Quant Tekel, formerly known as AscendX, is gaining attention among prop traders. It offers funded accounts of up to $200,000 without risking personal capital.

But is this all too good to be true? In this TRU Insight, we’ll reassess Quant Tekel Prop Firm’s key features, from its registration process to its rules and payout terms.

This comprehensive review unpacks what Quant Tekel really offers. Explore whether its promises align with real trader experiences – and if it’s worth your trust.

What is Quant Tekel? Founder and Company Overview

Quant Tekel is a proprietary trading firm, headquartered in London, United Kingdom. The firm has been operating since late 2023. They also made a notable rebranding in September 2024 to reflect their modern, data-driven approach to prop trading.

Led by Scott, with an impressive background as a former executive at Credit Suisse, Deutsche Bank, and Barclays.

Quant Tekel operates under Quant Teke Consultancy Ltd with a mission to bridge retail traders to institutional-level opportunities. The firm highlights flexible rules, transparent terms, and scaling opportunities reaching up to $2 million.

What’s astounding is that the profit split can be as high as 90%.

But the main question is: what are Quant Tekel terms and conditions? Let’s further uncover the expectations and reality.

Is Quant Tekel a Scam? Check Regulations Before Signing Up

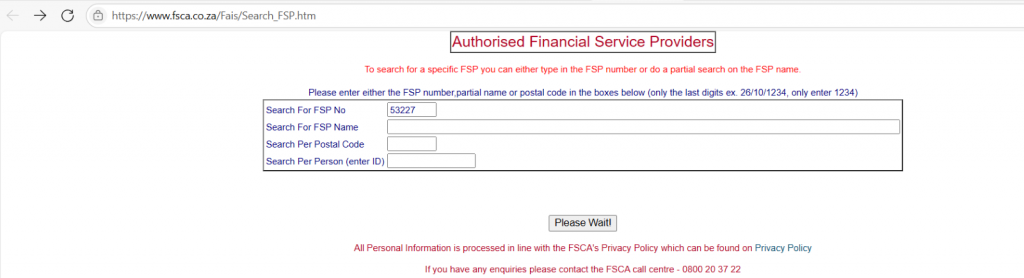

The good news is that no—quant tekel is not a scam. The firm has just previously succeeded in obtaining South Africa’s FSCA approval. This was officially granted to them on December 18, 2023, under license number 53227.

You can check this by plugging the license number in this official section of FSCA:

Moreover, it also partners with Eightcap, a broker regulated by ASIC and FSA, adding credibility to its operations.

For real insights, CommuniTrade filters the hype and never recommends unregulated brokers, so check there to see what verified, trusted traders actually vouch for.

How to Get Funded in Quant Tekel? What to Expect in Each Stage

Getting funded in Quant Tekel involves passing their evaluation. This is a straightforward yet strict process that traders should understand fully before signing up.

1. Challenge Phase

The Quant Tekel Challenge tests traders with an 8% profit target, 5% maximum daily loss, and 10% maximum overall loss.

There is no time limit, giving traders flexibility while ensuring strict adherence to Quant Tekel prop firm rules and disciplined risk management.

2. Verification Phase

The Verification Phase lowers the profit target to 4% while maintaining all other risk parameters unchanged to confirm consistent performance.

This stage reinforces Quant Tekel Consultancy Ltd’s goal of filtering only disciplined and strategy-focused traders before funding them.

3. Live Funded Account and Profit Sharing

Once both phases are completed, traders receive a live, funded account with an 80% profit split, which is upgradeable to 90% for consistent profitability.

Quant Tekel’s scaling plan can also increase account size up to $2 million. However, always review their terms and conditions for full eligibility and payout details.

What are the Key Features of Quant Tekel?

Perhaps you’re already considering this prop firm? Well, aside from regulations and phases, key features are still assessed for your comprehensive review below:

Trading Instruments

Here are the four instrument classes that you can trade using your Quant Tekel funded account:

- Forex– a wide range of selection of major, minor, and exotic pairs.

- Indices – Major indices are presented, including the S&P 500, Dow Jones, and NASDAQ.

- Commodities, including gold, silver, and crude oil, are primarily the leading assets they offer.

- Cryptocurrencies– Popular digital assets like Bitcoin and Ethereum.

Trading Platforms

Quant Tekel offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for advanced charting, algorithmic trading, and reliable execution.

In early 2025, they also excitedly announced the addition of cTrader to their lineup. This expansion strengthens their commitment to professional-grade and flexible trading platforms.

