When it comes to pensions, it’s always important to find a reliable pension fund that gives you peace of mind and financial security, especially in times of need.

The Government Employees Pension Fund (or GEPF) is one of the most secure pension funds in South Africa. With their easy GEPF login process, you can have a reliable account of the benefits that you expect as a pensioner.

This TRU Insight covers everything you need to know about their easy GEPF Self-Service login and how to do it efficiently. With our step-by-step guide, you’ll ensure a smooth and accurate payout process that is both timely and accurate.

Overview

- The Government Employees Pension Fund is one of Africa’s largest pension funds, with over 500,000 pensioners and beneficiaries.

- The GEPF login to the Self-Service portal allows users to manage their personal details, tax certificates, benefit statements, and track claims.

- The GEPF Self-Service login provides access to an efficient and convenient way to manage your pension scheme.

What is the GEPF Self-Service Login?

The GEPF Self-Service is an online portal that provides members access to their online pension scheme.

Through the GEPF login portal, members can manage information in their pension scheme. This information includes their personal data, history, and benefits.

The self-service portal login GEPF members have will also provide them with access to view and download documents related to their pension scheme. These data include their retirement benefit statement and tax certificate.

Steps in Logging in to the GEPF Self-Service Portal

You will need to have a member number and pin to access the GEPF Self-Service portal.

Remember: Before you can access the GEPF online login, you will be asked to register for the portal and provide your personal information. Ensure you have prepared your member number, contact details, and ID number.

After registering, you will receive a pin through email or SMS. You can use this pin to log in to the GEPF Self-Service portal.

Now, here are the steps to a proper GEPF login process:

Step 1: Open Your Browser

Using your desktop computer, laptop, or smartphone, start by opening a web browser that you prefer. Ensure you have a stable connection to proceed with this step.

Step 2: Log into the GEPF Website

On the Self-Service Login page of the GEPF website, there are two input fields where you need to put your username and password.

Use the login details given to you by GEPF to sign in. After tapping the “Sign In” button, you will be redirected to your dashboard.

Step 3: View Your Account Details

Upon accessing the GEPF login page, you can now view your account details using the “My Account’ button. Some information that you can view includes your pensioner access payments, pension benefits, and payment history.

What is GEPF in South Africa?

Established in May 1996, the Government Employees Pension Fund (GEPF) is one of the most wide-ranging pension funds in South Africa and globally. Currently, it has nearly 1.3 million active members and assets worth over R2.3 trillion.

This defined benefit pension fund manages and administers pensions and other benefits on behalf of South Africa’s government employees.

With a strong commitment to honesty, innovation, transparency, empathy, and professionalism, GEPF maintains a robust track record of protecting pensioners against inflation.

Upon gaining access through your GEPF login, GEPF members can view and enjoy the following benefits from its current benefit structure:

