Italtile, listed on the Johannesburg Stock Exchange (JSE) with the ticker “ITE,” is a group of companies focusing on manufacturing, franchising, and retail of tiles and other home-finishing products.

Its share price is a key indicator for investors interested in South Africa’s retail and construction-linked sectors.

This article provides a comprehensive look at the current Italtile share price, its recent performance and history, analysts’ forecast, and whether it is an attractive investment.

Italtile Company Overview

Founded in 1969, Italtile is a South African manufacturer, franchisor, and retailer of tiles, bathroomware, and other related products.

It operates through various segments, such as retail, supply and support services, franchising, manufacturing, and properties.

Italtile’s manufacturers are Ceramic Industries, which has seven factories in South Africa and one in Australia, and Ezee Tile, which has six factories in South Africa and three in the rest of Africa.

Current Italtile Share Price Analysis

Here are some key figures for Italtile on JSE as of September 29, 2025, according to Investing.com:

| Metric | Value |

| Share price | 937c |

| 52-week high/low | High: 904c Low: 1,480c |

| Market capitalization | ZAR 11.15 billion |

| P/E ratio | 7.5× |

| Earnings per share | 126c |

| Dividend yield (%) | 15.8 |

The current Italtile share price of 937c is lower than the previous close price on September 25, 2025, of 963c. The drop of 2.7% likely reflects negative sentiment or some market/sector headwinds.

The current Italtile share price is close to the bottom of the 52-week range, suggesting that the stock is under pressure.

According to the data from Simply Wall St., Italtile’s P/E ratio of 7.5x is good compared to the peer average of 9x.

Italtile’s earnings per share (EPS) of 126c shows that it earned 126 per share, which indicates limited EPS.

JSE:ITE’s dividend yield of 15.8% is higher than the bottom 25% of dividend payers in the ZA market (3.26%).

It is also in the top 25% of dividend payers in the ZA market (8.4%). Hence, Italtile offers strong income, which is attractive to income-oriented investors.

Historical Italtile Share Price Trends

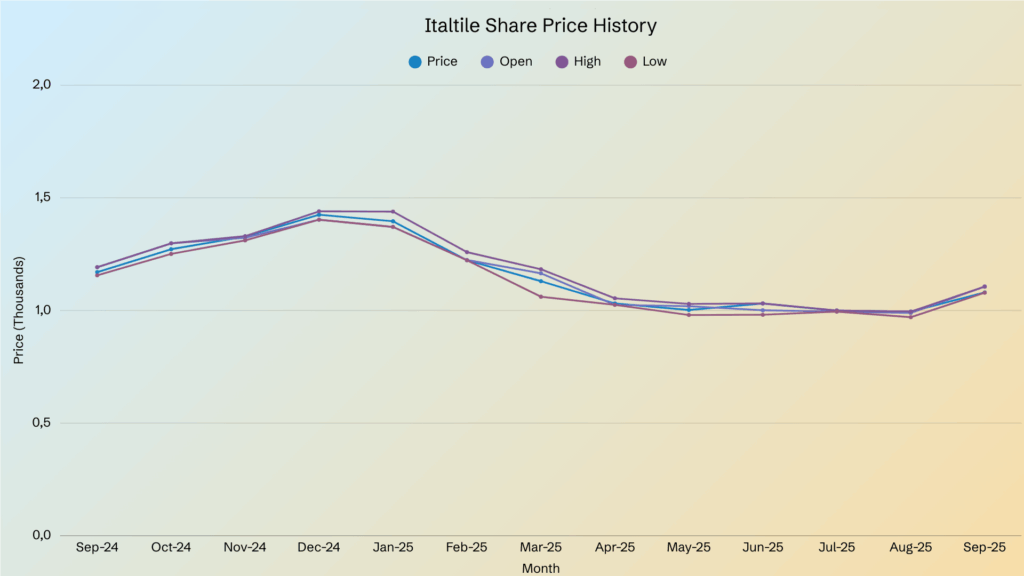

Here is the Italtile share price data from September 2024 to the same month this year, according to Investing.com:

The overall change from the starting price to the ending price was -7.7%, showing a downward trend in share price.

The months with the highest and lowest share price were January 2025 at 1,425c and August 2025 at 995c, respectively. The stock rebounded slightly in September 2025 at 1,080c.

The data shows a narrow day range, with a 20c to 30c difference between the day range. The exception was March 2025 with the high of 1,183c and low of 1,061c, showing a difference of 122c.

