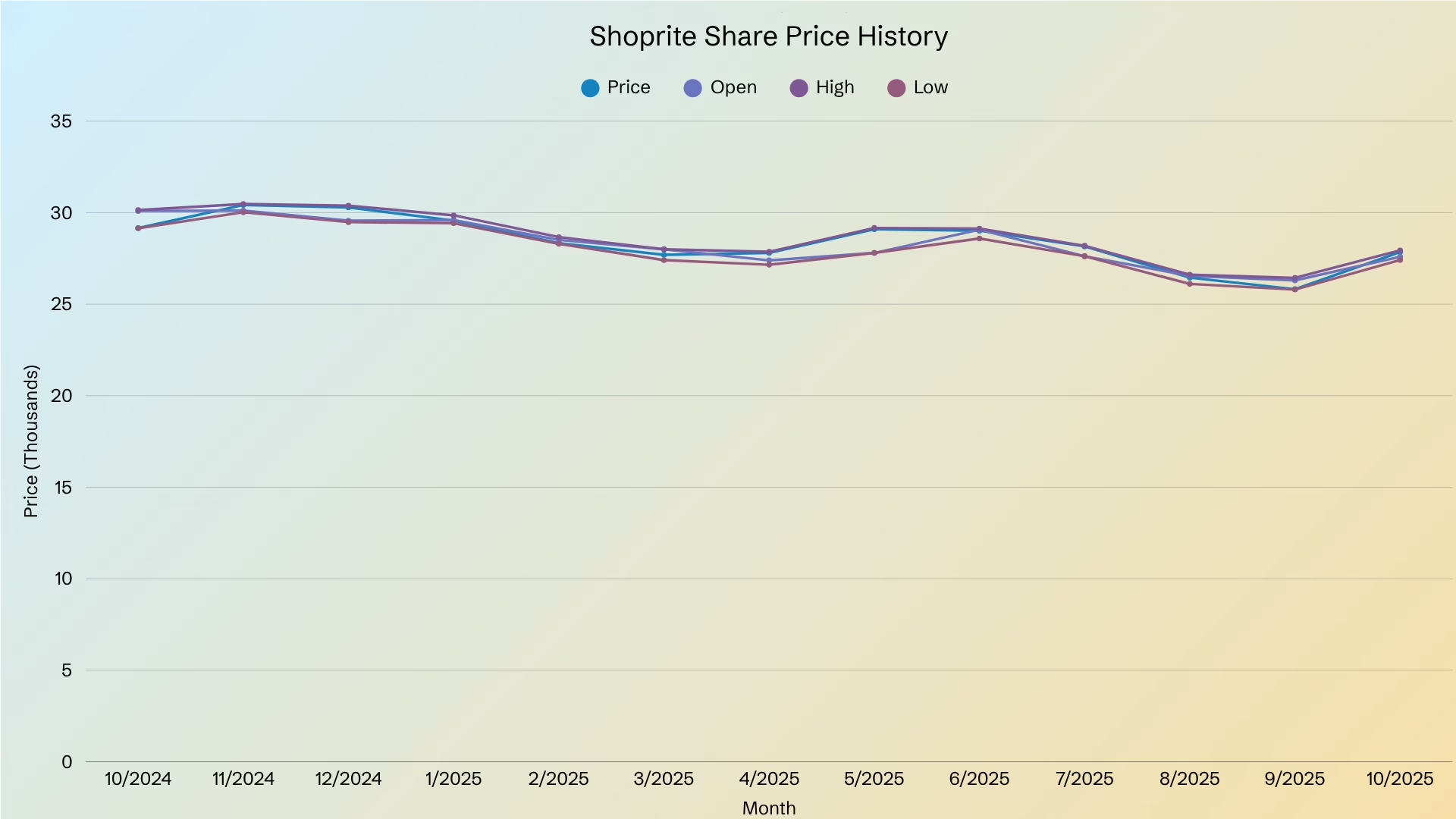

The graph below shows the historical Shoprite share price data from October 2024 to October 2025:

The lowest share price was observed in September 2025 at 25,820c, while the highest share price was observed in November 2024 at 30,288c.

