The growing number of people eyeing Clicks Ltd. as a potential addition to their investment portfolios underscores its role as a major player in South Africa’s pharmaceutical and retail industry. This guide offers a deep dive into Clicks’ expert forecasts, historical price movements, and current valuation.

Clicks Company Overview

Clicks Group Limited, together with its subsidiaries, operates as a beauty, health, and wellness retailer both in South Africa and internationally. It is listed on the Johannesburg Stock Exchange (JSE) under the ticker CLS and is headquartered in Cape Town. It runs a wide network of retail outlets, including:

- The Body Shop

- Clicks

- GNC

- Sorbet

As of 2025, Clicks operates 720 pharmacies and 936 retail stores, with medium-term plans to reach 1,200 outlets. According to MoneyWeb, Clicks had a jump in headline earnings of 14.3% from the year-end of August 31, 2024, alongside a 9.2% rise in annual turnover, bringing the revenue to R45.4 billion.

Got other stocks you’re watching? Join us at Traders United’s CommuniTrade today to explore insights like this. You’ll get regular access to expert price analysis and insights on top-performing companies, helping you stay ahead in the market

Clicks Share Price Analysis

| Key Financials | |

| Market capitalization | 82,533,993,880 |

| Price/NAV | 13.13 |

| EPS-TTM | 1263.68 |

| Dividend yield | 2.28 % |

| Authorized shares | 600,000,000 |

| Issued shares | 234,898,662 |

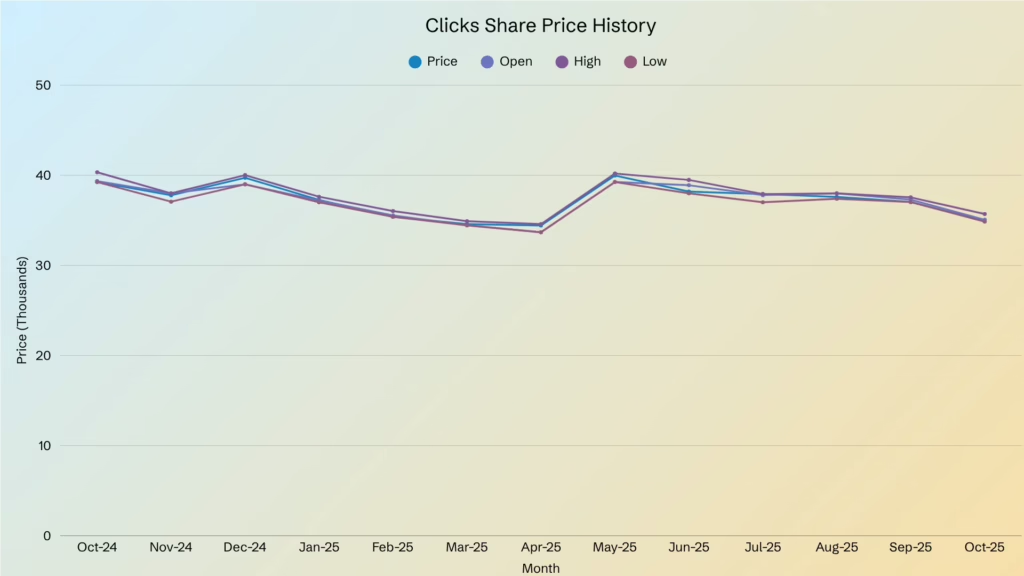

The stock. has shown a volatile performance, the Clicks share price fluctuating between R335 and R410. Its price point was initially at R380 in late 2024 before it climbed above R400 in December and then rose once more in May 2025, but was afterwards followed by some sharp pullbacks. Its lowest dip was in March 2025, when it went down to nearly R335, followed by another decline toward R350 in September 2025.

The stock is currently trending downward, making short-term trading risky and better suited for long-term investors. Meanwhile, in the medium term, Clicks demonstrated resilience through repeated rebounds. Its key resistance level rests between R400 and R410, which the stock has yet to break, suggesting a period of consolidation. Meanwhile, R400 serves as a potential profit-taking zone for investors.

From a long-term perspective, dips in the R340 and R350 range can be viewed as buying opportunities, provided the company maintains its strong fundamentals.

Historical Clicks Share Price Trends

The historical data for Clicks Ltd., covering October 1, 2024, to October 2, 2025, is sourced from Investing.com.

The overall trend reflects volatility, with a slight downward trajectory from October 2024 to October 2025. The share price peaked in May 2025 but gradually weakened in the succeeding months.

Intra-month volatility remained relatively low, as shown in the narrow differences between opening, high, low, and closing prices.

A sharp rebound occurred in April and May 2025, which resulted in a more stable share price before losing momentum.

Performance has weakened even further from July to October 2025, with steady declines pointing to a bearish market trend. Additionally, the tightly clustered closing, opening, high, and low prices suggest persistent weakness.

