Despite being new to the market, DRDGold Limited (JSE: DRD, NYSE: DRD) ranks as the 10th largest gold mining company in South Africa.

With the company’s specialization in gold reprocessing in mine tailings, DRD stocks pique the interest of ESG investors. This sustainability-focused approach has made their share price thrive despite the struggling South African gold industry.

In this post, we’ll look closer at DRDGold’s share price history, factors influencing its stock performance, and why it may be a solid investment for 2024.

Current DRDGold Share Price Performance

DRDGold share price recorded an all-time high of 46.92 USD in March 1997.

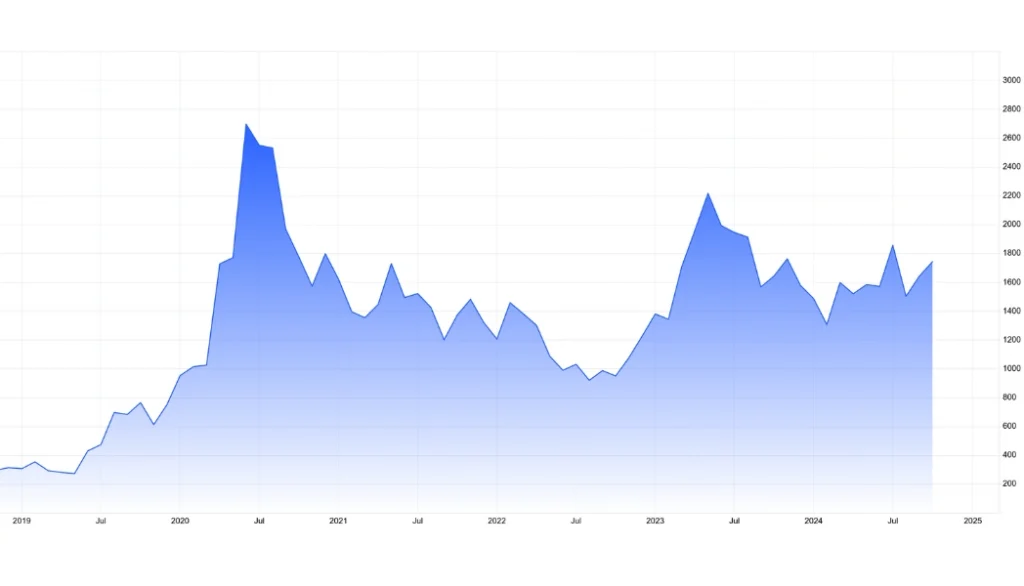

In this decade, DRDGold share prices have experienced significant movement and fluctuations. On July 20, 2020, the company stock had an all-time high of 15.24 USD– following the 1975.9 USD all-time high of gold in the same year.

The softening safe haven demand for gold after 2020 ended the climb of DRD stock. In fact, this South African stock dipped to its all-time low at around 5 USD in October 2022. However, the company’s ongoing growth contributed to a significant increase and stability of its share price after the drop.

Today, DRDGold’s stock has a 52-week range of 12.00 – 19.50 ZAR. Moreover, the company recorded a final dividend of 0.20 ZAR per share (2.35%).

Here are the DRDGold share price data in South Africa:

| ZAR | |

| Market capitalization | 14.58 B |

| 52 Week Price range | 12.00 – 19.50 |

| ESP-TTM | 1.54 |

| Dividend yield | 2.35% |

| Authorized shares | 1,500,000,000 |

| Issued shares | 864,588,711 |

Quick Overview: What Is DRDGold Limited

DRDGold Ltd. is managed by Daniël Johannes Pretorius. The business focuses on surface gold tailing – a more modern, sustainable approach to gold mining.

With its continuous growth and sustainable operations, DRDGold ranks as the 10th largest gold mining company in South Africa per market capitalization.

In 2024, the company reported revenue of $333.824 million—a 14% increase from 2023’s $309.991 million. This contributed to the 17th consecutive year of the company’s dividend payout.

Currently, the company is headquartered in Johannesburg, South Africa.

Reprocessing of Tailings

DRDGold’s tailing reprocessing operations make the company stocks interesting and even a viable investing option for ESG investors.

Unlike conventional mining, which involves extracting gold from newly discovered ore, DRDGold reprocesses mine waste (tailings) from historical mining activities.

- Lower Costs: Reprocessing mine tailings is generally less expensive than traditional mining because there’s no need for large-scale excavation or new mining infrastructure.

