Johannesburg is widely known as Africa’s financial and business epicenter. It’s highly influential in the economic sphere since it is home to Africa’s largest stock exchange: the Johannesburg Stock Exchange (JSE), the largest stock exchange on the continent. Its banking sector also takes Johannesburg’s economic strength up a notch, with companies in Johannesburg like Africa’s “Big Four” banks all headquartered in Johannesburg, namely: Standard Bank, Absa, Nedbank, and FirstRand. Aside from dominating the local market, these banks also greatly contribute to the shaping of financial trends across the region.

Why Does Johannesburg Excel in the Investment Sphere?

Investopedia listed South Africa as one of the emerging markets in the economy, meaning it offers a wealth of opportunities across multiple sectors. As an emerging market, South Africa has a propensity for rapid GDP (Gross Domestic Product) growth compared to more mature markets. Much of this growth is driven by companies in Johannesburg, which stand at the heart of the country’s business activity.

Where Growth Is Happening

In the past few years, Johannesburg has experienced significant expansion in multiple sectors. Below are some of the top-performing sectors in Johannesburg in 2025.

- Financial and Business Services

- Renewable Energy and Energy Infrastructure

- Transportation and Logistics

- Tourism and Hospitality

- Agro-Processing and Food Tech

Join the conversation and help others discover smart ways to grow their money, only here at Traders United’s CommuniTrade.

Booming Companies in Johannesburg

We decided to use the Johannesburg Stock Exchange (JSE) as our primary reference to identify high-value companies in Johannesburg that we’ll be analyzing for investment opportunities. One of Africa’s most trusted benchmarks, the JSE lists high-performing companies based on market capitalization, financial performance, and investor confidence.

With the JSE as a reference point, we will feature companies in Johannesburg that meet rigorous standards in terms of financial growth performance and governance, making them strong candidates for investors looking for stability and long-term returns.

1. Prosus N.V.

| Key Financials | |

| Market capitalization | 2,756,724,752,357 |

| Price/NAV | 2.82 |

| EPS-TTM | 4702.92 |

| Dividend yield | 0.17 % |

| Authorized shares | 5,000,000,000 |

| Issued shares | 2,378,947,836 |

Prosus operates in the Software & IT Services industry, specifically in the Software and Computer Services sector. Although originally founded in the Netherlands, it maintains strong ties in South Africa through its parent company, Naspers Ltd. Considered the world’s largest technology investor, Prosus focuses on building and scaling e-commerce ecosystems.

The company operates in several key areas such as:

- Food delivery

- Payment & Fintech

- Ventures

- Classifieds

Prosus also holds significant stakes in Tencent, one of China’s most profitable and largest tech companies.