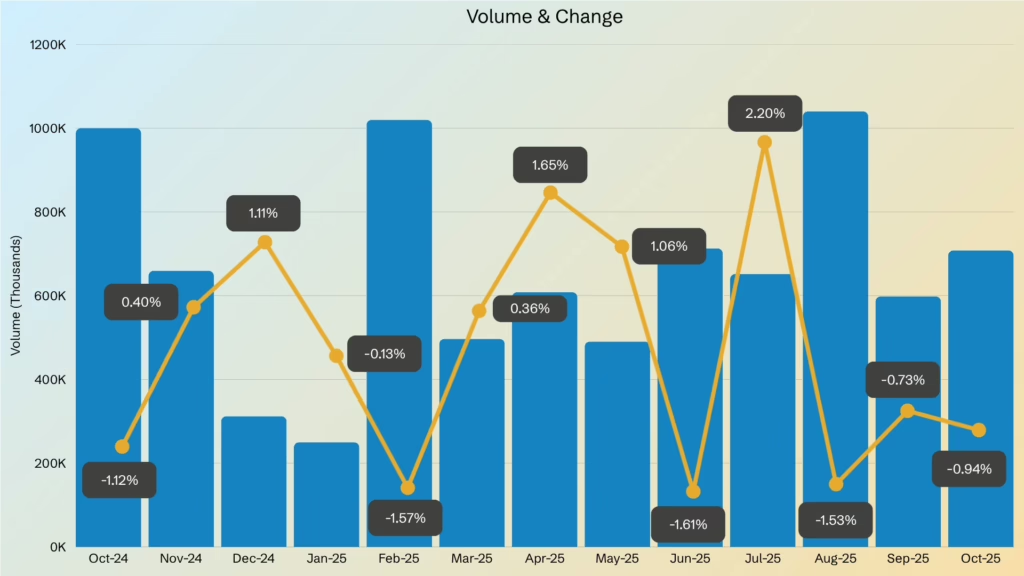

The volume and change chart show heightened periods of volatility. Noticeable dips took place in February and June 2025, with returns falling between -1.61% and -1.57%. This was strongly followed by strong rebounds, which shows the resilience of trading activity and investor sentiment. The sharpest gain recorded was in July 205 at 2.20%.

The strongest upward movements were seen in December 2024, April, May, and July 2025. But from August 2025 onwards, the trend started to shift downwards, with losses ranging from -1.53% to -0.94%, which suggested a period of profit-taking.

Overall, the chart reflects a short-term trading environment where investors can see opportunities from buying after sharp pullbacks and selling into rebounds.

Clicks Share Price Forecast

| 2026 | 2027 | |

| Revenue | 53.660 | 58.570 |

| Earnings | 3.603 | 4.114 |

| EPS | 15.26 | 17.22 |

The forecast shows growth in the Clicks share price over the next two years. Revenue is expected to rise by approximately 9% while the projected earnings are expected to increase by 14%.

Furthermore, the EPS (earnings per share) is also set to grow by nearly 13%, reflecting both stronger profitability and improved operational efficiency. These projections suggest that Clicks is on a healthy upward trajectory, positioning the stock to deliver stronger returns in the future.

Frequently Asked Questions (FAQs)

To help investors like yourself make informed decisions, we’ve compiled some of the frequently asked questions, along with expert-backed answers provided by our analysts.

What is the current Clicks share price?

As of the latest update, the Clicks share price stands at R354.

What are the 52-week high and low for Clicks shares?

Over the past 52 weeks, Clicks has traded between a high of R405.39 and a low of R313.82.

Does Clicks pay dividends, and what is the yield?

Yes. Clicks pays dividends on a semi-annual basis, with a current dividend yield of approximately 2.3%.

What is the Price-to-Earnings (P/E) ratio of Clicks?

Clicks’ P/E ratio is currently in the range of 28.3× to 29×, reflecting its premium valuation relative to earnings.

Is Clicks considered a good long-term investment?

Yes. Despite the downward trajectory in the 1-year performance chart above, Clicks remains a strong candidate for long-term investments, as it operates in a non-discretionary industry. Thus, it benefits from consistent demand even during periods of economic weakness. Additionally, its dominant market position, supported by its ClubCard loyalty program, gives it power and resilience against competitors.

Clicks also has a proven track record of delivering reliable dividends, making it attractive for long-term investors looking for income stability and growth potential.

Long-term investors may see the price dip as a buying opportunity given the company’s solid fundamentals and ability to sustain growth in the healthcare retail market.

Final Verdict

Clicks share price has trended lower over the past year, yet the group continues to hold its ground as one of South Africa’s most established names in healthcare and retail pharmacy. Backed by steady dividend payouts, rising revenues, ongoing store expansion, and consistent earnings growth, the company’s fundamentals still suggest meaningful long-term value for investors.

Overall, Clicks still stands out as a reliable JSE-listed stock, balancing growth potential and stability.

Join Traders United’s CommuniTrade today to stay on top of stock insights like this. You’ll gain access to expert analysis of the performance of leading companies so you can invest with confidence.