Spreads and Fee Structure

The firm offers competitive raw spreads with a commission of $4 per round trip, as well as variable spreads with no commission. Moreover, swap-free trading is also standard for all accounts.

Leverage Options

Quant Tekel provides leverage of up to 1:50 for forex, 1:20 for indices and oil, 1:15 for metals, and 1:1 for crypto. These settings strike a balance between flexibility and prudent risk exposure for traders managing larger, funded capital.

Subscription Options

Traders can choose from 1-step, 2-step, or 3-step evaluations with fees ranging from $99 to $749, depending on the account size. The fee is a one-time payment and is fully refundable upon successful funding and first payout.

Payment Methods

Quant Tekel supports payments via credit/debit cards, crypto (BTC, ETH, USDT), Wise, Revolut, and Skrill. This ensures accessibility for global traders, with crypto deposits processed within a few hours.

Withdrawal Policies

Profit withdrawals are available twice a month, with a split of up to 90%, and are processed within 1–2 business days.

Refund Policy

Quant Tekel refunds the evaluation fee after the trader passes the challenge and completes the first funded payout. This merit-based refund structure incentivizes discipline and consistency throughout the prop firm’s rules.

Trading Rules and Risk Management

Quant Tekel enforces strict risk rules, with a 4% daily drawdown limit and a maximum overall loss of up to 10% depending on the account type.

Read more: Top Prop Firms South Africa 2025 + Forex Funding Guide

Quant Tekel Evaluation Phase and Programs: Exploring Key Features and Rules

Here’s a quick look at the main evaluation programs and what traders can expect from each:

1. QT Instant

This is suitable for experienced traders wanting immediate access to capital without lengthy evaluations. Recent updates have increased the maximum daily risk limit from 1% to 2% and removed the 3% payout buffer, providing traders with more breathing room, faster profit payouts, and a more realistic reflection of live trading conditions.

Accounts range from $1,250 to $100,000 with an 80% profit split, reflecting Quant Tekel Consultancy Ltd’s evolving commitment to trader flexibility.

2. QT Prime

QT Prime suits traders seeking structured growth with a choice of 2-step or 3-step evaluations and account sizes up to $100,000.

It offers a competitive 90% profit split, 4% daily drawdown, and no consistency rule, allowing sustainable long-term trading performance.

3. QT Power

QT Power targets beginners and budget-conscious traders with the lowest entry costs, starting at just $16 for evaluations.

It uses a simple 2-step process, 6% profit targets per phase, and delivers a 90% profit share upon funding, making it ideal for those building prop firm experience.

What are the Pros and Cons of Quant Tekel?

Weighing the pros and cons is a crucial aspect of considering the risks you can tolerate and the strong points that may make you reconsider.

| Pros | Cons |

|---|---|

| No time limits on challenges | Limited availability |

| High profit split up to 90% | Strict risk management rules |

| Wide range of instruments | Evaluation fees are non-refundable if the evaluation fails |

| Multiple platform options (MT4, MT5, cTrader) | Higher drawdown threshold up to 8% |

| Recent rule updates for QT Instant – higher daily risk limit and removed payout buffer, improving trader flexibility | Newer prop firm, lacking extensive long-term public reviews compared to decade-old firms |

Read more: Choosing the Best Proprietary Trading Firms in South Africa

FAQ

Does Quant Tekel can payout?

Yes, Quant Tekel offers bi-weekly payouts. Withdrawals are processed via crypto, Skrill, Wise, or bank cards within 1–2 business days after approval.

What is the consistency rule of Quant Tekel?

According to Quant Tekel prop firm rules, QT Instant accounts adhere to a 25% consistency rule, meaning that no single trading day’s profit should exceed 25% of the total profits.

What happens when my account becomes inactive during the evaluation process?

If your Quant Tekel evaluation account remains inactive for 30 consecutive days, it will be terminated without refund as per their terms and conditions. Staying active within this period is crucial to avoid forfeiting your evaluation progress.

Final Verdict: Is Quant Tekel a Good Prop Firm to Try?

Quant Tekel offers flexible programs, fast payouts, and competitive trading conditions, making it attractive for both beginner and experienced traders. However, like any prop firm, it carries risks that demand strict discipline, so understanding its rules and fee structure is crucial before signing up.

For traders seeking deeper insights beyond reviews, joining communities like CommuniTrade can be valuable. It’s where verified traders and financial experts share real market analytics, vouch for prop firm queries, and collaborate in a safer, more transparent trading space.

[Join CommuniTrade Toda