- Sustainability: DRDGold’s method significantly reduces its environmental impact. To promote its go-green initiatives, the company reclaims land, processes old mining waste, and minimizes water usage.

- Profitability: With lower operational costs and access to an abundant supply of tailings, DRDGold can remain profitable even when gold prices are relatively low.

These advantages were manifested in DRD’s continuous growth despite the ongoing struggle of gold mining companies in South Africa.

Gold Prices Influence the DRDGold Share Price

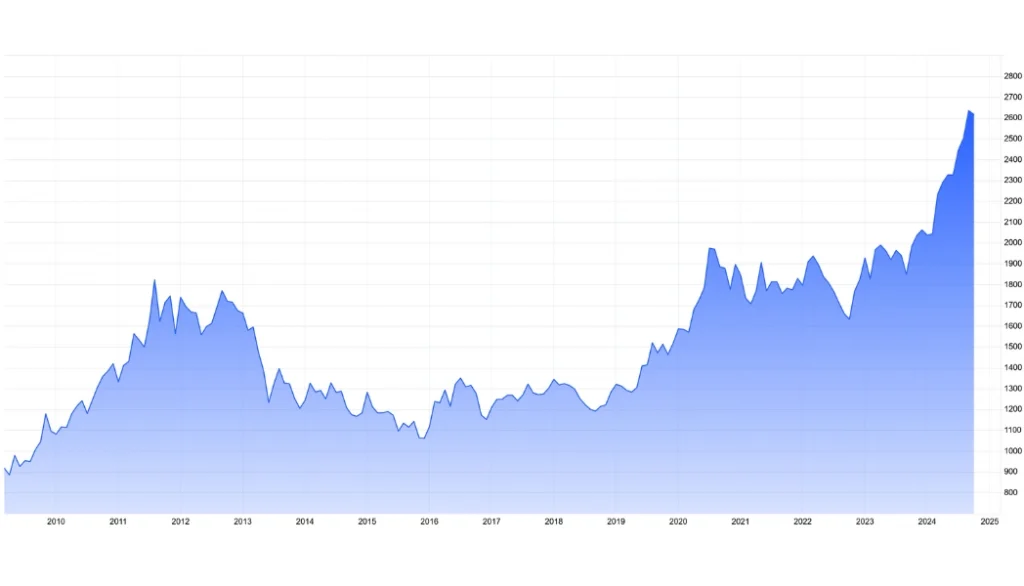

Like in the case of any gold mining company, the price of gold heavily influences DRDGold share prices.

A notable example was when gold peaked at 1975.9 USD in 2020 and hit its highest level since 2011.

This global gold event skyrocketed even the DRD share price, which recorded 15.24 USD in the same month.

With gold continuously hitting higher highs and positive market sentiment about the DRD shares, investors have a one-year target of 13.25 USD for the DRD share price.

17th Year of Consistent Dividend Payments

In 2024, DRD marks the 17th year of consistent dividend payments to its shareholders.

All DRDGold shareholders are paid a dividend of 0.22 USD per share (2.24% dividend yield) in the second half of 2024.

While this signifies a 51.23% decrease from last 2023’s 0.34 USD, DRDGold’s status as a regular dividend payer has made income-focused investors optimistic about investing in its stocks.

Why ESG Matters for Investors

Over the past decade, the world has seen the devastating impact of climate change—thus, the call for sustainable practices in mining and other industries that cause economic distress.

With this ongoing global sustainable trend, companies that meet high ESG standards often see increased investor interest and higher share prices.

ESG-focused funds and institutional investors seek companies like DRDGold that prioritize environmental sustainability.

Note: According to Bloomberg, Global ESG assets will reach over $50 trillion by 2025.

Frequently Asked Questions

Is DRDGold Listed in NYSE?

Yes, DRDGold is listed on both NYSE and JSE. This dual listing has provided enhanced liquidity for DRDGold Ltd. as it’s exposed to a broader range of investors, specifically Americans.

Why is DRDGold a sustainable investment?

By specializing in tailing or reprocessing gold mine waste, DRDGold stocks become a viable investment option for investors prioritizing ESG initiatives. DRD’s consistent dividend payment makes it a sustainable and attractive investment for income-focused investors.

Want to explore more investment opportunities like DRDGold? CommuniTrade connects you with a community of traders and investors where you can share insights, develop strategies, and stay informed on the latest market trends. At CommuniTrade, every interaction is a step closer to more informed trading.