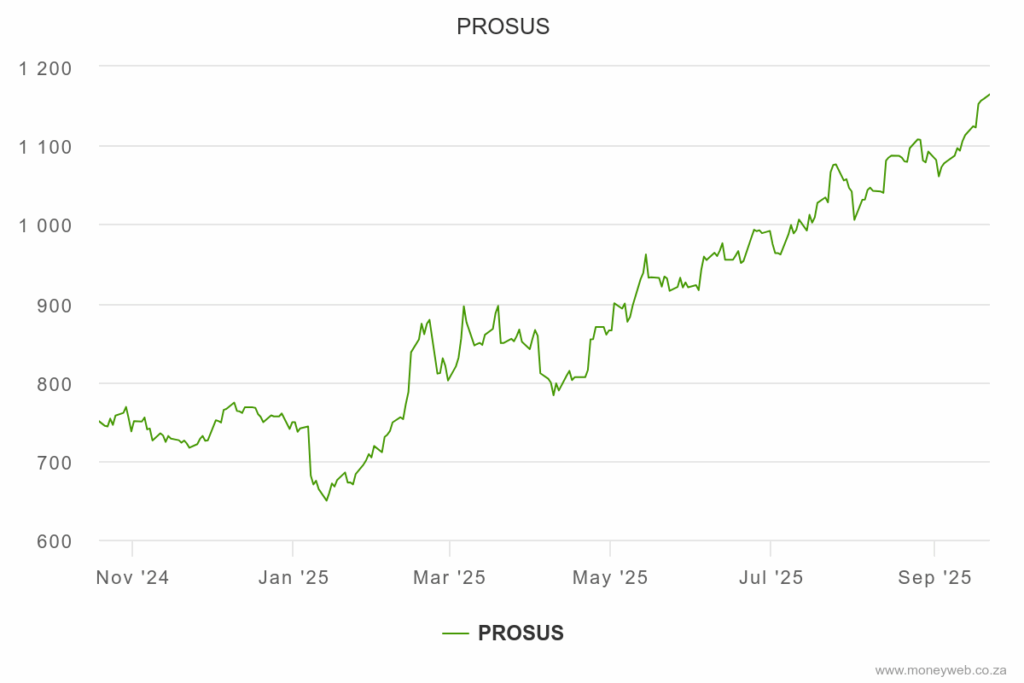

Chart Insights

The chart shows strong upward momentum, with a 66.9% increase over the past year and a 54.7% rise year-to-date. This steady climb and sharp recovery reflect a growing investor confidence, strongly driven by Prosus’ exposure to high-growth sectors like fintech, e-commerce, and technology. Additionally, Prosus holds a strategic stake in Tencent, which strengthens investor appeal.

2. British American Tobacco p.l.c.

| Key Financials | |

| Market capitalization | 2,120,606,926,365 |

| Price/NAV | 1.82 |

| EPS-TTM | 2698.87 |

| Dividend yield | 6.24 % |

| Authorized shares | 2,858,265,349 |

| Issued shares | 2,328,801,808 |

British American Tobacco (BAT) operates in the Tobacco industry, specifically in the Consumer Staples sector. It was founded in London back in 1902, operating globally in more than 180 countries.

One of the world’s largest nicotine and tobacco companies, it’s among the biggest consumer stocks available to investors. BAT has a stable presence in the JSE, with its high-dividend yields, making it an attractive investment option.

BAT operates in several key areas, including:

- Combustible Tobacco

- Reduced-Risk Products (RRP)

- Cannabis

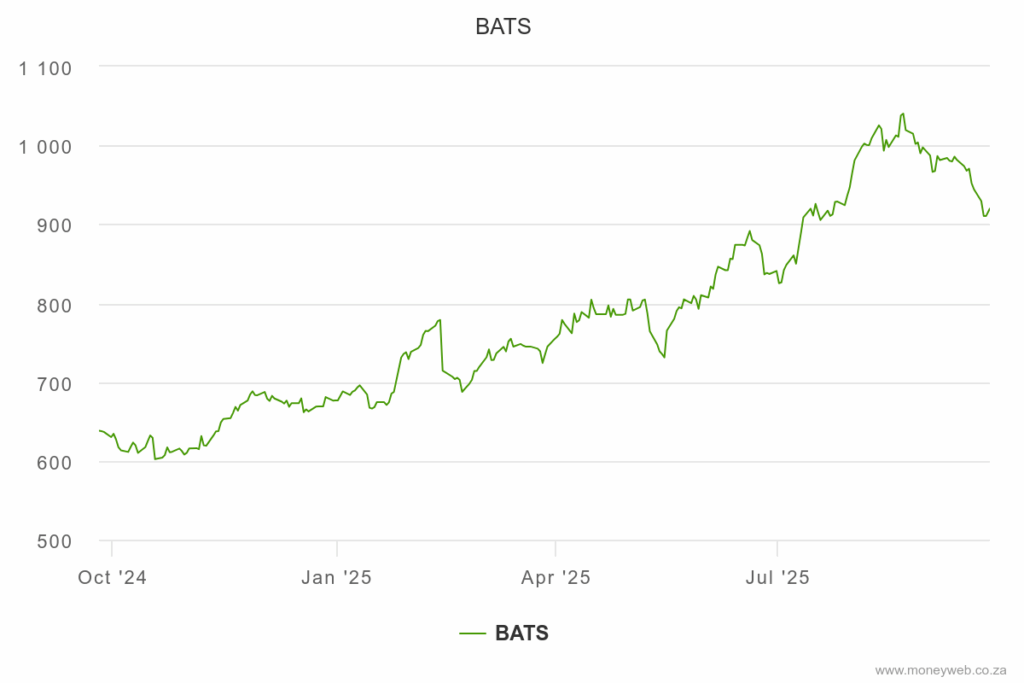

Chart Insights

BATS shows a significant upward trajectory over the year, moving from R620 toward the close of 2024, peaking at over R1,050 by mid-2025, with a slight correction by September 2025 at the R900 range. This 40–50% year-on-year reflects strong investor confidence.

BATS has a strong global footprint, dividend yield, and growth in RRPs, and serves as a high-value stock option for income-focused and defensive investors.

