Tesla stock price has been on a rollercoaster in 2025. From political tensions to a $29B stock grant for Elon Musk, the headlines alone are enough to stir investors’ curiosity. But behind the noise, something deeper is unfolding.

This comprehensive review breaks down Tesla’s latest price action, expert-backed forecasts, and the catalysts that could shape its future.

From AI-powered robotaxis to tariff tailwinds, our trading analysts unpack the real story behind the charts. Whether you’re holding, buying, or just watching, this is the insight you’ve been waiting for.

What is a Stock Price?

A Stock Price is simply the cost of buying one share of a company. It moves based on how people value that company at any given moment.

Technically, it’s the last traded price between a buyer and a seller on the open market. It reflects supply and demand, and a broader market sentiment, which often shifts within seconds.

Inside CommuniTrade, verified stock traders share live updates and chart breakdowns that go beyond surface-level price tags. It’s where real-time insights, trading tools, and market signals come together.

Tesla Stock Price Data Today

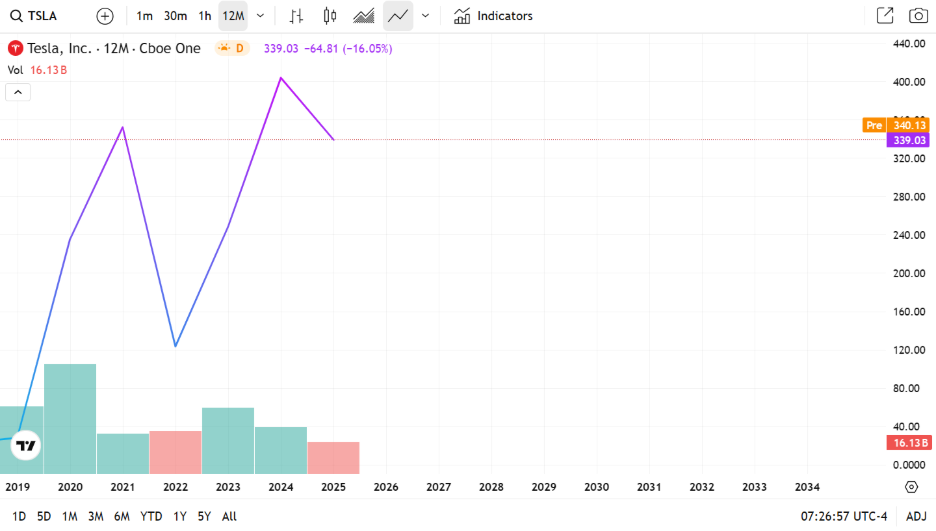

Upon researching the current Tesla stock price, our financial analyst discovered the following data:

| 52-Week Range | $197.06 – $488.54 |

| Market Capitalization | 1.94 Trillion |

| Volume | 103,663,869 |

| Average Volume | 105,627,050 |

Tesla does not currently offer dividends. This may influence how long-term investors weigh its growth potential versus passive income strategies.

As of today, Tesla stock price is at $339.00, reflecting a volatile but active trading range.

To illustrate, below is the chart sourced from Yahoo Finance, showing Tesla’s live price movement and technical indicators set in a yearly range:

Read more: Best 10 Share to Buy in South Africa to Watch in 2025

An Overview of Tesla Inc.

Company Details

Tesla Inc. is a publicly traded American company. It operates in automotive, renewable energy, and battery storage. It generates a remarkable revenue of around $100 billion as of 2025.

The company was founded in 2003 by Martin Eberhard and Marc Tarpenning, with Elon Musk joining shortly after and becoming CEO in 2008. Their headquarters is located in Austin, Texas.

History

Tesla began as Tesla Motors in 2003, aiming to build high-performance electric vehicles. Its first model, the Roadster, launched in 2008, followed by the Model S in 2012 and Model X in 2015.

The company went public in 2010 and expanded into energy solutions with the acquisition of SolarCity in 2016. In 2017, it rebranded to Tesla Inc. to reflect its broader mission.

Fraud Controversies

Tesla’s financial reporting has faced scrutiny over the years. Bloomberg raised concerns in 2013 about General Accepted Accounting Principles (GAAP) compliance.

By 2019, the SEC questioned Tesla’s CFO about warranty reserves and lease accounting practices.

Hedge fund manager David Einhorn went further, accusing Elon Musk of “significant fraud” and publicly challenging the legitimacy of Tesla’s accounts receivable.

These allegations haven’t led to formal charges but have fueled skepticism among institutional investors. The recurring scrutiny continues to shape how analysts and traders assess Tesla’s valuation and financial transparency.

Criticisms

Tesla has drawn criticism from traders over data privacy and internal security lapses. A 2023 lawsuit revealed that employees shared sensitive footage from customer vehicles.

Whistleblower Lukasz Krupski exposed internal systems that stored personal data, which is accessible to most staff. This raises serious compliance concerns.

Short sellers remain vocal. The TSLAQ community actively challenges Tesla’s valuation and accounting practices. While many lost billions during Tesla’s stock surge, skepticism persists among those who track its disclosures and governance.

Sales Milestones

Tesla delivered 1.8 million vehicles in 2023, a 38% increase from the previous year, and produced its six millionth car in March 2024.

However, global sales have faced setbacks. In Germany, sales dropped 76% year-over-year in February 2025, driven by political controversies and subsidy cuts.

In Canada, Tesla sold 8,600 vehicles in 72 hours before the EV rebate program was suspended. The government has since barred Tesla from future rebates amid ongoing tariff disputes.

Frequently Asked Questions (FAQs)

How much is Tesla stock per share?

As of 2025, Tesla stock price is trading at approximately $300 per share.

When to buy Tesla stock?

Tesla stock remains volatile. While some analysts see upside from AI and robotaxi developments, others urge caution due to valuation risks and political headwinds.

Our financial advisors suggest that timing your entry may depend on watching price dips, regulatory shifts, and how fast Tesla executes its tech roadmap.

Does Tesla stock pay dividends?

Tesla does not pay dividends to shareholders. The company reinvests its earnings into expansion, innovation, and scaling operations across energy and automotive sectors.

Is Tesla a Good Stock to Buy this 2025 and in the Future?

Tesla stock price continues to show sharp swings in 2025. The price movements are often driven more by global headlines than core performance.

From our recent trading tests, the long-term potential tied to AI and mobility remains. However, short-term risks like valuation pressure and regulatory shifts can’t be ignored.

Tesla stock price may still be worth watching, though timing and risk tolerance are key.

For those monitoring Tesla’s next moves, a reputable trading community like CommuniTrade could help you make smarter decisions.

It offers a clearer view into how traders interpret these shifts in real time. It’s where market signals meet context, helping users make sense of volatility.