Telkom shares today may sound like an underrated stock investment, but little did investors know that this company is one of the largest telecommunications companies in South Africa, and the profit earnings of this firm are hard to ignore.

With a consistent upward trend since January, it seems like Telkom investors are still eyeing the greener side of charts to wrap up their long-term value and moderate the risks it involves.

This makes Telkom stock performance worth reviewing more closely, especially since they are cooking a strategic pivot that could potentially propel their stock performance in the future.

In markets like this, timing and insights matter; that’s why this TRU Insight breaks down the technical and financial indicators that matter. Whether you’re a cautious investor or looking for undervalued opportunities, understanding Telkom’s current position is key.

Read on to see where Telkom shares outlook might be headed next.

What Company is Telkom?

Founded in 1991 and located in the land of Centurion, Gauteng, South Africa, Telkom is a public company that is known in the field of Information and Communications Technology (ICT). It provides a wide range of services, including mobile, fixed-line, IT, infrastructures, and properties.

Telkom Shares Today (JSE: TKG)

Telkom SA SOC Ltd is listed under the Johannesburg Stock Exchange (JSE) with a stock symbol of JSE: TKG.

The data presented in the table reflects values as of the most recently available date of Telkom stock performance. Please note that certain financial metrics are subject to market fluctuations and may vary over time.

| 52-Week Range | ZAC 2,568.00 to ZAC 6,059.00 |

| Market Capitalization | 25.84 billion |

| P/E Ratio | approximately 9.31 to 9.37 |

| Dividend Yield | 3.23 % |

| 1 Year Beta | 0.66 |

| Average Volume | 1.3 million shares |

| Revenue (TTM) | 44.13 billion |

| Net Income (TTM) | 2.78 billion |

Read more: Best 10 Shares to Buy in South Africa to Watch in 2025

Fundamental Analysis of Financial Indicators

The wide range gap of the lowest to the highest price movement in Telkom’s 52-week lowest and highest suggests that the stock has experienced significant volatility this year. Moreover, the data shown regarding market capitalization falls under the category of mid-cap, which typically represents a moderate growth potential.

With investors paying roughly nine times the company’s earnings per share, the relatively low Price-to-Earnings (PE) can be seen as undervalued. However, this is subjective as several factors, like market conditions, could still possibly shift the outlook of long-term opportunities. Nevertheless, the one-year beta suggests that it’s more suitable for investors who prefer a more stable and lower-risk investment since Telkom stock performance is less volatile than the market.

Telkom also responsibly pays out a portion of its earnings to its shareholders, and it’s evident in the dividend yield. Other values like average trading volume, revenue income, and the net income overall demonstrate that Telkom shares today increased a demand for service shows that the company is indeed a solid groundwork of business activity, which means a higher chance of profitability.

Technical Analysis

To better comprehend Telcom’s stock chart below, our financial analyst examines the broader landscape of price movements over the year, alongside experts’ insights to analyze the data effectively.

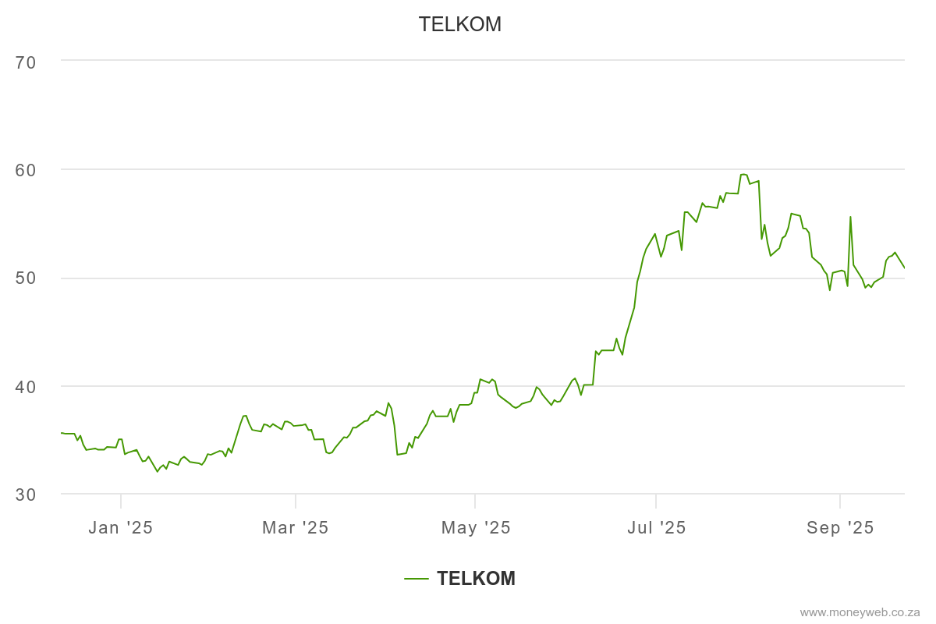

The visual element of TKG stocks is leaning on the greener side of the chart, and it’s evident that the gradual uptrend can be seen from January to early July 2025, whereas mid-July experiences a sharp increase. This upward momentum continued until it reached a resistance level near ZAR 60 around late August. However, following this peak, there was a slight downward correction in early September, which may reflect profit-taking or market uncertainty.

Support levels can be identified around ZAR 35 in early March and ZAR 45 in mid-May, where the price previously consolidated before continuing its upward movement. Although volume data is not visible in the chart, typically, a surge in price accompanied by high trading volume confirms strong buying interest. The overall trend suggests a bullish phase with a recent cooling-off period.

Frequently Asked Questions

Is Telkom one of the largest telecommunications in South Africa?

Yes, the government of South Africa owns less than 50% company shares, Telkom is the powerhouse for being the largest telecommunications company by annual revenue, and adding up the institutional shareholders, government employees’ fund, and individual investors.

Is Telkom planning a strategic expansion?

Yes, Telkom is focusing on widening its service by integrating a modernized approach of Artificial Intelligence. Moreover, the expansion of fiber broadband and leveraging its infrastructure assets could all add up to its positive outlook.

How does Telkom’s performance compare to other telecom companies?

Telkom shares today has outperformed many of its peers in 2025, with a nearly 95% one-year return, driven by strong earnings and strategic restructuring. This puts it ahead of competitors like Vodacom and MTN in terms of recent share price growth.

What challenges is Telkom currently facing?

Despite the strong performance of JSE: TKG, Telkom faces a 20% decline in legacy revenue, staff turnover at OpenServe, and uncertainty around future capital expenditure

Is Telkom a Good Investment in 2025?

Upon the compiled assessments of our financial analyst, Telkom’s strategic pivots strongly suggest a high chance of incoming upward trend, this signals a solid investment choice for 2025.

Final Verdict: Is TKG Share Price a Good Buy in the Future?

Telkom share outlook might not be the most talked-about stock, but its recent performance tells a different story. With solid earnings, a resumed dividend, and a shift toward modern infrastructure, it’s quietly building long-term value.

The stock’s upward trend, low valuation, and stable volatility make it a smart pick for investors looking for both growth and reliability. While risks remain, Telkom shows signs that it’s not just a surviving company but rather an evolving company.

If you want to keep up with Telkom shares today in price JSE update, equipping yourself with the right starter packs for stock trading can be found in CommuniTrade. It’s a resourceful environment to learn from stock trading courses, alongside fundamental and technical analysis that can be learn from its free live webinars.