The share price fell from 29,159 in October 2024 to 27,850c in October 2025, showing an annual net decline of ~4.5%.

Overall, the trend shows alternating gains and losses, with no clear long-term direction.

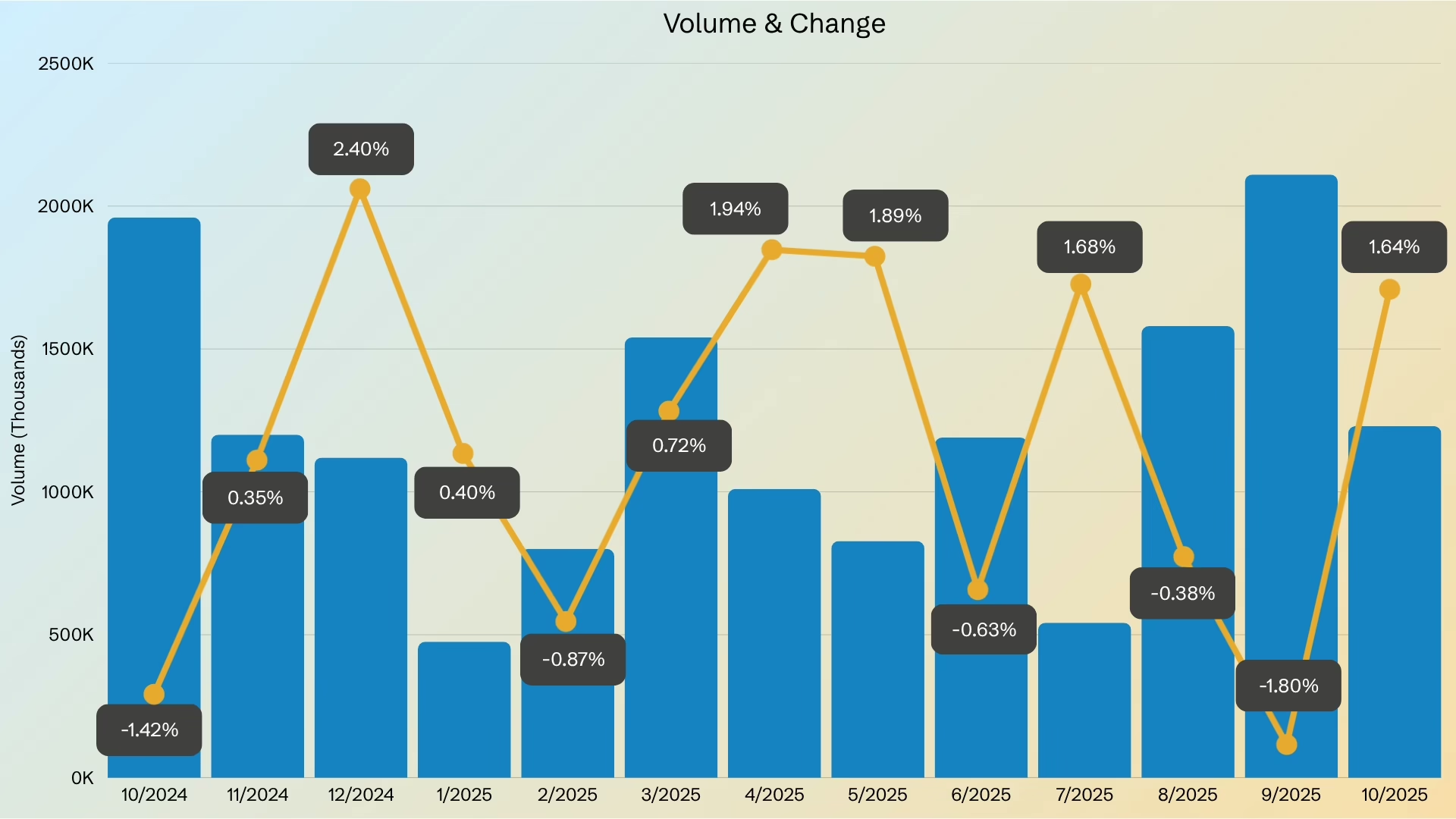

In terms of trading volume, the highest trading volume was observed in October 2024 at 1.96M, indicating strong sell-off activity after Q3 results or portfolio rotations.