3. Compagnie Financière Richemont SA

| Key Financials | |

| Market capitalization | 1,742,072,390,151 |

| Price/NAV | 3.80 |

| EPS-TTM | 13056.29 |

| Dividend yield | 2.03 % |

| Authorized shares | 0 |

| Issued shares | 537,582,089 |

Compagnie Financière Richemont SA, better known as Richmonte, is a leading player in luxury globally. Johann Rupert, a South African businessman, founded the firm back in 1988, and the Rupert family remains an influential part of the business to this day.

Richemont is a globally diversified business model, with a strong presence in the Asia Pacific, Europe, and the Americas. South Africa, meanwhile, serves as a historical base. As a dual-listed company, it is listed both on the JSE and the SIX Swiss Exchange. As such, it helps South Africans get tied into international luxury brands, offering them diversification outside of local stocks.

Richmont’s main business areas include:

- Fashion & Accessories

- Online Distributors

- Jewellery Maisons

- Specialist Watchmakers

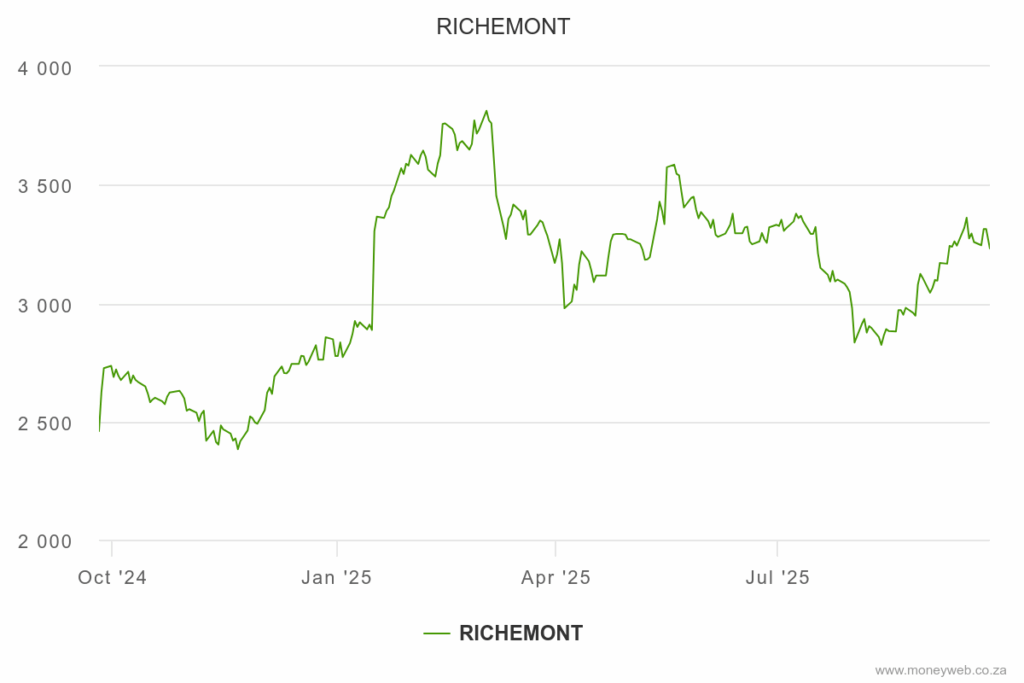

Chart Insights

According to this 1-year stock performance chart, the share price started a bit below R2,600 at the year-end of 2024 before it rose, peaking at nearly R3,900. The stock experienced some fluctuations and corrections between R3,000 and R3,500. This shows strong momentum with volatility, but with signs of resilience. It has a positive trend overall and represents solid growth and recovery from market dips.

4. Naspers Ltd.

| Key Financials | |

| Market capitalization | 952,197,226,640 |

| Price/NAV | 24.15 |

| EPS-TTM | 27868.7 |

| Dividend yield | 0.2 % |

| Authorized shares | 500,000,000 |

| Issued shares | 157,962,380 |

Naspers Ltd. started out as a publishing company in 1915 before it transformed into a technology and global investment group in Cape Town, South Africa. It ranks in the JSE as one of the largest company stocks based on market capitalization, hence why many local and international investors watch Naspers’ performance closely, especially with its strong ties with Prosus, as its primary investment arm.