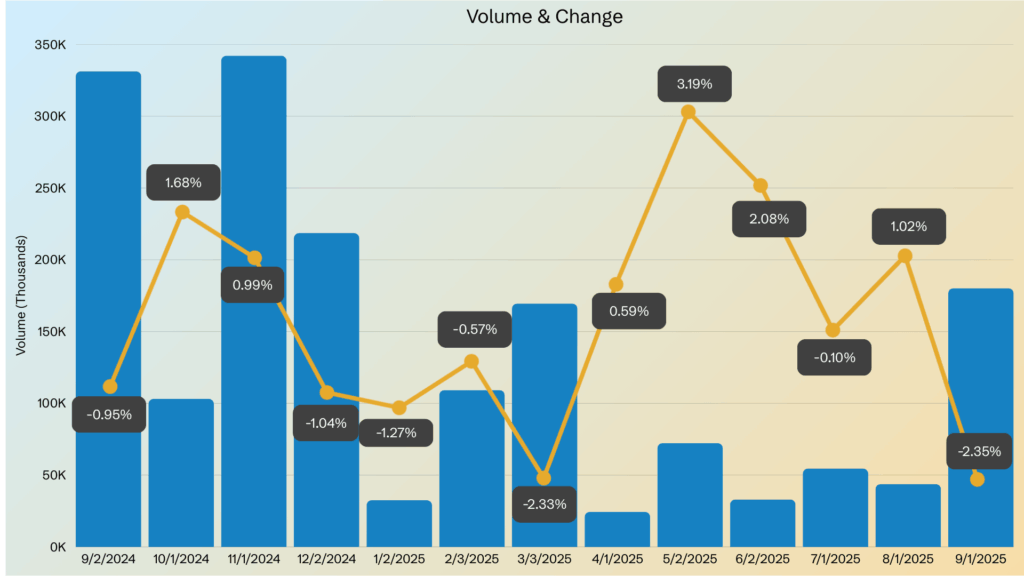

The highest and lowest volumes were observed in September 2024 at 331.31K and June 2025 at 33.01K, respectively.

The strongest gains were observed in May and June 2025 at 3.19% and 2.08%, respectively.

Meanwhile, the worst drops were observed in March and September 2025 at -2.33% and -2.35%, respectively.

The sharp drop in March 2025 and weak recovery show investors’ lack of confidence in the first half of 2025.

Overall, Italtile share price shows weakness with intermittent rebounds. The current share price is closer to the 52-week low than its high, showing bearish sentiment.

Italtile Share Price Forecast

Here is the Italtile share price forecast in the next 3 years:

| 2026 | 2027 | 2028 | |

| Revenue (ZARb) | 9.108 | 11.150 | 9.959 |

| Earnings (ZARb) | 1.514 | 1.654 | 1.677 |

| EPS | 1,270c | 1,350c | 1,410c |

Analysts forecast that Italtile will grow its earnings and revenue by 4.4% and 6.6% per annum, respectively.

Italtile’s forecasted revenue in 2026 is ZAR 9.108 billion. It is expected to increase to ZAR 11.150 billion in 2027. However, it is expected to drop to ZAR 9.959 billion in 2028.

Italtile’s revenue is expected to grow faster than the ZA market (6.6% vs 5.7% per annum).

On the other hand, Italtile’s earnings are expected to have a steady growth for three years.

Italtile’s earnings are expected to grow more slowly than the ZA market (4.4% vs 17.3% per year).

They also forecast that the return on equity will be 18.1% in 3 years.

Frequently Asked Questions (FAQs)

What is the current Italtile share price on the JSE?

The current Italtile share price on the JSE is 937c.

How does the Italtile share price compare to Pan African Resources’ share price?

The current share price of Pan African Resources PLC (JSE:PAN) is 2,083c, which is higher than the current Italtile share price of 937c.

What is the Mondi share price compared to Italtile’s?

The current share price of Mondi PLC (JSE:MNP) is 23,588c, which is much higher than the current Italtile share price of 937c.

What is the MTN share price compared to Italtile’s?

The current share price of MTN Group Ltd (JSE:MTN) is 13,784c, which is much higher than the current Italtile share price of 937c.

How does Italtile compare to Purple’s share price performance?

The current share price of Purple Capital Ltd (JSE:PPE) is 274c, which is lower than the current Italtile share price of 937c.

Conclusion: Is Italtile a Good Buy in 2025?

Italtile’s fundamentals remain solid, supported by its established retail and manufacturing base, operational efficiency, and a dividend yield of 15.8%, which is above the ZA market average.

While analyst forecasts point to steady revenue and earnings growth in the medium term, Italtile’s earnings are projected to grow more slowly than the broader market, which may limit capital appreciation.

Therefore, Italtile may be worth considering for income-oriented investors. However, growth-oriented investors may want to weigh the slower earnings outlook against alternative opportunities on the JSE.

If you want to keep informed about the fluctuating JSE:ITE share price, CommuniTrade is a space where verified traders share information about trading topics. Get access to insightful tips, financial mentor advice, and more exclusive perks that await.

[Join CommuniTrade Today]: https://tradersunited.org/register