Meanwhile, the lowest activity was observed in January and July 2025 at 475K and 542K, respectively.

Volume spikes were observed in March and September 2025 at 1.54M and 2.11M, respectively. These volume spikes usually precede or accompany price reversals.

For example, the volume spike in March 2024 preceded the strong rally in the April-May rally. In addition, the volume spike in September 2025 coincided with the lowest share price in a 12-month period and a change of -1.80%.

Key Factors Behind Shoprite Share Price Movement

Here are the key factors behind the movement of the Shoprite share price:

Load Shedding

One of the major challenges faced by Shoprite is load shedding. Load shedding involves a series of widespread power cuts across the entire grid to reduce the overall load and preserve critical equipment.

In the 2023 financial year, Shoprite spent ZAR 1.3 billion on diesel to power generators for its stores across South Africa.

Meanwhile, in the 2024 financial year, Shoprite spent ZAR 754 million, which is a remarkable improvement from the diesel expenses for the previous financial year.

In their recent F2025 report, Shoprite decreased its diesel costs to ZAR 335 million.

Consumer Spending Trends

One of the factors that affects the movement in Shoprite share price is consumer spending trends.

For example, Shoprite’s half-year sales in F2024/25 grew by 9.6%. They attribute this growth to the upmarket and discount customers stocking up on food during the festive season.

In their F2025 report, Shoprite reported a 15.8% increase in full-year earnings, which they attribute to consumers stocking up on food during the festive and Easter seasons.

Shoprite Share Price Investment Outlook

Here is the forecasted revenue and EPS for Shoprite for the next 3 years:

| Metrics | F2026 | F2027 | F2028 |

| Revenue (ZARb) | 276.944 | 302.202 | 327.645 |

| EPS | 15,966c | 17,839c | 19,659c |

| EPS Range | 15,927c – 16,004c | 17,827c – 17,851c | 19,640c – 19,678c |

Analysts from Simply Wall St. forecast that the revenue will grow at 8.6% per annum. They also forecast that EPS will grow by 11.8% per annum.

Moreover, Shoprite’s revenue is expected to grow faster than the ZA market (6.3% per annum). Analysts also forecast that Shoprite’s ROE for the next 3 years will be 26.7%, which is higher than the market at 24.0%.

Frequently Asked Questions

How Much is a Shoprite Share Today?

The Shoprite Holdings Ltd share price today is 27,987c.

Is Shoprite a Good Investment?

Yes, ShopRite is a good long-term investment due to its strong fundamentals, consistent demand for consumer staples, and resilience despite challenges like load shedding and inflation.

While the share price decreased by about 4%–5% over the past year, its recent recovery and steady trading volumes suggest renewed investor confidence and growth potential.

Can I Buy Shoprite Shares?

Yes, it is listed on the JSE with the ticker SHP. It also has secondary listings on the stock exchanges of A2X, Zambia, and Namibia.

The Bottomline

The Shoprite share price trend reflects the company’s ability to navigate South Africa’s challenging economic environment while maintaining steady growth.

Although the Shoprite share price in rands showed a 4.5% decline from October 2024 to October 2025, the company has consistent earnings growth, a strong ROE, and expanding revenue.

With revenue and EPS forecasted to grow steadily over the next three years, analysts remain optimistic about its medium- to long-term performance.

Overall, Shoprite remains a solid investment choice for investors who are looking for defensive exposure in the retail sector.

To get more in-depth reviews, join the CommuniTrade community today. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.