The company is built around the following:

- Education technology

- Ecommerce

- Online Classifieds

- Food delivery

- Payments and Fintech

- Internet platforms

- Media and Publishing

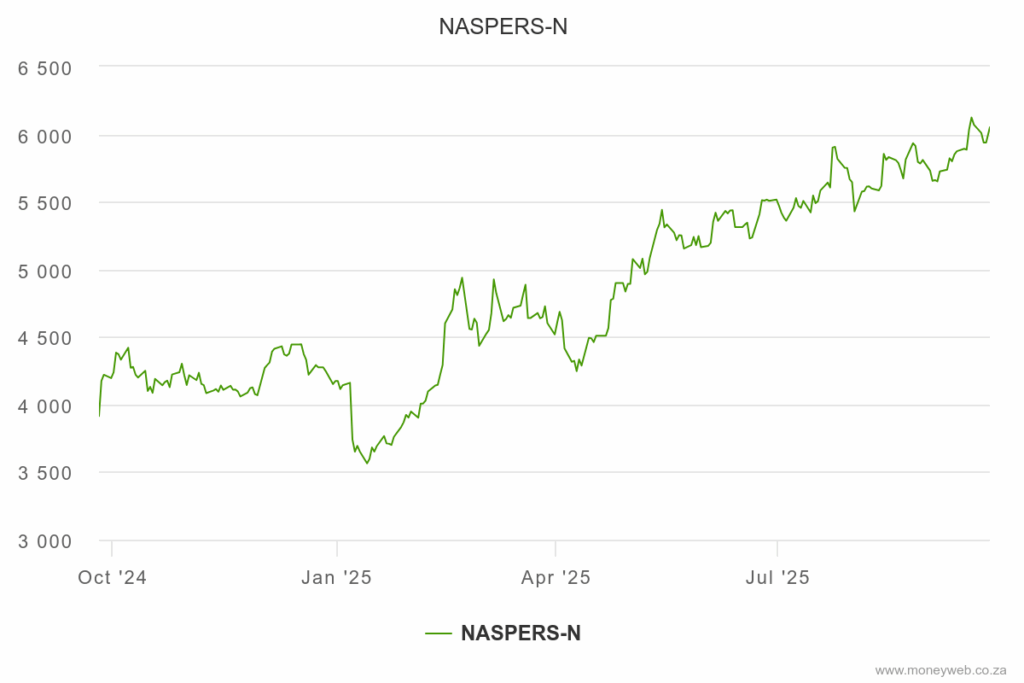

Chart Insights

The stock experienced a dip in December 2024, falling from around R4,500 to R3,500 due to some market corrections. But Naspers has shown a strong recovery beginning in January 2025 as it rebounded sharply during the first quarter. The stock maintained the steady upward movement from April onwards with some minor fluctuations. By September, Naspers finally peaked at R6,000, marking a 33% gain over the year to date. The overall trend signals a growth-oriented and resilient outlook for the company, supported by investor confidence.

5. Gold Fields Ltd.

| Key Financials | |

| Market capitalization | 615,508,174,662 |

| Price/NAV | 5.71 |

| EPS-TTM | 3878.74 |

| Dividend yield | 2.04 % |

| Authorized shares | 1,000,000,000 |

| Issued shares | 895,024,247 |

Gold Fields is a leading gold mining company headquartered in Johannesburg, South Africa, with its legacy dating back to 1887. This makes it one of South Africa’s oldest mining companies and played a key role in establishing the country’s reputation as a global gold hub.

As a mid-tier gold producer, it focuses on high-quality, low-cost assets that can generate steady flows of cash rather than aiming for sheer production volume.

Among its primary operations is the South Deep Gold Mine, one of the largest gold deposits in the world. Johannesburg’s rise as Africa’s financial hub was historically built on the strength of its gold mining industry. Today, companies in Johannesburg continue to build on that legacy, with operations like the South Deep Gold Mine playing a pivotal role in its economic foundation.

Chart Insights

The Golds Fields stock price dipped slightly in January 2025, falling from its initial price point of around R300 in November 2024, before entering a period of steady growth, maintaining a consistent upward trajectory despite some market fluctuations. By September 2025, it reached an all-time high of R700, reflecting a remarkable gain of over 130% year-to-date. The surge highlights a strong market performance and investor confidence. Key drivers behind the climb include operational efficiency, rising gold prices, and the growing interest in gold stocks. Overall, the chart signals a bullish outlook for Gold Fields.

Final Verdict

As an emerging market, South Africa, particularly Johannesburg, offers a wealth of investment opportunities from both local and global companies. No investment is ever without risk. Even then, top-performing companies in Johannesburg, especially the ones listed in the JSE, are well-positioned to give investors long-term value as they adapt to evolving market conditions and scale up.

Looking for smart ways to grow your investments? Join us TODAY at Traders United’s CommuniTrade, every trader’s go-to hub for expert insights and community-driven strategies to help you make confident, informed decisions.