- Retirement benefits

- Withdrawal benefits

- Disability or ill-health benefits

- Death benefits

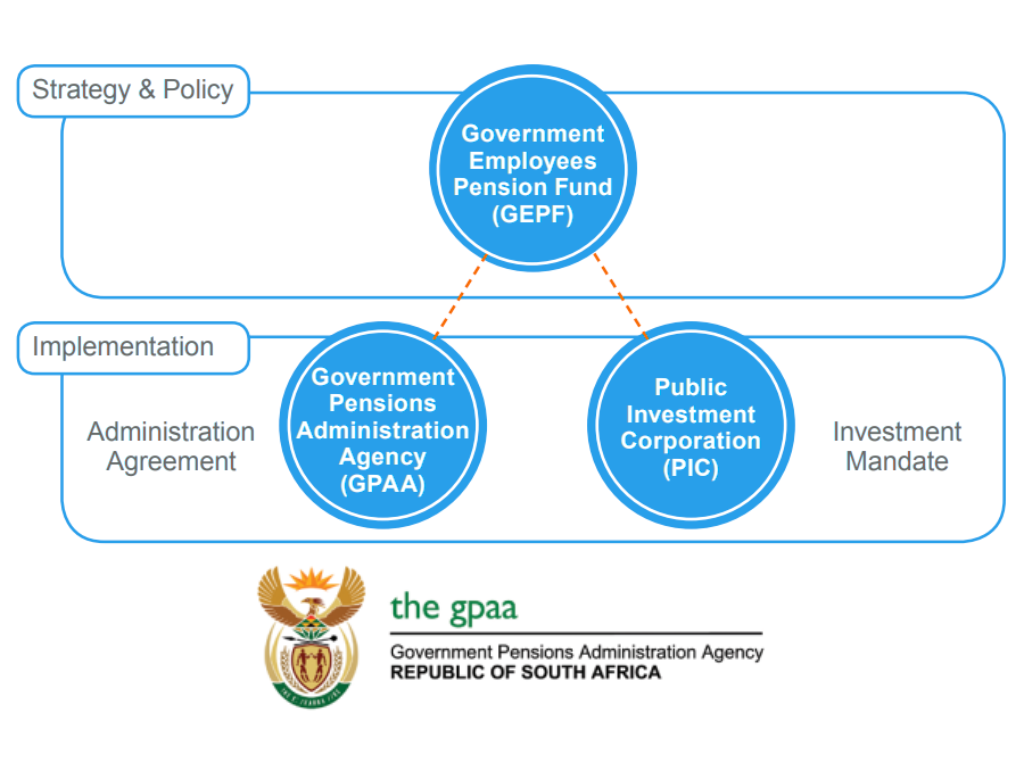

The 1996 Government Employees Pension Law (or GEP Law) governs their core business. The Government Pensions Administrative Agency (GPAA) handles its daily administration, while the Public Investment Corporation (PIC) carries out investment activities on behalf of GEPF.

Services Offered in the GEPF Self-Service Portal

Once you log into the Self-Serice portal using your GEPF login, you can finally access a wide array of services and manage your payment scheme.With a simple GEPF login, you can seamlessly access these features:

- Latest GEPF Announcements

- Contact and Address Updates

- Tax Certificate Access

- Track Benefit Claims

- Real-Time Benefit Statements

- Please-Call-Me Feature

With convenience and enhanced security in mind, the GEPF designed the Self-Service platform to provide you with a more efficient way to manage your GEPF benefits.

Is Your Pension Safe With the GEPF?

Having R1.8 trillion in assets, the GEPF is one of the largest investors in the Johannesburg Stock Exchange (JSE)-listed companies.

The pension fund adheres to strict regulations that limit its financial liability to members, pensioners, and beneficiaries.

Its investment strategy employs a liability-driven approach that considers long-term objectives, including potential future benefit payments, the actuarial position, and the fund’s overall solvency risk.

As a defined benefit fund, GEPF guarantees benefits to all members in terms of the rules laid down by the GEP Law.

The payment method for members will depend on their years of service in the GEPF and their average final salary at the time of their exit from the fund. These factors will determine the payout amount upon resignation.

That said, you can rest easy and continue to check your account through the GEPF login, knowing that your money and benefits are safe.

Still Having Trouble with Your GEPF Log In?

The GEPF login may be as simple as 1-2-3, but some users may encounter issues, such as those linked to their member ID and contact information.

If you still have trouble accessing your account on GEPF, you can contact our experts and traders from CommuniTrade.

Our community understands the frustration that comes with this inconvenience. Join millions of individuals in the discussion and work together to find a concrete solution to potential issues.

FAQs

Why is GEPF not loaning money to members like me?

The pension fund receives numerous inquiries from active members and pensioners regarding potential cash loans. However, the GEP Law does not permit members to have loans, as GEPF is not registered as a financial service provider. That said, GEPF cannot allow loans as it is against the law.

How do I check my GEPF status online?

You can now access your GEPF benefit statement immediately, thanks to their self-service portal. You will only need your ID number and password to access your latest benefit statement after your GEPF self-service login.

How can I check the amount of money I have in my pension?

If you want to check your workplace or private pensions, GEPF provides yearly statements. These documents show you the amount you have in your pension pot, as well as your investments’ performance.

Can I withdraw my funds early using my GEPF login?

You are not allowed to make an early access withdrawal from your pension fund. Instead, you can only access funds when you exit the fund through resignation, retirement, ill health, or discharge from service. This restriction aligns with the stipulated rules in the GEP Law.

Find Out What Lies in Store for You

GEPF Self-Service offers an efficient way to manage your pension scheme. But the thing is—knowing how to navigate the GEPF login and explore the Self-Service portal services may be daunting for some.

Gain the confidence to rise above this fear and know more about the process of obtaining your pension funds at GEPF. While there are a lot of benefits to choose from, our experts can offer you tips on how to go about the process effectively.

Learn with millions of experts and grow your resources at CommuniTrade!