Is there a secret strategy or some holy grails that profitable traders use to ensure forex trading gains?

None.

Instead, they religiously analyze the market to predict how and where it will move.

Order blocks represent the previous limit order of institutional traders, bringing out concentrated buying and selling pressure on the market. Given that these traders split their trades into multiple portions, the concept of order block suggests that the area will continue to bounce off the price once hit.

Thus, order block effectively identifies the key levels of support and resistance driven by the institutional traders.

Now, what is an order block in forex? This article walks you through the nitty-gritty of forex order blocks and its best trading practices for ensured gains.

What is an Order Block and Its Importance in Forex?

An order block in forex is the specific price area where institutional traders want to buy or sell currency pairs.

Remember the buzzword: want to buy.

This means institutional traders never execute the trade at the market. They place it at a predetermined price level, which will only be executed when it reaches the limit.

This order block appears when one among the series of institution’s limit orders is fulfilled – the rest will be executed at the same price level and will ultimately reverse the price direction.

Read more: What are Forex Order Types: Market, Limit, and Stop Orders [2024]

When these pending orders from big market participants are executed, they create an order block—the price’s turning point. Correctly identifying an order block in forex gives you references to key levels of support and resistance.

With its highly liquid nature, order block is considered one of the most strategic and profitable ways to enter and exit the market.

The Role of Institutional Investors in Forex

If you analyze the forex market structure, you’ll see how big of an impact institutional investors’ participation has on the market. They place an extremely large number of trades—often amounting to millions—which results in a market imbalance (supply and demand imbalance) and drives up market sentiment.

Executing their entire trade volume could create sharp market movement. Thus, it becomes common for these big traders to split their orders to prevent drastic price changes that could harm the positions of individual investors.

Say the Bank of Japan wants to intervene with the current USD/JPY exchange rate. An executive orders to short 1,000 positions USD/JPY. However, the 1,000 positions will be cut into ten parts with 100 units to keep the market safe.

Despite cutting the supposed 1,000 short positions, this still creates significant selling pressure in the market that would push the price down.

Institutions use order blocks as an intervention tool to ensure that the pair’s exchange rate remains sustainable for investors.

Forex Market Structure

You have it wrong the moment you think that the forex market is only comprised of retail traders. Retail traders have a small market share in forex. It’s the large market participants that move the market.

Institutions

Central banks, multinational corporations, and other commercial entities are the major forex players.

These market participants execute high-volume forex trades to the point that they can move the market in the preferred direction, a process called forex intervention.

Whales

Whales are often individual traders that are known to execute a large number of forex trades.

Oftentimes, whales have follower-base clout. One characteristic of whales is their power to move the market with words or statements.

Read more: TradersUnited – Market Sentiment Explained

Retail Traders

Also known as individual traders, retail traders execute trading positions actively for their personal investment strategy.

These traders must use online brokerage firms to access the forex market, unlike institution traders, who need no brokers.

Identifying Order Blocks in Forex

This goes without saying: Market sentiment can surely dictate the market’s price movement.

A bullish market is likely to occur when buying pressure is apparent. On the other hand, the market will be bearish when it becomes immersed in selling pressure.

This supports the significance of order blocks in establishing key support and resistance levels in the market.

Known for executing high-volume trades, institutional traders shape market psychology.

A chunk of short (sell) orders from them would form a bearish order block. Signifying the price’s resistance level, a bearish order block forms at the peak of an uptrend and indicates a trend reversal.

On the other hand, a bullish order block forms when institutional traders place a large number of long (buy) orders. This block appears at the bottom of a downtrend and signals a potential bullish reversal.

However, you need to remember that the market mover here is the collective execution of the forex traders. If most retail traders execute positions aligned on the order block, the support and resistance signal it provides strengthens.

Order blocks in forex don’t certainly tell you about the exact market movement; it’s just your preference on what will happen if the participants act based on these forex order blocks.

How to Trade Order Block in Forex?

Again, institutional traders can move the market with their trades. Order blocks, followed by the market sentiment, can effectively predict potential market movement.

Here are the three key steps in trading order block in forex.

Spot an Engulfing Candlestick Pattern

An engulfing candle signifies an abrupt price change. The type of engulfing candle signifies the potential direction of the market:

- A green/white engulfing candle represents a bullish market reversal (bullish order block)

- A red/black engulfing candle indicates a bearish market reversal (bearish order block)

Draw the Order Block

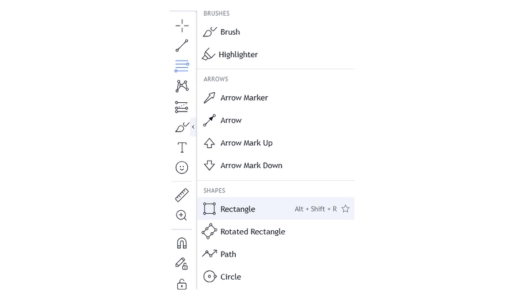

Now, use the Rectangle tool in your charting platform to draw the order block or the support/resistance level.

Only after drawing the rectangle can you start observing the market psychology. Analyze how the market reacts as it approaches the drawn-out key support or resistance level.

If the price starts bouncing on and off the order block range, it signifies a strong reversal signal.

Note: The price may trade beyond the exact point or level, and that’s expected. Just think of the order block as a zone, not a precise level.

Place Entry Points Depending On Price Reaction

To trade order blocks, your positioning should be based on two possible scenarios: Reversal or Breakout.

If the market forms a shooting star, hammer, or engulfing pattern – it will potentially reverse.

For this reversal scenario, you should place your entry point below the resistance level (if selling) or above the support level (if buying).

On the other hand, a market that forms pennant and wedge patterns indicates a potential for a breakout.

If you plan to trade a breakout, you must wait for the price to retest the level.

Remember never to use the order block as an ultimate indicator. You should use it with other technical analysis tools to supplement your analysis.

Types of Order Blocks

You need to consider two kinds of order blocks in forex – bearish and bullish order blocks.

These order blocks are like the footprints of institutional traders that retail traders follow.

Bearish Order Block

In the price chart, a bearish order block is represented by the last bullish candle followed by an engulfing bearish one. This signifies the abrupt bullish market move due to the concentrated selling pressure from institutional traders.

The engulfing second candle should trade above the high and close below the low of the previous candle.

Bullish Order Block

If you look at your price chart and see a bearish candle followed by a bullish engulfing candle, you might be looking at an order block.

Why? The bullish engulfing candle represents a sudden spike of buying pressure amidst the market’s ongoing downtrend.

This simply means one thing – the institutional traders act up!

A bullish order block represents the market zone with concentrated buying pressure, which was initially formed by the limited buy orders of institutional traders.

When the price enters this zone, a trader can expect the price to spike up.

Order Blocks: Trading Strategies

Trading order blocks in forex is considered profitable as it allows you to ride with institutional traders’ market influence.

However, spotting one and trading it requires great practice. Here are three common trading strategies you can use to maximize the potential of order blocks:

- Identifying Potential Levels

- Breakout Trades

- Retracement Entries

Large Market Participants: Who Are the Institutional Traders

If you look at the forex market structure, you will see that forex trading is not only for individual traders. In fact, a large portion of the forex market encompasses institutional traders, including hedge funds, commercial banks, central banks, and any institution that executes high-volume buy or sell orders.

Because of the large volume, institutional traders can greatly impact the share price of a security.

Here are the key players in the forex market.

Central Banks

Central banks participate in the free forex market to control their currency’s exchange rate movement. They do this for one sole purpose: to prevent any potential crisis in their country.

Moreover, such institutions enter the forex market to intervene in their respective currency’s exchange rate movement.

Here is a list of some central banks in the world.

| South African Reserve Bank (SARB) | SA | https://www.resbank.co.za/ |

| European Central Bank (ECB) | EU | https://www.ecb.europa.eu/ |

| Bank of Japan (BOJ | JP | https://www.boj.or.jp/ |

| Federal Reserve (Fed) | US | https://www.federalreserve.gov/ |

| Swiss National Bank (SNB) | CH | https://www.snb.ch/en |

| Bank of England | UK | https://www.bankofengland.co.uk/ |

Commercial Banks

Also known as investment banks, commercial banks participate in the forex market to grow their capital and their clients’ investments. Here are some of them:

- JPMorgan Chase & Co.

- Citi

- Barclays

- Goldman Sachs

- Bank of America Corp.

- Wells Fargo & Co.

These commercial banks actively execute large amounts of forex transactions daily, making them among the market’s significant sources of liquidity.

Did you know:

Aside from the exchange rate, commercial banks dictate the bid/ask and spread of each forex market.

Hedge Funds

Hedge funds and investment managers are the companies that execute trading positions on traders’ behalf. These institutional traders deal with large amounts of investment funds daily, which will be reinvested in the forex market.

These hedge fund managers participate in the forex market to hedge investment risks that may harm the companies they represent.

Why Is Order Block in Forex Important?

An order block in forex is indeed a profitable trading strategy. However, behind its profitability is the complexity of spotting and actually trading it.

That’s why it’s essential to be familiar with order block formation, different block types, and the best practices for spotting these blocks.

Want to explore more proven strategies to keep your investment safe in risky forex trading? Join TradersUnited, connect with thousands of online traders worldwide, and learn from their experiences.